Coal stockpiles at the Richards Bay Coal Terminal (RBCT) in South Africa could have a window to build ahead of closures in July following low demand and exports, although ongoing rail issues could keep spot pricing supported at high levels.

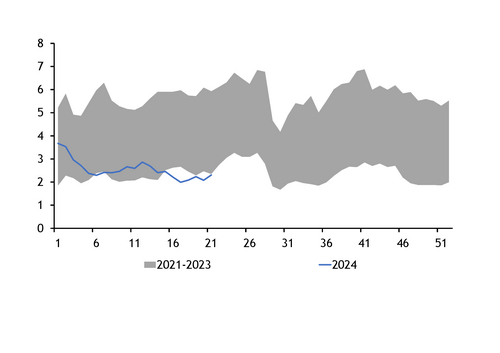

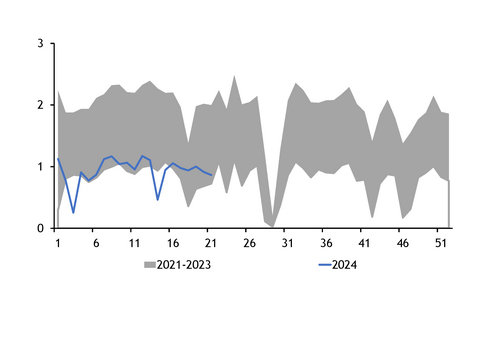

Stocks at RBCT increased to 2.3mn t as of 27 May, up from 2mn t a week prior, according to Argus data. This was despite railings to the terminal falling more than 5pc in the week ending 27 May to 863,000t on the back of a three-day derailment that shut down the coal line.

But coal exports from RBCT fell more sharply, dropping by 41pc to 636,000t between 20-26 May. The figure marks the lowest exported volume recorded this year, against weekly average exports of about 1mn t.

Stocks at RBCT in July face the possibility of falling critically low because of two weeks of planned annual maintenance shutdown between 9-18 July.

In the previous three years the maintenance has seen stocks fall on average around 900,000t, requiring an increase in railings to rebuild RBCT stocks. Railings would have to significantly exceed the weekly export volume, which had appeared unfeasible based on rail performance so far this year, particularly with firm demand from key market India.

But a window for stocks to build could be emerging before the expected depletion in mid-July because of tapering demand from India alongside other Asian markets recently.

Shipping data shows South Africa exported coal to India, China, Japan, and Kenya between 20-26 May. Some sellers also pulled their laycans based on transport disruptions, a market participant said. Supply strains have caused the South African coal prices to edge higher in the recent weeks with API 4 index now at a premium to API 2 prices.

Sellers can be hesitant to offer coal which hasn't already been delivered to RBCT stockpiles as there is a possibility the tons will not be delivered on time, meaning the spot market has less offers and as such can be bid higher.

Argus' cif Amsterdam-Rotterdam-Antwerp and fob Richards Bay NAR 6,000 kcal/kg physical assessments stood at $106.57/t and $110.13/t, respectively, as of 24 May. Paper prices have also followed the pattern with South African prices being well supported, even with European values falling.

There remains some risk however that any increase in spot demand could pull stockpiles even lower.

After July, which marks the peak of Indian monsoon, this coupled with anticipated post-election demand could bring more spot buyers into the market and see a depletion of stocks, spiking spot prices further.

But the key factor, according to market sources, was the performance of the coal railings due to the volatile nature of numerous derailments and theft issues along the network. National rail operator Transnet had made numerous pledges this year and has several plans to help with performance, but market sources do not anticipate any improvement in rail volume or even any stability for at least the remainder of the year.