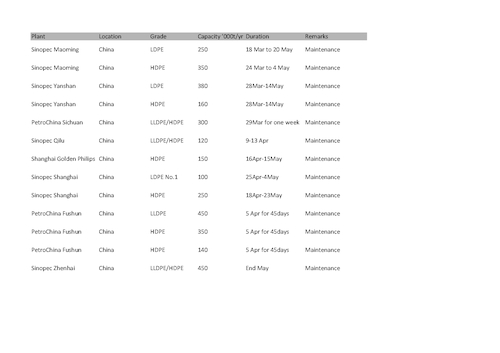

China has entered its heavy turnaround season this month, with around 3mn t/yr of polyethylene (PE) capacity at domestic plants being shut or to be shut down for maintenance.

China's PE plant maintenance shutdowns in 2021 are expected to impact 8mn t/yr of capacity. Production losses from such closures are expected to reach 800,000t, with no comparison with 2020 available. Heavy plant maintenance in April alone will account for 25pc of production losses for the entire year. Some scheduled shutdowns this year have been postponed because of decent margins since late February, contributing to a heavy turnaround schedule in April.

The turnarounds in April will lead to a total PE production loss of around 200,000t, including 100,000t of losses in high-density polyethylene (HDPE), 40,000t in linear-low-density polyethylene (LLDPE) and 60,000t in low-density polyethylene (LDPE) production.

The LDPE production loss will worsen the supply tightness for LDPE and further widen the price gap against the other two grades.

Only one new LDPE unit is expected to start up in 2021 — private-sector Zhejiang Petrochemical's 400,000 t/yr LDPE plant. It is expected to be operational at the end of this year. Any shutdowns prior to the start-up will tighten LDPE supplies.

Upcoming new capacity may partially offset the losses in HDPE and LLDPE production. Private-sector petrochemical firms Haiguo Longyou Daqing Lianyi Petrochemical and Zhejiang Satellite are expected to start up their new HDPE plants in April, each with 400,000 t/yr of capacity. Private-sector firm Ningbo Huatai Shengfu is looking to bring on line its 400,000 t/yr LLDPE/HDPE unit in May.

Among all the shutdowns, turnarounds at three particular producers will evidently tighten domestic PE supplies.

State-controlled Sinopec Maoming shut its 250,000 t/yr LDPE and 350,000 t/yr HDPE units in late March for 45 days. The company, located at Maoming in Guangdong province, is a major PE producer in south China and these shutdowns will significantly reduce PE supplies in the region. Sinopec Maoming, which operates a total capacity of 360,000 t/yr at two LDPE units, has the largest share of the LDPE market in south China. The other major producer in Guandong is CNOOC Shell, which has a capacity of 250,000 t/yr for LDPE and 960,000 t/yr for HDPE.

Sinopec Yanshan, the only PE producer in Beijing and Hebei province, began an overhaul on 28 March, affecting 540,000 t/yr of PE capacity. This will last until 14 May, and the production losses will need to be covered by the surrounding regions of Tianjin, Inner Mongolia and Liaoning.

State-controlled PetroChina Fushun shut a total of 940,000 t/yr of PE capacity on 5 April for 45 days. The affected plants are located at Fushun in northeast China's Liaoning province. Supplies from other local producers, including Bora Lyondellbasell with 800,000 t/yr of PE capacity, Dalian Hengli's 400,000 t/yr HDPE unit and Liaoning Huajin's 300,000 t/yr HDPE plant, will help make up for the shortfall from Fushun.