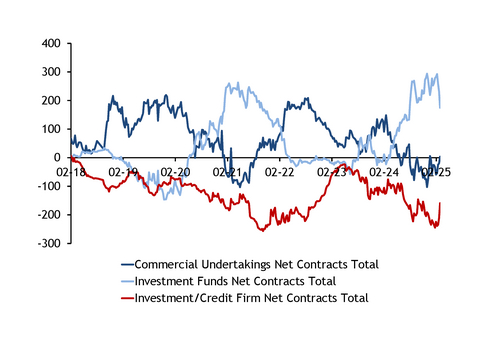

Investment funds have slashed close to 120TWh off their near record-high TTF gas net long position on the Intercontinental Exchange (Ice) in the past three weeks, according to the most recent Ice Commitment of Traders (CoT) report.

Investment firms' net long position plummeted to around 175TWh in the week ending 28 February, down by 57TWh from the previous week and by nearly 118TWh from the first week of February. This is investment firms' smallest net long position since the week ending 26 July 2024 (see net positions graph). Investment firms cut 151TWh of long positions across the three-week period and closed 34TWh of shorts. This led to an aggregate open position of 520TWh, down from 705TWh in the week ending 7 February.

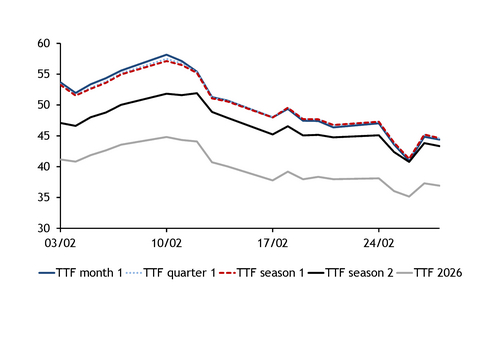

Over the same period, Argus' benchmark TTF front-month assessment dropped from a peak of €58.16/MWh on 10 February to €44.39/MWh on 28 February, while other prices further down the curve dropped by similar amounts (see prices graph). This suggests that the shift in investment firms' positions contributed to the drop in prices. A growing sentiment in the market that Russian gas transit through Ukraine could resume, signalling from the European Commission on more flexibility in meeting storage filling targets, and a mild weather outlook across Europe for March, all contributed to the recent drop in European gas prices. Many market participants have pointed towards a desire to take profits over the past few weeks while prices remained elevated and cut risk exposure as unpredictable geopolitical events, particularly regarding the war in Ukraine and US president Trump's tariff policies, have upended many commodity markets.

But while investment funds cut their net long position, commercial undertakings — predominantly firms with retail portfolios — flipped to a small 3TWh net long position for the first time since late December and before that September. Their net short position had been as high as 54TWh on 7 February. This was driven mostly through firms closing their short positions, with commercial undertakings cutting 57TWh of risk reduction short contracts — generally used for hedging purposes — between the weeks ending 7 and 28 February, compared with 20TWh of risk reduction longs.

In addition to commercial undertakings moving to a net long position, the other main category of market participant, investment/credit firms, slashed their net short position by 80TWh in these three weeks to end at 159TWh.