Brazil's rare earths extraction capacity will struggle to catch up with China through 2050, not unlike the rest of the world, according to the Brazilian energy transition innovation center (ETIC)'s deputy coordinator.

Brazil's ample resources will fall short of enabling it to become a key rare earths market as long as processing remains almost monopolized globally by China, ETIC's deputy coordinator Erik Rego, who is also a former electric power studies director at the energy research bureau (EPE), told Argus.

"The world is seeking an energy transition from a dependence on oil producing countries to only one mineral processingand supply country, and that is China," he said. "Youcould buy minerals from across the world, but only one country is processing them."

Still, the government is eyeing mineral reserves onshore and offshore to increase production and market share during an energy transitionramp-up ahead of Brazil's net zero targets in 2050.

Brazil holds 23pc of the world's rare earth reserves, 26pc of the graphite reserves and 94pc of the niobium reserves, according to geological survey SGB.

Companies such as the US' Rare Earths Americasand Aclara Resources have set sights on Brazil for that market.

But production is still incipient. Only one company — Brazil's Serra Verde — produces rare earths in the country. It is the only source of commercial production outside of Asia.

Brazil has been insisting on its claim to a mineral-rich offshore territory known as Rio Grande Rise in the eastern South Atlantic margin.

Mineral race

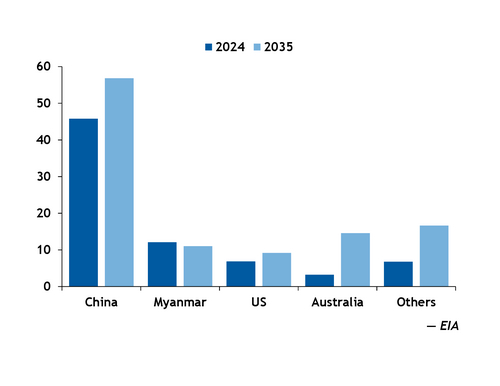

China's mining supply of magnet rare earth elements — such as praseodymium, neodymium , terbium and dysprosium — is expected to increase by 24pc to 56,800 metric tonnes (t) in 2035 from 2024, according to International Energy Agency (IEA) projections (see graph).

Australia, currently the fourth top mining country in the segment, is set to lift its output fourfold to 14,570t in 2035 from 2024.

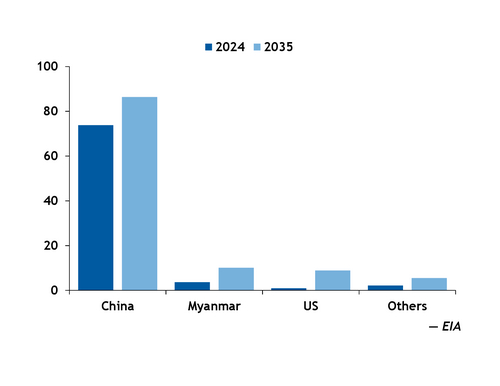

China represented 68pc of rare earths mining production in 2022, followed by the US with 11pc and Australia with 9pc, according to IEA. As for the processing of these elements, China alone accounted for 90pc, ahead of Malaysia with 9pc and Estonia with 1pc.

China also led processing of other rare minerals in 2022, such as copper, cobalt, lithium and 100pc of graphite, while it only appeared among the top three producing countries in mining of rare earths and graphite during the period. The data show that, as opposed to geopolitical debates recently over mineral reserves, the world should pay more attention to processing, which is concentrated in the Chinese market, not extraction, Rego told Argus.

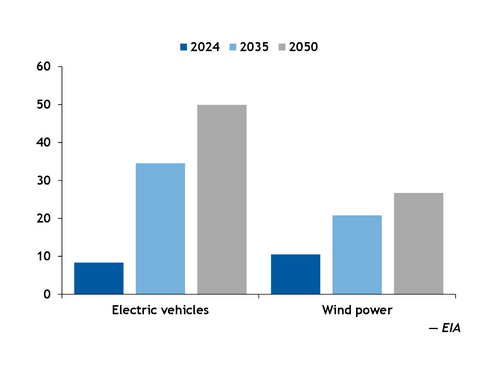

Rare earths have been in focus since the ramp-up of production of electric vehicles (EVs) and wind turbines, which make them valuable to the energy transition agenda.

Rare earth elements, especially, are mostly used in offshore wind power generation, besides a modest presence in onshore and nuclear facilities. The EV sector will require around 49,890t of magnet rare earth elements in 2050, up from 8,360t in 2024, according to IEA data. Meanwhile, wind power generation is expected to reach 26,700t of magnet rare earth elements in 2050 from 10,500t in 2024 (see graph).