Dry weather and minimal maintenance over January-March 2026 could support coal deliveries to Australia's Newcastle port, as well as exports from the thermal coal hub, which would help it recover from severe disruptions that took place during May–September.

Newcastle has a 57pc chance of receiving 339–450mm of rain over the first three months of 2026, slightly above its historical median of 338.5mm but still below levels likely to cause port-side or rail disruptions, data from the Australian Bureau of Meteorology (BoM) show.

The coastal city received approximately 517mm of rain during May–July this year, data from BoM show, during which Newcastle port implemented multiple rounds of vessel movement restrictions.

The weather challenges pushed up the average vessel queue at the Port Waratah Coal Services (PWCS) up to 60 ships in July, from 41 vessels a year earlier. PWCS has partly cleared its ship queue since, but it still hovered at 36 vessels in November, up from just 11 vessels a year earlier.

Demand in January-March

Weaker demand during the first quarter of 2026 could help ease vessel congestion at Newcastle port's coal terminals. Exports to key markets in northeast Asia including Japan, China and South Korea typically decrease in the first quarter, after the peak winter season.

La Nina weather conditions in Japan are expected to weaken in the second half of winter, according to the Japan Weather Association (JWA). The country faced a severe cold season in February this year, but the JWA predicts an arrival of spring-like conditions in February 2026. This could ease demand for coal exports to Japan during that period.

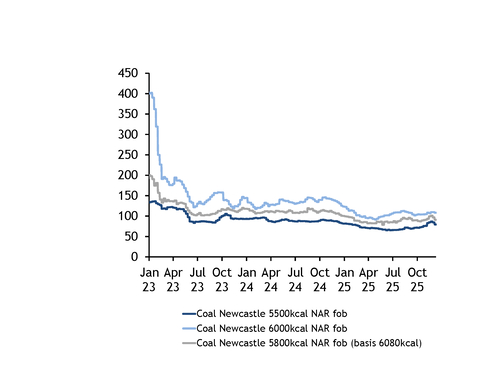

But weaker demand could put pressure on coal producers if prices fall steeply next year. Newcastle high-calorific value (CV) NAR 6,000 kcal/kg coal prices trended downwards from February-April after the winter season in Japan, reaching its lowest level of $91.71/t fob Newcastle at the end of April.

High-CV NAR 6,000 kcal/kg coal is usually exported to Japan and Taiwan, while China mainly imports high-ash NAR 5,500 kcal/kg coal from Australia. If the premium between NAR 6,000 kcal/kg and high-ash coal tapers, producers are likely to maximise profits by selling more coal to China.

Chinese utilities usually buy Australian coal to take advantage of the price arbitrage compared with domestic Chinese coal supplies delivered from north China ports. But the price of domestic coal in China was volatile from November 2024-January 2025, owing to safety inspections at major coal mines in the country.

Thermal coal exports out of Australia averaged 15.4mn t/month in the first quarter of 2025, according to customs data, which is consistent with averages recorded in the first quarters of 2023-25. But this is lower than the yearly average of 16.8mn-17.3mn t/month during 2023-25.

Movements to port

Producers are also likely to face fewer rail disruptions over the first quarter of next year. Australian state-owned rail operator the Australian Rail Track (ARTC) has just a single maintenance shutdown planned over the period. It will close its Hunter Valley coal lines — which link New South Wales mines to the port — for 72 hours in February (see table).

ARTC conducted four rounds of major maintenance over July–November this year, pushing down deliveries to PWCS' terminals at Newcastle port. Producers sent 87mn t of coal to the terminals in January-November, down by 4.4pc on the year, data from PWCS show.

By Avinash Govind and Nadhir Mokhtar

| ARTC track maintenance | ||

| Date | Lines | Length of Time (hrs) |

| 10-13 February | Warabrook/Kooragang to Muswellbrook | 72 |

| 10-13 February | Muswellbrook to Ulan | 72 |

| 10-13 February | Muswellbrook to Turrawan | 72 |

| 30 March-2 April | Warabrook / Kooragang to Muswellbrook | 48 |

| 30 March-2 April | Muswellbrook to Ulan | 72 |

| 30 March-2 April | Muswellbrook to Turrawan | 72 |

| 16–19 May | Warabrook/Kooragang to Muswellbrook | 72 |

| 16–19 May | Muswellbrook to Ulan | 72 |

| 16–19 May | Muswellbrook to Turrawan | 72 |

| 16–19 May | Islington Junction to Port Waratah | 48 |

| 16–19 May | Islington Junction to Telarah | 72 |

| 21-24 July | Warabrook / Kooragang to Muswellbrook | 72 |

| 21-24 July | Muswellbrook to Ulan | 72 |

| 21-24 July | Muswellbrook to Turrawan | 72 |

| 22-25 September | Warabrook / Kooragang to Muswellbrook | 72 |

| 22-25 September | Muswellbrook to Ulan | 72 |

| 22-25 September | Muswellbrook to Turrawan | 72 |

| 17-20 November | Warabrook / Kooragang to Muswellbrook | 72 |

| 17-20 November | Muswellbrook to Ulan | 72 |

| 17-20 November | Muswellbrook to Turrawan | 72 |

| Source: Australian Rail Track Corportation (ARTC) | ||