Overview

The rare earth permanent magnet market - anchored by neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo) technologies - is projected to exceed $9bn by 2036. With over 90pc of magnet production concentrated in China alongside the vast majority of rare earth processing capacity, buyers face rising risks from geopolitical tensions, export controls and supply chain bottlenecks. Argus Rare Earths Analytics provides the independent data and forecasting tools needed to secure reliable sourcing, optimise procurement strategies and anticipate market disruptions.

Pricing rare earths can be challenging, with few sources of marketable product in the global spot market and most of that from a handful of Chinese producers that supply manufacturers across the globe. The Argus Consulting team produces forward-looking price outlooks with the inherent advantage of being underpinned by Argus' industry-leading historical database of rare earths prices - built on decades of trusted price assessments. Using proprietary forecast models and deep market fundamentals, we deliver short and long-term perspectives grounded in the same robust pricing expertise that the market itself uses for transactions.

Argus is a valuable business partner for any company that depends on the rare earths supply chain or which is looking into financing rare earths-related projects. In addition to the detailed report and raw data sets in Excel that are included with the Argus Rare Earths Analytics Service, clients have access to subject matter experts for various formal and ad-hoc conversations and bespoke work.

Argus provides price forecasts for rare earth oxides and feedstocks including:

Cerium | Dysprosium | Europium | Erbium | Gadolinium | Holmium | Lanthanum | Lutetium | Neodymium | Neodymium-Praseodymium | Praseodymium | Samarium |Terbium | Thulium | Yttrium and Ytterbium

Rare earths are no longer just niche materials - they are strategic assets. And in a market this complex and politically charged, independent analytics are not just helpful - they are essential.

Key features

Monthly rare earths outlook

12-month price projections with comprehensive trade data, supply and demand analysis, and crucial developments.

Biannual rare earths analytics

Comprehensive 15-year forecasts for prices, production, and supply and demand, with unrivalled detail on rare earths and magnet global trading.

Inform your strategy and minimise your risk

Plan your next move with one-year and 15-year forecasts across supply, demand, prices and projects updated every six months. Stay ahead of impending regulations, policy changes and supply chain challenges.

Data and downloads

Access and manipulate valuable data with the Excel add-in, including project trackers, import/export numbers, electric vehicle (EV) sales and forecasts, demand projections for renewables and magnets.

Adding context to data

Understand the drivers and limiters behind our rare earth outlooks with extensive market analysis and commentary.

Access to experts

Subscribers gain access to our rare earths consultants and subject matter experts in 28 offices across Asia-Pacific, Africa, Europe and the Americas.

Customers that benefit

Mining Companies

Mining companies use Argus Rare Earths Analytics for competitive analysis of additional capacity through new mining projects and additional options for developing refining partners in new markets. Demand from end-use markets is also analysed to uncover potential opportunities for business development.

Rare Earths Refiners

Refiners benefit from using Argus analytics data in their long-term supply and demand projections to ensure resilience in the supply chain and identify additional refining projects in development that could threaten market position.

Traders

Traders rely on Argus impartial forecasts to spot favourable market conditions for imports and exports, plan for tightening supply, tariff implications, and to time trades effectively.

Manufacturers

For buyers of rare earths - or products that rely on them - an independent forecast offers critical advantages, including price risk management, strategic sourcing, transparency on information imbalance, investment decisions, and regulatory readiness.

Magnet manufacturers

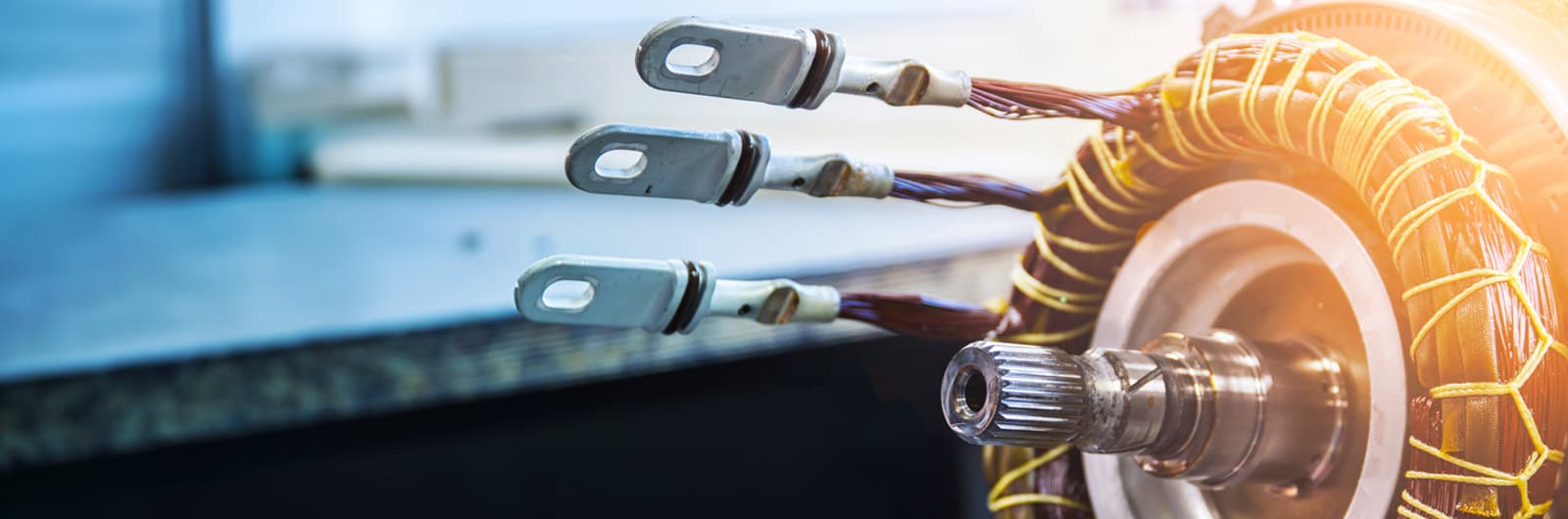

Magnet manufacturers use the fundamental data in Argus Rare Earths Analytics to ensure a reliable supply of rare earths feedstocks, to understand demand drivers from various end-use markets and to plan for geopolitical complications for trade.

Government entities

With rare earths being central to geopolitical tensions due to their use in many important defence and technology applications, government entities that are responsible for securing critical materials can look to Argus for detailed information on the global supply and trade landscape.

Product Specifications

The Argus Rare Earths Analytics Service gives you access to market-leading and independently developed price forecasts and analysis across the global rare earths market with a specific lens on China as the dominant producer. Clients receive a monthly PDF with short-term analysis and outlook by element, and a biannual long-term analytics report with a data-rich executive summary of long-term fundamentals and forecasts, as well as the raw data in Excel accessible via a client portal.

Key price assessments

Argus prices are recognised by the market as trusted and reliable indicators of the real market value. Explore some of our most widely used and relevant price assessments.