The Ripet terminal's proximity to tariff-hit Asian markets makes Canadian propane increasingly attractive, writes Dennis Kovtun

Canadian midstream firm AltaGas could benefit from the government's attempts to reach new trade agreements with China, having seen its growing propane exports move to China in place of Japan as a result of US-China trade tariffs.

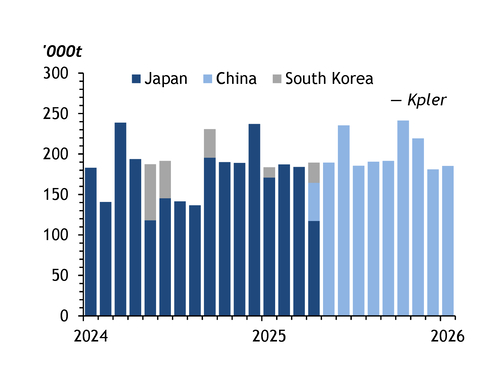

The Calgary-based company operates the 92,000 b/d (2.7mn t/yr) Ridley Island propane export terminal (Ripet) in Prince Rupert, British Columbia, and the Ferndale LPG terminal in Washington, US. It has shipped an average 76,000 b/d of propane to China from Ripet since April 2025. AltaGas historically delivered around 97pc of its propane to South Korea and Japan under term contracts, it said in December. This was heavily weighted towards Japan, which received 2.1mn t from Ripet in 2024, while South Korea took 150,000t, data from trade analytics platform Kpler show. Cargoes headed to Japan began to be redirected to China from April — China received all of the 1.9mn t shipped from the facility in May-January.

AltaGas intends to sign term contracts with Chinese customers, from whom it has received "a lot of interest", midstream vice-president Randy Toone says. China is still seeking alternatives to US propane following the threat of prohibitive trade tariffs from the administration of President Donald Trump and Beijing's imposition of a 10pc tariff on US goods since April. And Ripet's geographical proximity to Asian markets makes Canadian propane increasingly attractive, Toone says. A very large gas carrier can load at the terminal and arrive in Japan in 10 days, whereas a US Gulf coast shipment transiting the Panama Canal takes around 30 days, not factoring in any potential delays at the canal.

AltaGas will install a methanol removal unit at Ripet by the end of 2026, which will mean the propane it exports meets Chinese propane dehydrogenation (PDH) plant specifications — something that has hindered trade. AltaGas' new 55,000 b/d Ridley energy export facility, which is adjacent to Ripet and can also export butane, will also have a methanol removal unit when it starts up later this year.

"We knew we were missing out on a big market that we weren't able to penetrate just because of methanol content," Toone says. Chinese buyers have accepted the higher methanol content from Ripet on a short-term basis in order to diversify from US supply. "Our assumption is they've blended it with other [propane] so they can use it," he says. But the new methanol units make term agreements feasible. And while rapid growth in Chinese PDH demand for propane imports has slowed in the past year, Toone expects China to remain a critical buyer over the longer term.

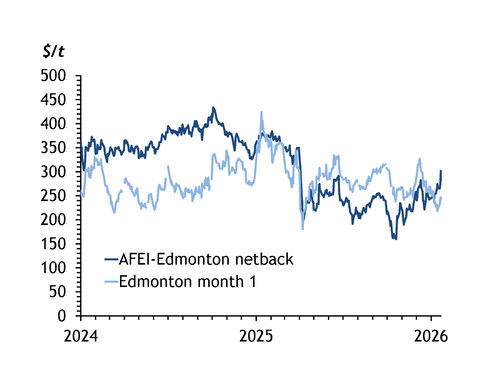

Cargoes have been sold to China in recent months on the Argus Far East Index (AFEI), covering northeast Asian deliveries, and AltaGas will continue to seek AFEI pricing in its term commitments with China, Toone says. AltaGas already sells to South Korea and Japan on an AFEI basis.

Pacific pacts

Canadian prime minister Mark Carney visited Beijing to sign eight initial agreements with China, including a commitment to increase co-operation on LPG trade. "Right now, LPG is probably the easiest way to get energy over there. Obviously there's bitumen, but we think LPG is a long-term fuel for China," Toone says.

Canadian propane prices are lower than US prices and exports to Asia benefit British Columbia's economy, where the lumber industry has been hit hard by US tariffs, Alberta-based ATB Financial chief economist Mark Parsons says. "Energy has been an emerging growth story for the province, not only natural gas extraction but some of the midstream sectors and exports of these products," he says, adding that shipping more propane to China will allow Canada to reduce its US exposure. And Asian demand growth is not limited to China. "The demand is there. We don't have to create it," he says, noting Malaysia and Indonesia as other prospective markets.