Distributors aim to produce bio-LPG, renewable LPG and rDME in sufficient volumes to displace fossil LPG, writes Aidan Lea

Major LPG distributors outlined their plans to scale up production of bio-LPG and other similar renewable molecules to future-proof the industry at the LPG Week conference in Dubai this month.

Upstream companies — the traditional suppliers of LPG — have so far shown little interest in developing renewable versions of LPG, which has forced downstream distributors to look to move up the supply chain to stimulate production. The LPG industry must develop "five or six different pathways" to hit decarbonisation targets, distributor SHV Energy's chief executive, Bram Graber, told the World LPG Association event, which was held on 5-9 December. SHV aims to sell 100pc renewable molecules by 2040.

Graber spoke at a session dedicated to galvanising support in the industry for a molecule that is neither propane or butane — renewable dimethyl ether (rDME) — but that has similar properties, and is considered a viable blending stock or even replacement. Also on the panel were US peers UGI and Suburban Propane. SHV Energy and UGI intend to establish a $1bn joint venture that aims to develop up to six plants that can produce 300,000 t/yr rDME combined by 2027, while retailer Suburban Propane owns a 39pc share in rDME production start-up Oberon Fuels.

"It is a pivotal moment… we must provide lower-carbon solutions [that are] affordable by leveraging existing infrastructure and reliable with guarantee of supply," UGI president Roger Perreault told delegates. The LPG sector has the expertise to exploit the similar rDME molecule, Suburban Propane chief executive Mike Stivala said, calling it a "natural extension" to the industry's core business.

Oberon Fuels began producing commercial volumes of rDME in June, while SHV signed a deal with UK firm Kew Technology in June 2021 to develop a 50,000 t/yr rDME plant in central England. The plant, which will use municipal waste as feedstock, is due to open in the fourth quarter of 2023 or the first quarter of 2024. It will be developed under SHV and UGI's Circular Fuels joint venture once the partnership has secured EU approval.

Blending rDME into propane can reduce its carbon footprint to near zero, depending on the feedstock and percentage mixed. Oberon plans to use waste methane from dairy farms that yields rDME with a carbon intensity of minus 278g CO2 equivalent/megajoule (CO2e/MJ), compared with propane's 83g CO2e/MJ. Suburban is trialling a 4pc rDME-propane blend, but the firm says this could rise to around 20pc. Cost and feedstock availability are major barriers to scaling up production of new bio and renewable fuels. But the molecule will eventually be cost competitive with fossil LPG and the business is viable without subsidies, Graber said. The feedstock challenge "is not present [with rDME]", he said.

All academic

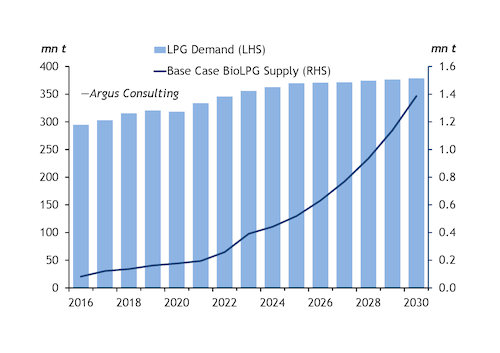

The plan is to develop rDME in tandem with bio-LPG and renewable LPG to ensure volumes can more sufficiently displace fossil LPG. Companies in the sector are increasingly aware that supplies of bio-LPG as a by-product from biodiesel or other biofuel plants is only ever going to be limited. "Our call to action is to invest in on-purpose production facilities," Perreault said.

SHV invited academics to propose new dedicated production pathways for bio-LPG in March, and has since selected five of these to invest in, SHV chief scientist Keith Simons told delegates. But it is important that other companies in the sector get involved too, Graber said. "We need a very important and broad joint effort in the industry and also partners outside."

Outside the US and Europe, a consortium of Japanese distributors is aiming to produce 30,000 t/yr of renewable LPG by the first half of 2030. "Japan's recent announcements are very interesting", Perrault said.