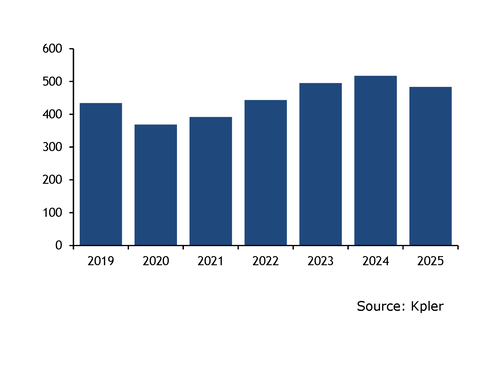

Indonesia, the world's largest thermal coal exporter, is weighing production cuts and policy changes that is fuelling fresh uncertainty in the global seaborne market heading into the new year.

Jakarta is considering setting coal production target under 700mn t for the next year down from its nearly 740mn t target for 2025. The actual production volume can vary, but a broad government guidance signals an intent to cut the production quotas, or the RKAB, for coal producers which could weigh on overall exports. The move to tighten supplies comes as demand from key coal importing markets — China and India — has remained subdued this year. And the outlook for next year is not very encouraging.

Coal producers have realigned operations in response to weak demand with Indonesia's annual coal exports likely to decline for the first time since 2020. Most suppliers are treading cautiously because of a slew of planned policy measures — such as an export tax on coal — that could be implemented as soon as January 2026.

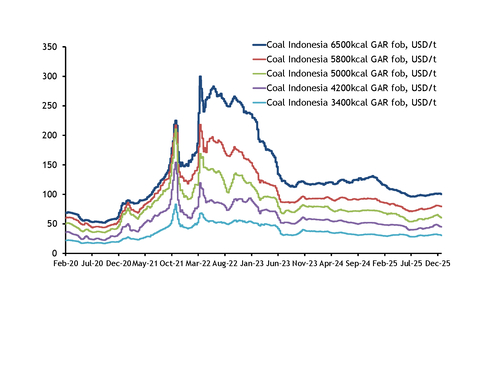

The drop in coal prices from their highs seen over the last five years have also depleted Indonesian coffers with its finance ministry eyeing additional streams of revenue by taxing coal exports, on top of the royalty and other indirect taxes and levies producers already pay.

Argus assessed the widely traded GAR 4,200 kcal/kg coal for Supramax vessels at $44.99/t fob Kalimantan on 24 December, down 71pc from its all-time high of $154.21/t on 21 October 2021. Prices hit a more than four-year low of $39.40/t in June this year and have since hovered in a narrow range that some producers say barely covers costs.

The Indonesian government has also taken other measures in 2025 to tighten supply as it believes that the ongoing surplus has kept prices under pressure. Some of these steps include withholding export sales proceeds in onshore bank accounts, tweaking domestic coal reference prices, or the HBA, rolling out mandatory biofuel blending norms, banning coal hauling in parts of South Sumatra, imposing export tax on coal and reverting to annual RKAB appraisals with increased compliance on mine reclamation.

Such measures need careful, calibrated implementation, considering Indonesia's strategic domestic coal requirements, particularly for power generation, as well as export opportunities in a softer global market, Gita Mahyarani, executive director at the Indonesia Coal Mining Association told Argus.

The lack of clarity, especially around the measures involving production cuts and export tax, add further complexity, directly affecting cost structures and investment decisions, Mahyarani added.

The uncertainty over policy moves and the announced measures could result in a slowdown in coal mining and prompt producers to focus on efficiencies across the value chain and market diversification.

Some coal companies are unable to plan business for the first quarter of 2026 even though there could be a January-March grace period linked to the previous three-year RKAB regime, a coal producer said. The suppliers are also not able to estimate volume and sales realisation due to lack of details on the proposed export duty. There is also ambiguity over the new production quotas, a coal trader said, adding that the market has pencilled in a drop in production and exports in the new year, as prices are expected to remain sluggish. Hundreds of small companies sitting over non-producing mines face potential sanctions with authorities directing them to comply with RKAB application norms, even as the large miners await fresh quotas.

A few producers have sought flat-to-high production quotas for 2026 from a year earlier hoping to achieve scale in terms of volume to offset the decline in revenue in a weak price and demand environment.

Demand trajectory

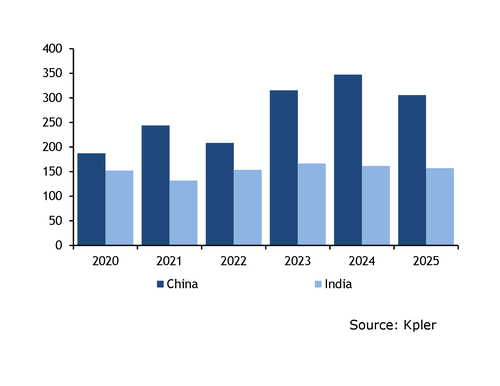

Weak demand from China and India — the world's top two coal importers — is weighing on the overall seaborne market.

The two countries are sitting on a huge pile of domestic reserves and suppliers from South Africa and Australia are competing for their market share in these demand centres. Indonesian sellers are also finding the Southeast Asian region — a key market that is expected to grow even though it's smaller than both India and China — highly competitive.

In China — the world's biggest coal importer — economic growth is expected to slow to 4.4pc in 2026 from an estimated 4.9pc in 2025, according to World Bank projections. China is also gradually increasing the share of renewable energy in its power generation mix putting further pressure on overall coal demand. Similarly, coal burn in India has largely remained lacklustre following an extended monsoon spell in 2025 and increase in renewable power generation. The sharp depreciation of the Indian rupee in 2025 has also weighed on imports.

The demand downturn in the two countries prompted several producers to change their sales strategies, with some raising shipments to Indonesian smelters in recent months. But it is not clear if these sales will account for the compulsory domestic market obligation that Indonesian miners need to adhere to where they must sell at least a quarter of their production locally, a producer said. Sellers have also adjusted sales as key buyers in Asia are focusing more on spot or short-term fixed price and index-linked contracts given the looming uncertainties, another trader said.

The Indonesian coal industry is witnessing a situation of falling output chasing weaker demand with some traders facing liquidity issues.

In this context, regulatory clarity and consistency remain critical, Mahyarani added, pointing to Jakarta's steps to rebalance the coal market through policy moves.

"As the industry closes 2025 amid weaker demand and escalating cost pressures, 2026 will be shaped by careful policy calibration and strengthened operational discipline," she added.