International and US state-level programs to reduce greenhouse gas (GHG) emissions from the transportation sector are poised to transform the market for alternative jet fuel, but economic and policy challenges may throw the brakes on its growth.

Fuel producers think the UN's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and low-carbon fuel standards (LCFS) in California and Oregon will make alternative jet fuel an attractive option for them.

"We believe jet fuel is the one that is going to help us thrive and, more importantly, help finance projects," Red Rock Biofuels chief executive officer Terry Kulesa said yesterday at an aviation industry conference in Washington, DC.

Red Rock Biofuels is building a biorefinery in Oregon that will use woody biomass waste to produce 15mn USG/yr of jet fuel and start operations in late 2019. Southwest Airlines and FedEx have already agreed to purchase 100pc of the product.

Alternative jet fuel refers to any jet fuel sourced from non-petroleum feedstocks, such as waste oils, wood fiber or algae. Their use can cut GHGs by as much as 80pc compared with traditional jet fuel.

CORSIA aims to freeze global aviation net GHG emissions at 2020 levels, which will promote the use of less carbon-intensive alternatives to traditional jet fuel. To date, 76 countries including the US have agreed to participate in the system, which will apply only to international air travel.

The airline industry expects CORSIA to generate a market demand of 2.6bn metric tonnes of CO2-equivalent offsets.

"That is more than has been produced in the voluntary or other markets to date," said Nancy Young, vice president of environmental affairs for Airlines for America, which represents the industry in the US.

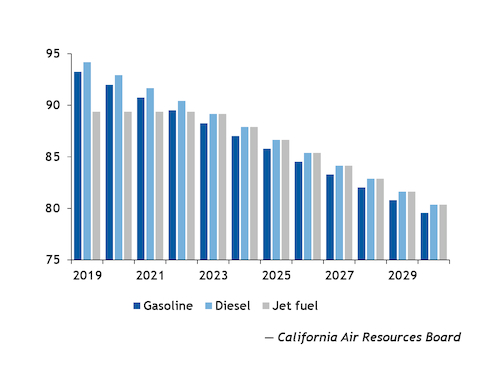

State LCFS programs, which require reductions in the carbon intensity of motor gasoline and diesel, will also drive demand for alternative jet fuel. Both California and Oregon will add the fuel as an eligible credit generator to their respective programs starting in 2019.

California regulators estimate that alternative aviation fuels could account for as much as 5pc of credits generated per year by 2030. Biomass-based distillates, including alternative jet fuel, could generate over $1.2bn in LCFS credit value in 2030, assuming an average credit price of $110/t.

Argus assessed California LCFS credits at $192/t yesterday.

Activity in the space extends to Canada. The federal government launched two competitions in August designed to increase investment in alternative fuels for the aviation sector. It also plans to develop a clean fuel standard that would apply to liquid fuels in 2022 and likely stimulate the production of all low-carbon alternative fuels, including jet fuel.

But hurdles remain.

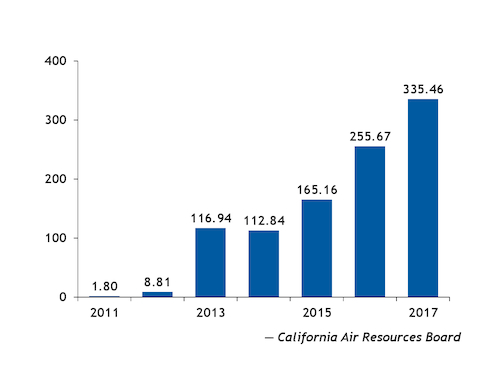

Renewable diesel is often co-produced with alternative jet fuel in the same refining process, which forces companies to make a decision about which fuel to produce. To date, the economics have largely favored renewable diesel.

"We could have produced renewable jet fuel in 2011," said Neville Fernandes, head of renewable jet fuel for Finnish refiner Neste. "We chose to focus on diesel, until now."

The company is the world's largest producer of renewable diesel and has contracts with a number of California cities that want to reduce emissions from their transit fleets.

The market for renewable diesel has grown significantly in recent years, particularly in California. The fuel surpassed ethanol as the largest generator of LCFS credits in the first two quarters of this year, indicating that the pull toward renewable diesel will remain strong.

Some producers argue that the design of existing policies does not help, either.

"We see major distortions that are incentivizing diesel significantly over aviation fuel, and we need to correct that," World Energy chief commercial officer Bryan Sherbacow said.

The company's Paramount refinery in California remains the only dedicated sustainable aviation fuel refinery in the US. Despite some of the challenges facing alternative jet fuel, it does not look as though World Energy will maintain that lonely position for long.