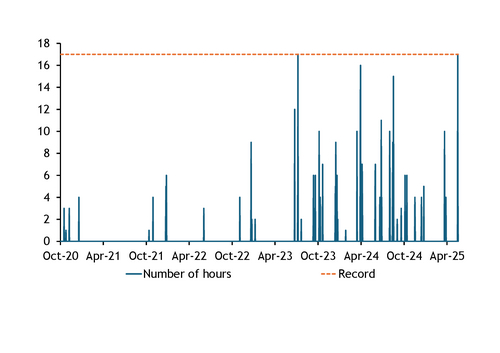

The UK's N2EX day-ahead power market matched a record for consecutive hours of negative pricing on 25 May, driven by strong wind and solar generation alongside low demand.

The UK's N2EX day-ahead power market recorded 17 consecutive hours of negative pricing on 25 May, tying the record previously set on 16 July 2023. Hourly prices fell to as low as minus £35.18/MWh, the lowest since 16 July 2023, when they hit minus £54.17/MWh. And an additional four consecutive hours of negative day-ahead prices were recorded yesterday, bringing May's total negative hours to 21, up sharply from just four in April and none in May last year.

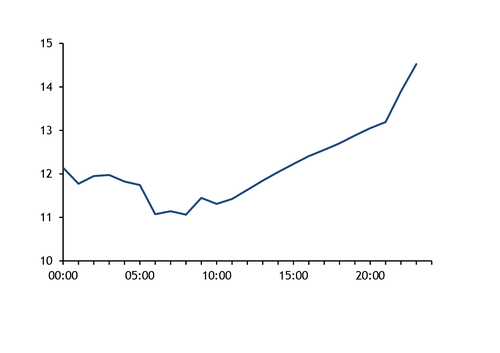

Sunday's high renewable generation combined with record low demand to weigh on day-ahead prices. Wind generation reached 12.2GW and accounted for 47pc of the generation mix, the highest share for any Sunday since 22 December 2024. Solar output averaged 7GW during peak solar hours, representing 24pc of the mix during the interval.

Gas-fired generation on the system was just 3.1GW across Sunday, or 11.9pc of the generation mix. This was the lowest for any Sunday since 24 August last year. At least 2-3GW of gas-fired generation is currently needed at all times in the UK to provide voltage control or inertia. The UK is currently investing in synchronous condensers, grid-forming inverters and battery systems with inertia emulation, which could reduce the minimum gas capacity needed for inertia and voltage control.

Weak weekend demand intensified negative pricing pressures. National demand fell to 16.5GW on Sunday, the lowest for any day on record. This was also some 1.2GW below the previous low of 17.7GW recorded on 2 July 2024.

Low day-ahead prices on 25 May moved the UK to a discount to all interconnected markets for the first time since August 2022, with the discount to the Norwegian NO2 zone reaching €28.26/MWh (£23.71/MWh), the largest since 12 December 2024. The UK exported a net 3.3GW to interconnected markets, the highest since 26 November 2022, with net exports to the NO2 zone averaging 941MW, or a 28pc share of the total. And exports to France averaged 496MW across the day, the highest since 4 February.

Negative prices likely drove curtailment of output at renewables installations that operate under a contract for difference (CfD), which accounts for roughly a fifth of total renewable capacity, latest data from CfD scheme operator LCCC show. Generation from wind plants typically follows a smooth S-shaped curve, but on days with negative hours it shows sharp declines or plateaus during periods when wind speeds are stable.

And negative prices discourage developers of renewable projects from signing CfD contracts. Starting with allocation round 4, CfD payments are not made for any hour when the day-ahead price is negative, regardless of duration.