Canadian railed crude exports have been cut in half from their late 2018 peak amid narrower differentials. But shippers are looking to late 2019 and early 2020 for a resurgence in demand to rail heavy Canadian crude to the US Gulf coast.

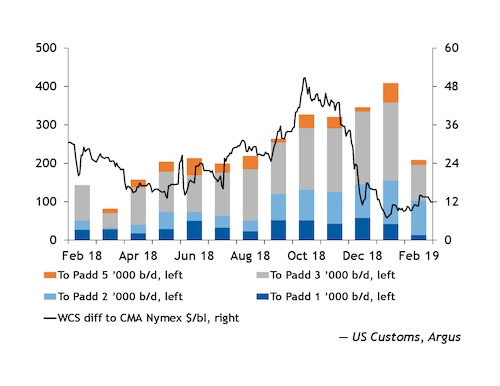

Overall Canadian railed crude exports plummeted in early 2019 after topping out at a record high of 354,000 b/d in December amid pipeline constraints and a wide discount between Canadian crude prices and the US benchmark that encouraged rail shipments.

February railed crude shipments fell by 60pc from January levels to 131,000 b/d, the lowest since August 2017. It was the largest monthly drop on record, according to data from Canada's National Energy Board (NEB), and came during the second month of Alberta's production curtailment order. March levels rebounded to about 168,500 b/d, suggesting that February could mark the bottom of the cycle.

Canadian railed crude flows to the US Gulf coast (Padd 3) peaked at about 200,000 b/d in January before tumbling to 93,000 b/d in February, according to the most current US Customs data available. Canadian rail to the US midwest (Padd 2) also peaked in January at 113,000 b/d before dropping to 89,000 b/d in February.

Pipeline congestion and soaring production sent Western Canadian Select (WCS) prices to a $50/bl discount to the WTI benchmark in October 2018. The WCS discount, a bellwether for railed crude profitability, shrank to near $10/bl in December 2018 after Alberta announced output cuts for the first time since 1981 in the face of severe export infrastructure constraints.

The key differential has widened to $17.50/bl this week, indicating a rising incentive for railed crude shipments. Shipping by rail is considered commercially viable when the discount is closer to $15-$20/bl. And forward prices for Canadian crude are showing a $20/bl differential to the Nymex benchmark for the fourth quarter of 2019, which put Canadian railed shipments squarely in the money.

New operators are adding capacity to move Canadian crude to the US Gulf coast. Clover Oil and Gas, based in The Woodlands, Texas, is assembling a 700-car fleet that will be dedicated to Canadian-US Gulf coast movements, and has moved two manifest trains so far. The first, which moved last week, was a manifest load of raw heavy undiluted crude from Alberta, Clover Oil and Gas president Brent Osmond told the Argus Canadian Crude Summit in Calgary last week.

Clover has a lease deal with carmaker Trinity to deliver 550 state-of-the-art new-build jacketed DOT-117 railcars starting in the third quarter of 2019, ramping up through early 2020.

Clover has commenced operations with a sublease of 110 DOT-117J railcars, as well as 103 DOT-1232 rail cars, bringing its total leased fleet to 763 railcars. Clover is working closely with Canadian Class 1 railroad Canadian National (CN) as its rail provider.

The cars will be able to access virtually all US Gulf coast destinations, including terminals across Texas and Louisiana, Osmond said. Crude-by-rail is a way for US Gulf coast refiners and exporters to ensure that they receive the expected quality of crude in a timely manner, Osmond said. A unit train can travel from western Canada to the US Gulf in about six days, compared to up to 30 days for crude through a long-haul pipeline.

"Crude by rail is a very timely way to get barrels from western Canada to the Gulf coast," Osmond said. "The barrel that goes in the railcar is the barrel that comes out of the railcar," as the mixing or transloading that occurs through pipeline shipments is not present for railed crude, assuring quality from origin to delivery.

Railed Canadian crude shipments could return to the 300,000 b/d level later in 2019 or in 2020, given pipeline constraints and rising production, Osmond said.

Clover Oil and Gas is employing technological innovations to allow customers to track their railed crude shipments and receive timely payments. Clover's railcars are equipped with tracking beacons that ping cell phone networks as they travel, giving a near real-time picture of their location, Osmond said. "This gives the producers and the buyers the comfort that the crude is going where they think it will go," and avoids traffic jams in unloading the crude at destination terminals, he said.

Clover is also working to create an automatic payment portal that allows faster invoicing and payments, Osmond said. The portal would use the tracking devices to help confirm that the carloads arrived at their location and allow for payments to possibly occur more quickly than the normal monthly cycle, he said.

The ends of the earth

The Louisiana logistics hub at St James could be an attractive destination for Canadian crude, both by rail and pipeline, because of the imminent reversal of the underutilized 1.2mn b/d Capline which currently moves crude north from St James to Patoka, Illinois. A reversed Capline could carry light crude to St James in 2020, with heavy capacity possible in 2022.

"I really do see St James as a very viable end destination for a lot of this" Canadian railed supply, said Ed Koshka, an industry expert at Oil Sands Consulting.

"St James really is the ends of the earth when it comes to Canadian heavy crude. And it is very well served by rail today," with robust interconnections with CN, Canadian Pacific (CP), Union Pacific (UP) and BNSF, Koshka said at the Argus Canadian Crude Summit.

A reversed Capline could feed into Marathon's proposed 600,000 b/d Swordfish pipeline from St James to the Louisiana Offshore Oil Port (LOOP), opening the door for heavy Canadian crude to be exported. Heavy crude can already reach St James via Shell's Zydeco pipeline or through the Bayou Bridge pipeline.

NuStar has commitments to offload at least 10 unit trains at St James, where it also holds about 8.3mn bl of tankage. The 10 unit trains carrying WTI, Bakken and WCS barrels to the Gulf coast are fully covered by minimum commitments, and there is "significant upside to that number," NuStar said on a 10 May earnings call.

Heavy crude producers want flexibility to sell into export markets from the US Gulf coast if they cannot get the right terms from area refiners, said Robb Barnes, senior vice president of commercial crude oil at Magellan Midstream Partners.

Magellan's joint-venture HoustonLink pipeline connects TransCanada's Keystone crude system to Magellan's Houston-area network. It allows TransCanada's shippers to reach Magellan's Houston and Texas City crude distribution system.

Gulf coast refiners who have invested in expensive kits to run heavy feedstocks are the most likely buyer of a Canadian heavy barrel, Barnes said. But refiners might use a Canadian producer's lack of options as pricing leverage if they expect that the supply will be captive to domestic markets once it reaches the Gulf coast, Barnes said at the Argus Canadian Crude Summit.

"If a heavy barrel can be exported, the shippers have the ability to use that flexibility to negotiate better rates to sell to refiners," Barnes said. "It comes down to tankage."

By some metrics, Canadian railed crude shipments to the US Gulf could be partially immune to short-term WCS discounts. For example, overall crude volumes through the Jefferson terminal in Beaumont, Texas, increased from the third quarter of 2018 through the first quarter of 2019 despite lower Canadian differentials. The Jefferson facility handled about 34,500 b/d of crude in the first quarter, nearly triple the 12,175 b/d from the third quarter of 2018.

With forward prices showing spreads of about $15-$20/bl for the third and fourth quarters, "We expect crude from Canada volumes to grow nicely over the balance of this year and next," said Joseph Adams, chief executive of Fortress Transportation and Infrastructure Investors, which owns the Jefferson terminal.

"There were a lot of commitments that people made in terms of obtaining railcars, negotiating rail slots from CN and CP and getting loading capacity," Adams said on a 3 May earnings call. Some deals were made on a multi-year, take-or-pay basis, so "you have less ability to just turn it on and turn it off every quarter," he said.