Coal producers across much of the US continued to ship less coal during peak summer months than they had a year earlier amid reduced generation and elevated power plant inventory levels.

US utility-scale power plants received 32.9mn short tons (29.8mn metric tonnes) of coal in July 2024 and just over 34mn st in August, the latest data from the US Energy Information Administration (EIA) show. These were the lowest figures for any July and August of EIA data going back to 2008.

Most coal producing regions had fewer shipments to US power plants during these months than they had a year earlier. One exception was Colorado and Utah, where production was recovering from tight levels. Deliveries from lignite mines in North Dakota and Texas also were higher on the year, reflecting increases in consumption at some power plants that are near those mines.

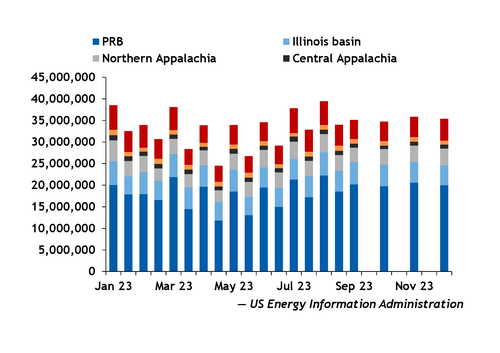

But deliveries from the US' larger coal-producing regions dropped. Power plants received 35.8mn st of Powder River basin (PRB) coal in July and August, down from 43.6mn st a year earlier. Deliveries from Illinois basin and Northern Appalachian coal mines decreased to 9.7mn st and 7.2mn st, respectively, from 10.2mn st and 8.2mn st in the same months of 2023.

Power plants also received less Central Appalachian coal in July and August after increasing their intake most of the first half of 2024 (see chart).

The number of plants receiving coal during the two months fell to 184 from 203 a year earlier. But only seven US power plants had units that retired between September 2023 and August 2024, and two plants have units that are scheduled to close by the end of this year, EIA data show.

Other power plants may have been holding off on taking coal because of elevated inventories and lower-than-expected generation dispatch. US electric power sector coal stockpiles were at a four-year high in May and held above year-earlier levels through the end of August.

Of the 15 US coal-fired power plants and facilities receiving the most coal in July and August, eight took in less during those months this year than they had in the same period of 2023. The biggest decrease was in deliveries to the Laramie River Station in Wyoming, which is operated by Basin Electric Power Cooperative. That plant received 957,187st of PRB coal in July and August 2024, compared with 1.35mn st a year earlier.

Other plants receiving less coal in July and August included Ameren's Labadie Energy Center in Missouri, Southern Company's James H Miller plant in Alabama and Vistra Energy's Martin Lake power plant in Texas. All of those plants take PRB coal.

The larger plants that received more coal in July-August than they had a year earlier were Vistra's Oak Grove and NRG's WA Parish in Texas, Prairie State Energy Campus in Illinois, Duke Energy's Gibson plant in Indiana, Rainbow Energy's Coal Creek plant in North Dakota and DTE Energy's Monroe coal plant in Michigan. DTE also received more coal at its BRSC shared storage site.

WA Parish, Coal Creek, Gibson, Monroe and Prairie State also were among the coal plants whose receipts for January-August were higher this year than they had been in the same period of 2023. But deliveries to Oak Grove were lower as were those to Laramie River, James H Miller, Labadie and Martin Lake.

Overall coal shipments to US utility-scale power plants in the first eight months of 2024 dropped to 238.8mn st from 290mn st.

Greater exports offset some of the decreases in US generator demand, but not all. The US shipped 33.8mn st of thermal coal to other countries in January-August 2024, a 2.6mn st increase on the year prior, preliminary figures from the US Commerce Department show.

For July-August alone, overall thermal coal exports were 2.4mn st higher than they had been in the same months of 2023. Coal receipts at US utility-scale power plants were 10.4mn st lower during these months, EIA data show.

| Top US power plant receipts and coal sources Jan-Aug 2024 | |||

| Power plant | Power Plant State | Coal received | Coal source |

| James H Miller Jr | Alabama | 6,453,929 | PRB |

| Labadie | Missouri | 6,272,691 | PRB |

| Oak Grove (TX) | Texas | 5,346,044 | Texas lignite |

| W A Parish | Texas | 5,069,907 | PRB |

| Coal Creek | North Dakota | 4,888,085 | North Dakota lignite |

| Monroe (MI) | Michigan | 4,618,661 | PRB, Northern Appalachia |

| Prairie State Generating Station | Illinois | 4,562,643 | Illinois basin |

| Martin Lake | Texas | 4,487,504 | PRB |

| Colstrip | Montana | 3,433,805 | PRB |

| Four Corners | New Mexico | 3,390,460 | New Mexico |

| — US Energy Information Administration | |||