Domestic associations have called for a built-in margin for distributors that would cover their costs and investments, writes Cas Biekmann

Mexico's LPG distributors are still grappling with weak profit margin challenges stemming from the government-set LPG retail price cap, but robust demand and falling international prices have helped prevent the problem from worsening.

Higher wholesale LPG prices in Mexico and a rigid retail price cap are making it difficult for distributors to operate, domestic distributors association Amexgas says. The average retail price cap across 2,747 cities was unchanged on the week at 10.93 pesos/litre ($2.19/USG) over 6-12 July. This had increased during the week ending 28 June following a climb in US propane prices — the first gain in 12 weeks.

State-owned Pemex has a major influence on domestic LPG prices, including the retail price cap, despite its limited presence in the retail market and a multitude of smaller-scale private-sector importers and wholesalers. Pemex's LPG production from gas processing fell to a record low of 50,000 b/d (133,000 t/month) in May — the same month it decided to cut exploration and production spending by 41pc this year. Ethane production also fell to a record low at 31,000 b/d. Pemex's LPG imports were nevertheless relatively stable on the year at 83,400 b/d in May, down from 92,700 b/d in April, suggesting private-sector importers picked up the slack.

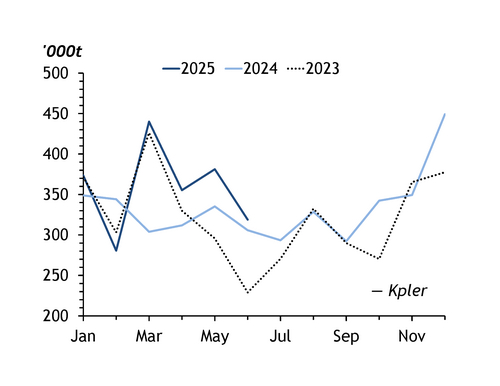

The decline in output means Mexico is becoming more reliant on imports. Pemex and private-sector importers brought in around 196,000 b/d (6.2mn t/yr) in 2024, with Pemex accounting for about 82,000 b/d of this and private-sector firms 114,000 b/d, according to energy ministry data. This trend has remained largely the same in 2025. Seaborne imports to the country stood at 2.15mn t over January-June, up from 1.95mn t a year earlier, Kpler data show. Domestic demand stood at about 200,000 b/d in 2024, energy ministry data show. The ministry expects this to increase slightly until 2037, as those still using more harmful fuels such as firewood move to LPG and as demand for use as autogas grows.

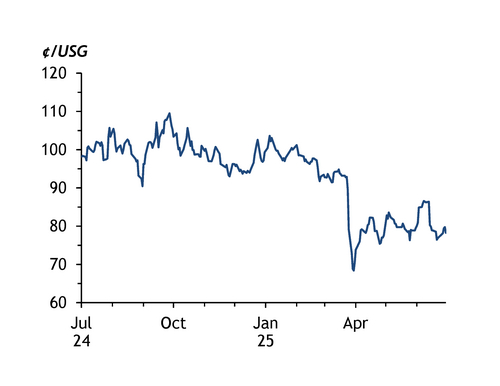

Mexico imports nearly all of its LPG from the US, with import prices pegged to US Gulf coast Mont Belvieu hub assessments. Mont Belvieu propane prices increased to an average of 87.8¢/USG ($458.50/t) in March, but dropped off in April. In June, the average was 76.59¢/USG, up by 1pc from 75.55¢/USG in June 2024. Regardless of international prices, domestic LPG associations have called for a built-in margin for distributors of Ps4.25/l plus value-added tax, "which would cover the necessary costs and investments for distributors", Amexgas said on 9 April.

Pemex's LPG wholesale prices averaged Ps6.65/l over the week ending 13 July. With the Ps10.93/l price cap, that leaves a profit margin of Ps4.28/l, sufficient for distributors to help restore financial stability and allow companies to invest in maintenance, Amexgas says. But the spread frequently moves below the Ps4/l mark, at times getting closer to Ps2/l, which barely covers the costs to keep operations running, let alone make profits, it says. The fleeting nature of a positive spread for distributor margins places them at odds with the government's position, which since the administration of former president Andres Manuel Lopez Obrador, maintains that the cap was necessary to prevent distributors from price gouging.

Counter strike

The government has not altered its retail price strategy, leading to distributors taking action by threatening strikes and blocking roads in Mexico City. A recent strike was delayed after Amexgas urged members to wait while it continues negotiations. Talks between the government and distributors are going slowly, with Amexgas focusing on explaining the maths behind the perceived unsustainable profit margins. President Claudia Sheinbaum has backed the price cap policy she inherited from Lopez Obrador. But the government and regulators are sympathetic to the problems distributors face, market participants say, paving the way for a new solution that would hopefully be amenable to the industry and the consumer.