French corn: Competing for growth in a shifting market

France’s corn export market is adapting to structural changes in the sector, as well as short-term market drivers. The 2025-26 marketing year could become a defining one for French corn as production in Europe falls, yields prove increasingly volatile and competition builds between exporters. Here are the key trends to watch out for.

European production in decline

Corn production in Europe has been falling compared with historical norms for the past four years. Production in 2025 stands at 54.8mn t according to Argus, versus an average of 62mn-63mn t over the past 10 years. This decline is explained by:

- Recurring weather incidents: Droughts and heatwaves in eastern Europe (Bulgaria, Romania, Hungary).

- Reduction in acreage: Spring crops are increasingly abandoned by many European producing countries (especially in eastern Europe) owing to high volatility in yields from one year to the next.

- Ukrainian competition: Despite logistical difficulties this year, imported Ukrainian corn remains a major competitor.

The EU has retained its position as the world’s second-largest corn importer, behind Mexico, with a total of 22mn t to import in 2025-26. A precarious situation for the EU’s own production should keep the bloc in need of imports for years to come.

France: Between stability and fragility

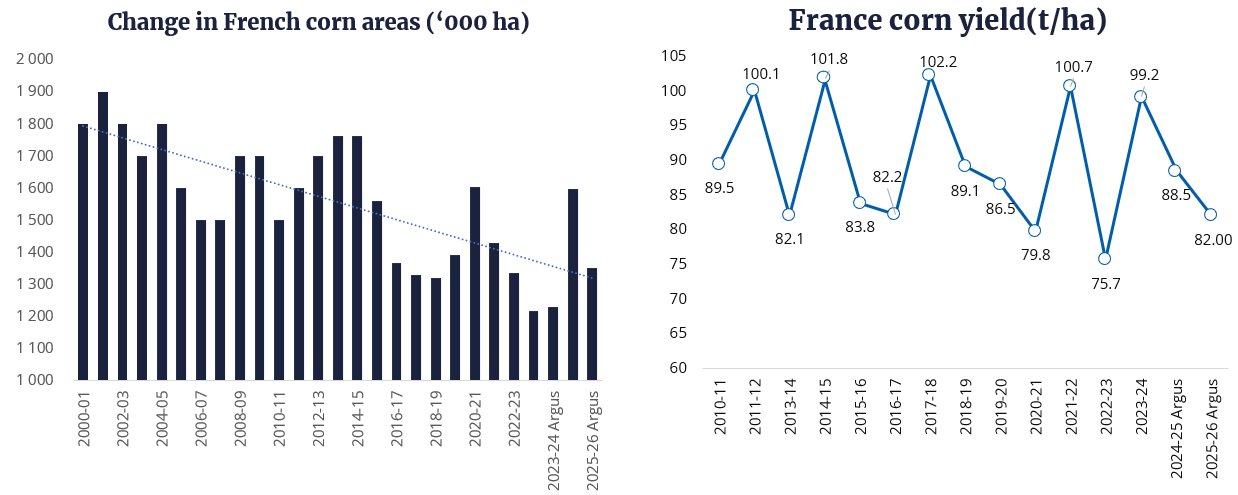

French corn production has fluctuated between 10.1mn t and 14.4mn t over the past 10 years. In 2025, it stands at around 12mn t, but the trend remains fragile:

- Acreages down: From 1.9mn hectares (ha) in the early 2000s, to 1.3mn–1.4mn ha today.

- Volatile yields: Yields can vary by as much as 20pc from one year to the next, accentuated by climate events.

This instability makes it more difficult for the sector to anticipate the supply available and properly manage its outlets in the market.

French outlets: Exports and animal feed lead the way

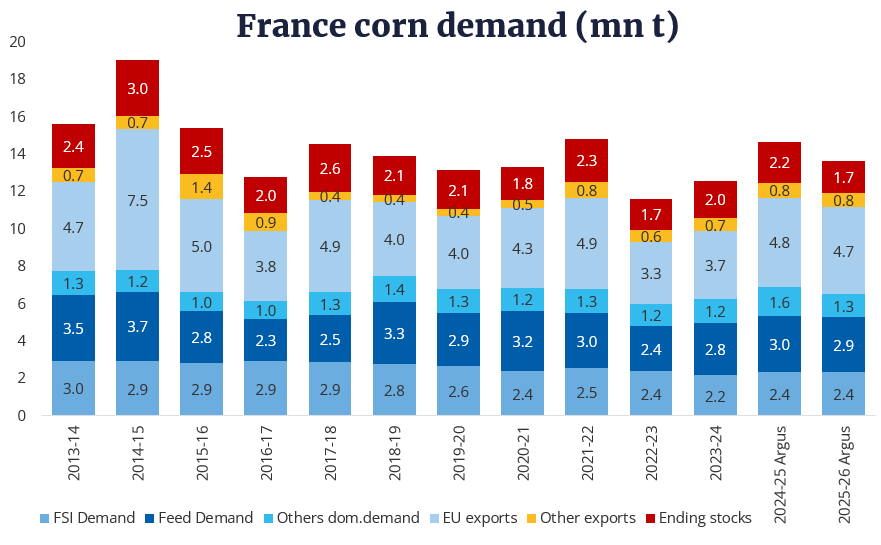

The market share for French corn in 2025-26 clearly shows which outlets are most price-sensitive:

- Exports: France remains an exporting country within an importing bloc. Of the 4.7mn t of total French corn exports that Argus estimates for 2025–26, around 90pc of could head to other EU member states. The largest buyers are France’s direct neighbours in Spain, the Netherlands and Belgium.

- Animal feed: Use of corn in animal feed is falling and unlikely to go above 3mn t this year, compared with

3.5mn-3.7mn t nearly a decade ago. - Industry: Around 2.4mn t goes to industrial uses, with three major segments:

- Starch: down slightly in recent years due to reductions in production capacity in recent years. Now stands at around 1.7mn t.

- Ethanol: a stable outlet using just over 500,000 t/yr. Its development is limited by a strong concentration of industrial sites in northern France, near sugar beet production areas. The European biofuels sector also mainly relies on rapeseed oil as a raw material, rather than cereal crops.

- Semolina: a smaller, more stable sector that takes around 130,000 t/yr.

This breakdown highlights the need for French corn to remain competitive both against French barley and/or wheat for a place with feed manufacturers, as well as against corn from other major exporters. Exports and sales to the animal feed sector are the two main outlets for French corn where there is room for the supply and demand balance sheet to change.

French corn is competitive on export markets

French corn has held a strong competitive advantage over other origins since the start of the 2025-26 marketing year, boosting exports:

- Logistical advantage for access to neighbouring countries.

- Less competition from Ukrainian corn imported into the EU market, given harvest delays in Ukraine caused by persistent rainfall since the start of harvesting, and logistical difficulties resulting from power shortages and degraded rail infrastructure.

- French corn is more competitive than usual in the cif Rotterdam (Netherlands) or cif Lerida (Spain) markets.

French corn is gaining market share and establishing itself as a key player in the European region at the start of the campaign.

Conclusion: What is the outlook for French corn?

The 2025-26 marketing year confirms a trend — French corn is asserting itself as a key player in the export market, even as the country’s production comes under pressure.

That said, there is no doubt that the market faces some challenges, such as cases of African swine fever detected in Spain or producers holding back on selling because of market prices that offer growers little or no remuneration.

For market players, the key will be to anticipate these developments, secure outlets and develop strategies that can respond to volatility in yields. In a context where Europe imports more and more corn, French competitiveness is an asset… so long as it lasts.

Author names: Pierre Maury and Antoine Guyon, Editorial Analysts, Agriculture