The US' capture of Venezuelan president Nicolas Maduro on 3 January is unlikely to have an immediate impact on the country's petroleum coke exports, although it could begin shipping to more nations if the US lifts sanctions on Venezuela's oil industry.

The shift in the country's governance could be a "game changer", one coke trader told Argus, as larger established trading firms could re-enter the market. Venezuelan supply could regain its historical quality premium if sanctions concerns, payment difficulties and shipping delays are no longer a factor, the source said. But Venezuelan coke could also be removed from the market entirely in the near term.

"I don't expect anything to change quickly," another coke trader said. But if the US lifts sanctions, "maybe there could be a change in the market this year".

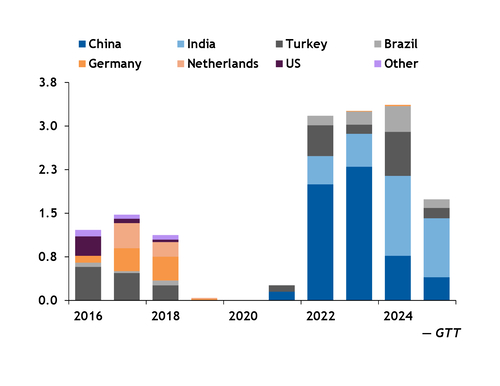

Sanctions imposed in 2019 have meant Venezuelan coke can only ship to a limited number of buyers that are not concerned with potential penalties from the US. This has meant exports over the past seven years have gone almost exclusively to China, India, Turkey and Brazil.

This was a shift from the trade flows prior to sanctions. Although Turkey and Brazil were still the largest buyers of Venezuelan coke before 2019, European countries and the US were also major buyers. And those countries tend to pay a premium for the medium-sulphur content of Venezuela's coke, as opposed to buyers like India.

While Europe and the US have reduced their overall coke imports over the past decade, a complete removal of sanctions could lead some buyers back into the Venezuelan market, displacing some coke from the US Gulf or other origins.

The short-term impacts of the US military operation are still unclear. Some market participants said that Venezuelan coke exports have been halted since the middle of December when the US announced a blockade on oil shipments from the South American country. But others said coke shipments have been moving normally, with one vessel loading coke for China just hours after the US' overnight raid on 3 January. Trade analytics platform Kpler was only showing one 50,600t shipment loading from Venezuela's Cardon refinery last month, signalling a destination in the Mediterranean.

"Technically, nothing has changed," said one trader that sells Venezuelan coke, as management at the country's state-owned oil company PdV remains the same. This is despite US president Donald Trump's initial assertion that the US and US-owned oil companies would be "very strongly involved" in remaking Venezuela's oil sector.

US secretary of state Marco Rubio appeared to walk back this claim on 4 January, although the US will not allow "the oil industry in Venezuela to be controlled by adversaries of the United States", he said.

Venezuela has been sending crude and other products to China under a large oil-for-loans program. A Chinese state-owned firm helped to finance new port infrastructure in 2022 that has allowed petroleum coke exports from the country to surge over the past few years. Green coke exports from the country totalled 3.12mn t, 3.26mn t and 3.47mn t in 2022, 2023 and 2024, respectively, according to customs data from importing countries compiled by Global Trade Tracker. This compares with 1.8mn t, 1.8mn t and 1.2mn t in 2016-2018, and 49,400t, zero, and 259,300t in 2019-2021.

Full data from all importing countries is not yet available from GTT for 2025, but the data so far suggest that exports dropped significantly. Data from importing countries so far show only 1.8mn t of exports from Venezuela last year. Exports fell because of stronger competition from the US, relatively high freight costs, and weaker demand in cfr markets.

The lower exports could continue this year, as Venezuelan coke is not particularly competitive in the global market. Fob costs are higher this year as traders are paying a higher premium to the US Gulf index, but cfr prices in the main importing markets of China, India and Turkey have been capped by weak coal prices.

In addition to the potential change in Venezuelan coke trade flows, the US raid could also adjust global petroleum coke production if Venezuelan crude flows shift. Chinese independent refineries have been major buyers of this crude as it sells at a wide discount to other origins, but now they need to find alternative supplies.

Most Chinese refiners using Venezuelan crude produce asphalt rather than petroleum coke, market participants said. But in the US, Venezuelan heavy crude has historically been a key feedstock for coking refineries. Some US refiners are still using this crude as Chevron has been allowed to import volumes under a sanctions waiver. If the US lifts sanctions entirely and encourages oil companies' investment in Venezuela, more of this crude could move to the US rather than China.