Power consumption in Germany's passenger vehicle manufacturing sector is set to fall given that overall output is likely to drop in the coming years, according to automotive association VDA chief economist Manuel Kallweit, as strong competition from China could outweigh any power demand uptick from electric vehicle (EV) production.

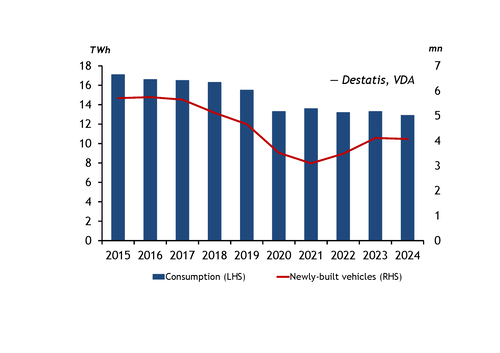

Electricity consumption in the vehicle, trailer and semi-trailer manufacturing sector totalled 12.86TWh in 2024, according to national statistics office Destatis, equivalent to 2.8pc of total German electricity consumption in the year. Consumption in the sector has declined slowly since 2020, after falling more sharply in the previous years. And production over 2015-24 has fallen alongside a decline in consumption (see consumption vs output graph).

VDA forecasts car production in 2026 to drop by 1pc from 2025 — when production totalled 4.15mn units, up by 2pc on the year but still 11pc below 2019 — to 4.11mn vehicles, while German car exports are forecast to decline by 1pc to 3.14mn vehicles.

Chinese EVs pressure German market

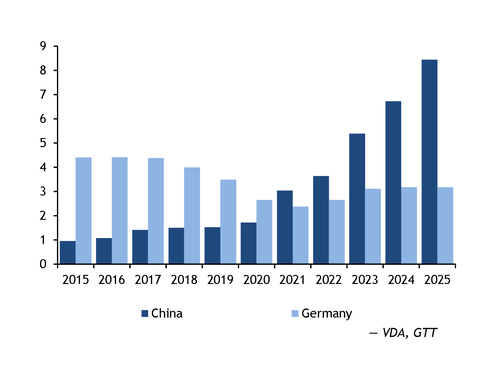

The electrification of vehicles is shifting the value chain of the automotive industry to Asia — and in particular China — with Europe unable to keep up with the redistribution of industrial value, Kallweit said.

In addition, China's control over a large part of raw materials supply and processing, as well as the country's various subsidy schemes to support the EV industry, is threatening Europe's automotive industry. Nevertheless, VDA opposes EU intervention such as imposing tariffs on Chinese EVs and would rather the industry continues to face the issue "head on".

China's share of global vehicle production rose to 34pc in 2024 from 28pc in 2019, while Europe's share declined by 4 percentage points to 19pc, according to European manufacturers' association ACEA data.

Meanwhile, US tariffs on parts and vehicles would have placed a "heavy burden" on the EU automotive industry, while the speed at which tariff proposals are introduced also results in a "significant" impact. The US in mid-January threatened additional 10pc tariffs on goods imported from Germany and several other European countries.

And India's recent reduction of tariffs on EU goods exported to India is a positive sign but not a solution to current challenges as the measure only produces long-term benefits, he said.

Production capacity continues to fall

The expected fall in German passenger car production in 2026 can be partially attributed to the end of vehicle production at US automaker Ford's Saarlouis factory in November last year, Kallweit said.

German carmaker Volkswagen also ended vehicle production at its Dresden plant at the end of last year, while the firm plans to stop vehicle production at its Osnabruck plant in autumn 2027, and to reduce production capacity at its main Wolfsburg plant due to partial assembly line relocation to Mexico in the same year.

And Volkswagen expects to reduce its German manufacturing capacity by 734,000 vehicles/yr by 2028, equivalent to roughly 40pc of its 2024 German output, although since it is "primarily" unused capacities being reduced, this does not necessarily mean the firm will build fewer vehicles, the company told Argus.

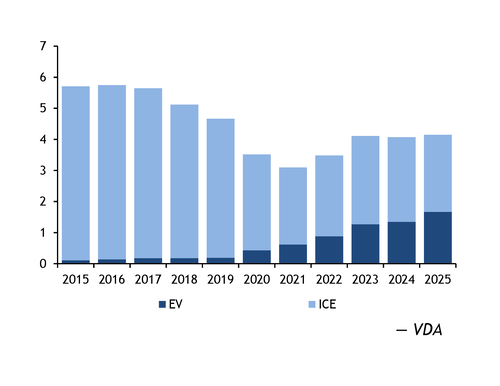

EV boom unlikely to lift overall demand

Production of EVs is increasing, against the overall trend, but this is unlikely to be enough to counteract the fall in internal combustion engine (Ice) vehicle manufacturing, Kallweit said.

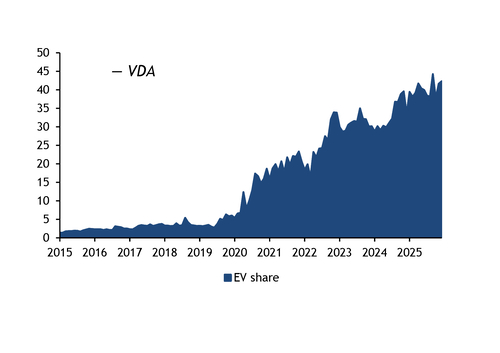

Of the 4.15mn passenger vehicles produced domestically in 2025, 1.67mn were EVs, up by 23pc on the year, while their share of total passenger vehicle production reached a new high at 40pc (see EV graphs). VDA forecasts domestic EV production to rise by 6pc in 2026 to 1.76mn vehicles.

Kallweit expects Germany to "soon" produce more EVs than Ice vehicles. The recently approved €3bn in subsidies for private buyers will provide a "boost" to electromobility, and in particular to German manufacturers due to the lack of a price cap which would have favoured less expensive, non-German-produced vehicles, he said.

But the subsidy targets a very small subsection of the market, he said, as only 30pc of EVs purchased in 2025 were privately owned, against 70pc commercial vehicles, while not all private buyers will qualify for subsidies.

While EVs' share of German production will "significantly increase" in the coming years, this will not lead to an overall rise in production, he said.

Meanwhile, Ice vehicle manufacturing will "simply have to" decline because of EU regulation, with only a few "premium" brands able to sell within the EU in the future, meaning the decline in Ice vehicle sales will outpace the expected increase in EV sales, he said.

As a result, Kallweit expects overall passenger vehicle production to continue to remain "under pressure", with the current level maintained only in an "optimistic" scenario.

All things considered — and excluding rising EV charging-sector electricity demand due to the replacement of Ice cars on the roads with EVs — a likely slow decline in German passenger vehicle manufacturing will result in falling automotive industry power consumption in the coming years.