Various factors will pressure PDH margins as the winter draws in and the seasonal shift will weigh on MTBE demand

China's LPG imports slightly increased on the year in the first eight months as the US-tariff-induced fall in demand from crackers was offset by a rise in demand from the propane dehydrogenation (PDH) and MTBE sectors. But the two drivers are likely to lose momentum in the fourth quarter on the back of weakening PDH margins and the end of peak gasoline blending season.

China imported 23.5mn t of LPG during January to August, 1pc up on the year, according to Kpler data. It was the lowest growth since the last trade war with the US in 2018-19, but was much better than expectations owing to the that were imposed from 14 May and are due to expire on 10 November.

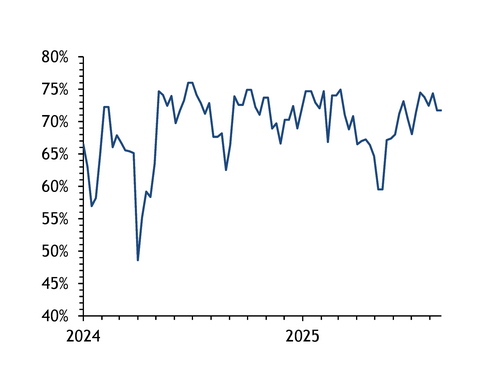

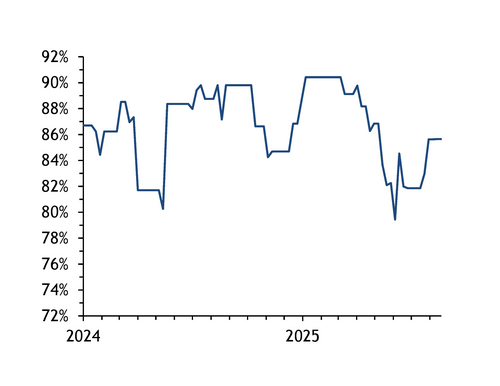

China's PDH operation rates averaged 70pc during January-August, with effective capacity of 24.3mn t/yr. This meant total propane consumption was about 13.4mn t, up by 23pc on the year, according to Argus data, as a result of better-than-expected PDH margins. Steam cracker runs fell to 80-85pc, lower than the usual 85-90pc, Argus data show, because many integrated refineries were under heavy turnarounds from the second quarter, while some natural gas liquid-fed crackers faced uncompetitive LPG prices against naphtha amid the tariff war and ethane supply disruptions in June and July.

China's strong MTBE exports drove demand for butane as the gasoline component is mainly produced from butane. In the first seven months, China exported 2.2mn t of MTBE, 33pc higher on the year, according to customs data.

Steam cracker demand for LPG fell following the escalation of the US-China trade war. LPG imports for cracking in China peaked at around 1mn t/month in 2024, Argus and Kpler data show, about 50pc of which was from flexible units that can switch feedstock. This was closer to 400,000t in August. Huatai Shengfu's 800,000 t/yr steam cracker in Ningbo completed its propane-to-ethane switch in January, and the Wanhua No 1 propane cracker was shut for an ethane retrofit from 2 June, resulting in nearly 300,000 t/month of propane demand loss. Other integrated steam crackers used self-produced or imported naphtha instead of higher-priced LPG. Only crackers without naphtha import quotas still need to import LPG.

Heated situation

PDH margins will face growing pressure in the fourth quarter. Firstly, global heating demand will pick up in winter, so the Argus Far East Index (AFEI) propane price is likely to gain support, especially when butane AFEI is higher than propane, which means LPG bottling plants prefer to blend more propane into the propane-butane mix. Secondly, Long Son's 1mn t/yr flexible-fed cracker in Vietnam restarted in mid-August, which could consume around two full cargoes, or 100,000t combined, of propane per month if run at full rate, further supporting propane AFEI. Thirdly, new refinery propylene capacity is coming on line in China, weighing on downstream propylene prices. CNOOC Daxie's 900,000 t/yr integrated polypropylene plant achieved on-specification production on 25 August, PetroChina Jilin's 1.2mn t/yr steam cracker is expected to start up in September, and PetroChina Guangxi's 1.2mn t/yr steam cracker is expected on line by year-end. And lastly, China's steam cracker run rates are recovering on the back of fewer maintenance works.

For MTBE, export demand is falling as the summer driving season ends, according to an east China-based MTBE exporter. And margins are also under pressure as butane prices are likely to rise as heating demand grows and butane blending into winter-specification gasoline starts in the US from October.

China's total LPG imports in 2025 are likely to be stable on the year at around 35mn t, according to Argus Consulting, but the demand structure has changed. The share of PDH, steam cracker, heating and other sectors is likely to be 54pc, 13pc, 24pc, and 9pc, compared with 47pc, 24pc, 24pc, and 4pc in 2024.