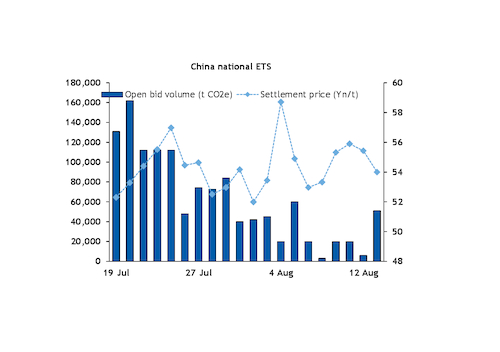

Trading volumes and prices in China's national emissions trading scheme (ETS) increased this week, boosted by a bulk deal.

Total trading volume was 379,868t of CO2 equivalent (CO2e) over 9-13 August, more than double a week earlier. Volumes in the latest week were boosted by 279,856t settled in a bulk agreement.

Open bid transaction volume was 100,012t of CO2e at a weighted average price of 54.7 yuan/t ($8.4/t). The market closed at Yn54/t today, up by 2pc from a week earlier.

The bulk agreement was done on 9 August at an average price of Yn50.39/t, 5.5pc lower than the open bid price on the same day. Open bid trading volume was just 3,010t of CO2e on 9 August, the lowest since the ETS launched in July.

Top state-owned power firms that participated on the first day of the ETS still account for most trading, while the registration process for smaller power plants has not yet been completed. This is restricting market activity, according to an analyst note from state-controlled oil trading firm Unipec, which participates in the market.

Major power producers that have assets throughout China will reallocate their allowances across their units at stable prices, meaning ETS prices are unlikely to soar, Unipec said.

The ETS is likely to develop a market maker mechanism that would allow institutional investors to participate, while providing diversified "financial tools" for emissions management, Lai Xiaoming, chairman of the Shanghai Environment and Energy Exchange — which operates the national ETS — said at a conference today. Only entities that own actual emissions allowances are eligible to trade in the national ETS currently.

Weekly policy review

China's electricity consumption increased to 775.8TWh in July, up by 12.8pc from the same month last year and 16.3pc higher than July 2019, according to energy regulator the NEA. Total consumption in January-July was 4,709TWh, up by 15.6pc year on year. Coal-based power accounted for about 60pc of total power generated in China last year.

Top economic planning body the NDRC has repeatedly called for increases in domestic coal output and reserves since this summer as it looks to stabilise supply and mitigate potential power shortages. China's coal imports increased sharply to a seven-month high in July, supported by robust power demand and tighter domestic supplies.

China will strictly control bank credit to energy- and emissions-intensive projects while supporting the "green transformation" and upgrades at these kinds of projects, China's central bank the PBOC said on 9 August. The PBOC in April released a list of projects considered eligible for green bond financing in China's 2021 green bond catalogue, which excluded fossil fuel investments.