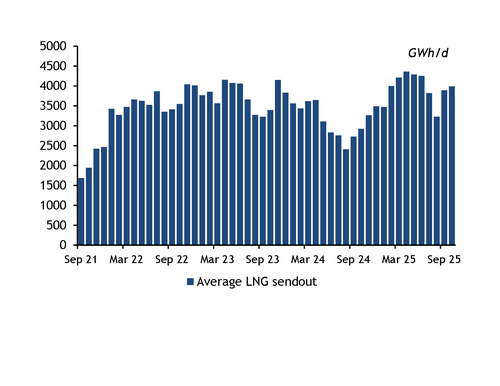

Regasification across European terminals last month was the highest for any September, but sendout could step down in October.

Aggregate sendout across all European terminals averaged 3.9 TWh/d in September, the highest ever for the month and substantially above a three-year average of 3.1 TWh/d. Sendout was also significantly higher than the 3.2 TWh/d regasified in August (see graph).

Europe imported 8.7mn t of LNG in September, equal to 11.2bn m³ of pipeline gas, according to ship tracking data from Kpler. This is up strongly from 6.4mn t, or 8.2bn m³ of pipeline gas equivalent, a year earlier and a three-year average of 6.2mn t or 8bn m³.

Ongoing storage injections needs in Europe drove global LNG demand last month, as temperatures across the northern hemisphere fell from their summer high point but remained high enough to prevent substantial heating. Asian LNG demand continued to be subdued, keeping the inter-basin arbitrage for US fob cargoes firmly shut for September deliveries, supporting quick shipments to Europe. LNG sendout in Europe helped to make up for lower pipeline gas deliveries to the continent last month, because seasonal maintenance at Norwegian upstream assets and the Algeria-Spain Medgaz pipeline took place at the same time.

Imports from the US doubled to 5.1mn t last month from 2.5mn t a year earlier, as the ramp-up of production at the Plaquemines facility brought US LNG exports to an all-time record high last month. Russia was the second-largest LNG exporter to Europe last month, having delivered 784,000t, followed by Algeria and Qatar at 747,000t and 655,000t, respectively.

The Netherlands continued to be the largest European LNG importer in September at 1.6mn t, followed by France with 1.4mn t and Italy with 1.3mn t. LNG deliveries to Italy surged to the second-highest monthly aggregate ever after a 30-day downtime at the 7.5mn t/yr Adriatic LNG terminal significantly cut deliveries in August.

Deliveries may step down in October

Growing competition from Asia and downtime at several German import terminals could cause LNG deliveries to Europe in October to fall on the month.

Declining LNG delivered prices in Asia have sparked interest for spot cargoes among price-sensitive buyers in Asia, which could entice uncommitted Atlantic supply away from Europe, traders told Argus. The front-month ANEA price dropped to a 17-month low of $10.45/mn Btu on 2 October. The price has increased in recent days, closing at $10.96/mn Btu on 6 October, but still holding lower than $11.25/mn Btu a month earlier.

And weaker import capacity in Germany could further weigh on European LNG imports this month as several import terminals are scheduled to be off line for maintenance.

Germany's Brunsbuttel terminal is due to shut down for the whole of October, while sendout capacity from Wilhelmshaven 1 and 2 will fall to zero on 6-10 October and 11-23 October, respectively. Combined, the maintenance means up to 6.91TWh of lost sendout for October, equivalent to six to seven LNG cargoes if those slots would have otherwise been fully used.

That said, cargoes could be redirected to other terminals. The northwest Europe delivered price for October delivery closed at an ample 65¢/mn Btu discount to the TTF, which prices in more expensive European facilities.