Crude receipts at the Croatian terminal of Omisalj fell in October, as a refinery served by the port caught fire and a disagreement continued between Omisalj's terminal operator and Hungary.

Overall Mediterranean crude imports dropped sharply in the month.

Omisalj receipts declined to 75,000 b/d last month, from 145,000 b/d in September, according to Argus tracking. Deliveries averaged 125,000 b/d in January-October, up from 110,000 b/d across 2024.

The terminal serves Croatian firm Ina's 90,000 b/d Rijeka refinery and is the start of the 400,000 b/d Adria pipeline that can supply three landlocked refineries — Mol's 161,000 b/d Szazhalombatta in Hungary and 115,000 b/d Bratislava in Slovakia, and NIS' 96,000 b/d Pancevo in Serbia.

Receipts fell as the US sanctioned NIS, and Szazhalombatta had a fire. There were sharp words over transit conditions between Mol and Janaf, in a long-running dispute.

October deliveries to Omisalj comprised 45,000 b/d of Azeri BTC Blend, plus 30,000 b/d of Caspian CPC Blend. Argus assessed average crude quality at Omisalj in January-October at 37°API and 0.7pc sulphur, lighter than the 2024 average of 35.8°API and 0.7pc sulphur.

Seaborne crude receipts at Mediterranean terminals — including Croatia, Spain, Greece, France's Fos-Lavera and Italy excluding Trieste — fell to 3.39mn b/d from 3.63mn b/d on the month. This was the lowest since June, when there were major works at two Greek refineries and Spain sharply cut crude purchases as a consequence of the end-April Iberian power outage.

October arrivals were down on a combination of a string of planned and unplanned works and an ownership dispute in Italy, unplanned maintenance in France, Szazhalombatta's fire and the US' NIS sanctions.

For refineries functioning correctly, middle distillate and gasoline cracks are buoyant. Greek's Helleniq Energy expects them to stay strong to year-end.

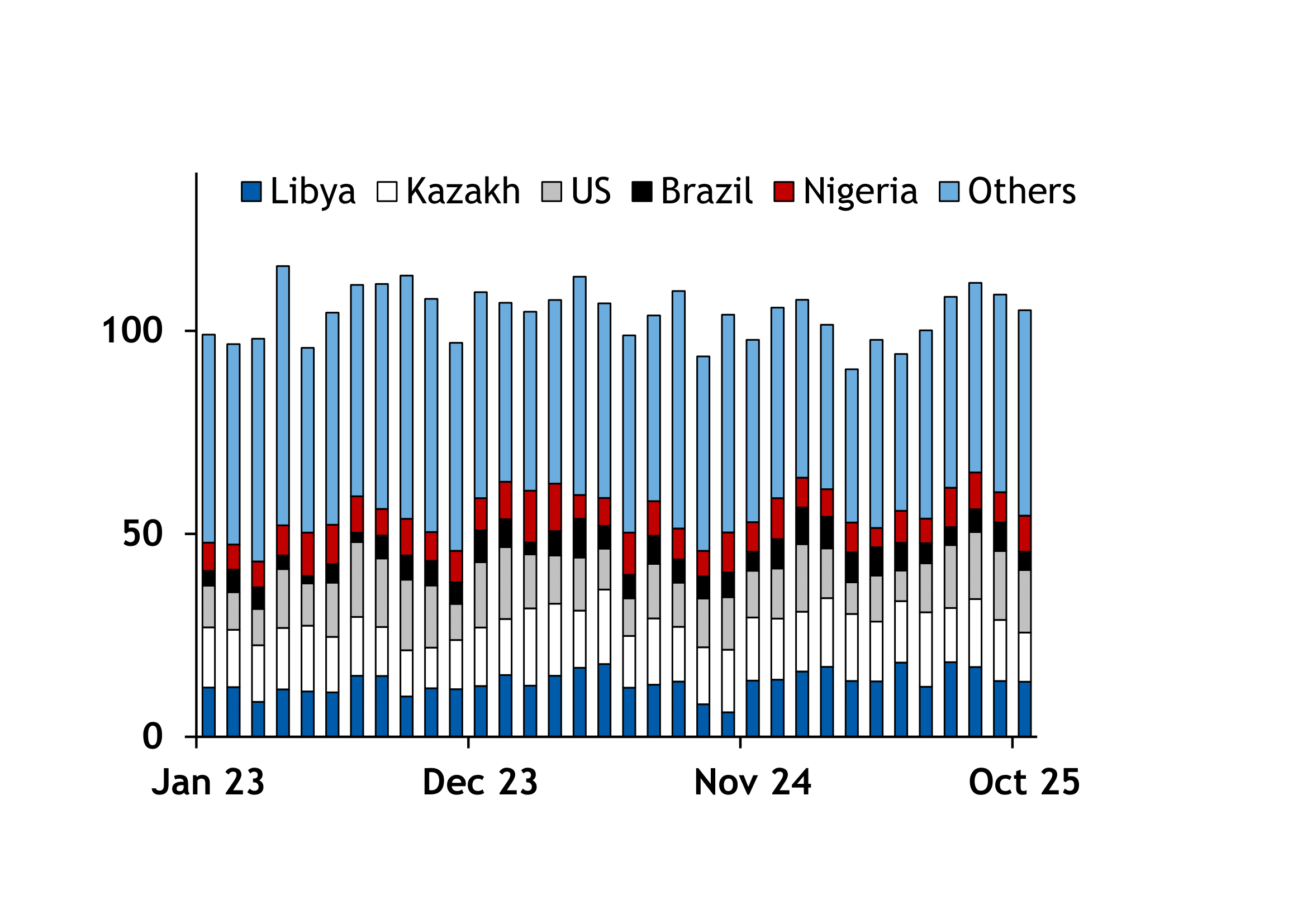

For the second month in a row the biggest crude supplier to the Mediterranean region was the US, with 495,000 b/d down from 565,000 b/d in September. Libya supplied 440,000 b/d and Iraq 445,000 b/d. This was the most Iraqi crude in the Mediterranean since November 2023, supported by strong Greek demand for Basrah Medium, plus returning Kirkuk supply.