The resurgence was driven by cold weather and the upcoming Ramadan fasting month, writes Efcharis Sgourou

Moroccan demand for LPG has strengthened this month on the back of cooler weather and the need to restock before the Islamic fasting month of Ramadan.

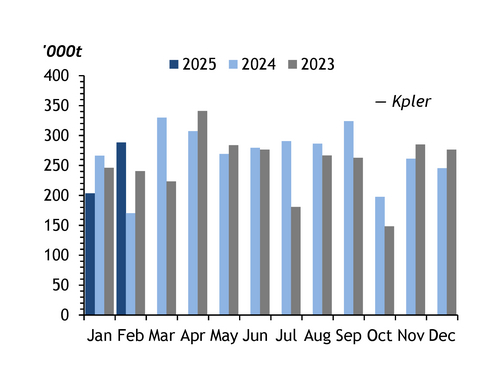

The country is due to bring in more than 250,000t of LPG this month, Kpler data show as of 4 February, compared with around 200,000t in the full month of January and 245,000t in December. A sudden drop in temperatures in late January combined with an imminent need to stockpile before Ramadan in March has fuelled a surge in spot enquiries, according to market participants.

Supply is also constrained for Moroccan buyers both in the Mediterranean region and in northwest Europe. Higher natural gas prices could be incentivising fuel switching to LPG in the Mediterranean, leaving supplies short, market participants say.

Cargo availability from the North Sea for February deliveries is also thin, with producers leaving more LPG in the gas stream because of high gas rates, tightening coaster supply.

Importing LPG from northwest Europe has also becoming trickier for Morocco after recent storms affected shipping. The spot freight rate for a 4,000t coaster loading from Tees, UK, to Mohammedia, Morocco, rose to $88/t in late January from $85/t on 20 January. Tightening cargo availability led to butane coaster prices in the Mediterranean reaching a two-year high of $755/t fob Lavera on 28 January, putting it at 116pc of naphtha.

Morocco's severed ties with neighbouring Algeria over the disputed Western Sahara territory led importers to source 90pc of their LPG from the US in February. Morocco's dependence on US LPG has grown significantly in recent years. It received 2.45mn t from the US in 2024, out of a total of 3.23mn t, Kpler data show.