Central and eastern Europe's underground gas stocks are on track to enter this summer significantly lower than a year earlier, and the region may struggle to boost imports enough to erode the deficit by next winter.

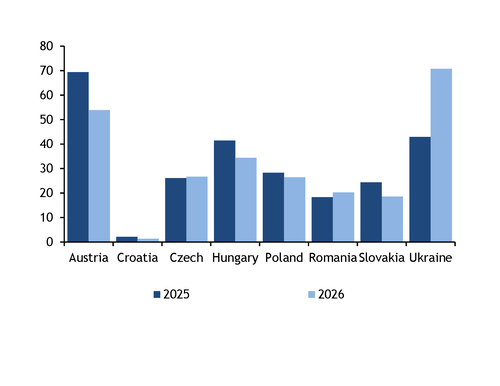

Stocks in Austria, Bulgaria, Croatia, the Czech Republic, Hungary, Poland, Romania and Slovakia were at a combined 182TWh on Tuesday morning, 28TWh lower than a year earlier and the lowest for the day since 2022, according to GIE transparency platform data (see stocks graph). Sites in these countries were 54.4pc full in aggregate.

The largest year-on-year deficit was in Austria at 15.3TWh, followed by Hungary at 7TWh and Slovakia at 5.8TWh. This more than offset a small year-on-year surplus in Romania, the Czech Republic and Bulgaria.

Stocks in northwest Europe were even lower in percentage terms. Combined EU stocks, excluding the central and eastern European countries listed above, were at 380TWh on Tuesday morning, 102TWh lower than a year earlier and at 46.7pc of capacity.

Cold weather has boosted heating-related demand across Europe in recent weeks and led firms to draw heavily on storage.

Even if the stockdraw on 20 January-31 March is in line with the same period in 2025 — keeping the year-on-year deficit stable — central and southeast Europe would end March with 95.7TWh in storage. This would be the second lowest for the date in the last seven years, behind only 2022.

Ukraine bucks the trend of other countries in the region. The country's storage sites held 70.02TWh, around 28TWh higher than a year earlier. Strong imports have helped to keep stocks higher, helping Ukraine to avoid a situation in which withdrawal capacity is constrained near the end of the season.

Summer supply limitations

Congestion on west-to-east routes may make it difficult for firms to significantly ramp up imports to central and eastern Europe this summer in order to rebuild stocks.

Firms already ramped up deliveries at western borders last year to replace Russian gas previously shipped through Ukraine, following the Ukraine transit halt at the end of 2024. West-to-east bottlenecks will cap how much more supply can be shipped east, while projects to deliver new supply to the region will only make a limited contribution.

Net Austrian imports from Germany at Oberkappel surged to 190 GWh/d in 2025 from 10.2 GWh/d in 2024 and were near technical capacity almost all summer. And Austria net imported 31 GWh/d from Italy last year, reversed from 154 GWh/d of net exports in 2024 when Austria was still acting as a transit market for Russian gas.

Flows to the Czech Republic from Germany at VIP Brandov similarly rose to 251 GWh/d in 2025 from 97 GWh/d in 2024, and were maximised for most of the summer.

Some projects to bring new supply to southeast Europe were commissioned last year, which may deliver incremental supply this summer.

The 4.3mn t/yr Alexandroupolis LNG terminal in Greece came on line in October 2025 but is scheduled for maintenance in the second quarter. This may limit imports through Greece and increase competition for alternative supply in the region. This could also cap the extent to which Ukraine can import from Greece using the integrated Route 1, 2 and 3 products.

The other upgrade was at Croatia's Krk LNG terminal, where regasification capacity increased to 4.7mn t/yr from October 2025 from 2.3mn t/yr previously. And Azeri transport capacity through the trans-Adriatic pipeline rose by 1.2bn m³/yr to 11.2bn m³/yr from 1 January, although some of this supply will be for other markets — Azeri state-owned Socar started delivering gas to Germany and Austria this month.

Hungarian state-owned utility MVM also signed 2.05bn m³/yr of supply LNG deals in recent months aimed at diversifying its import options.