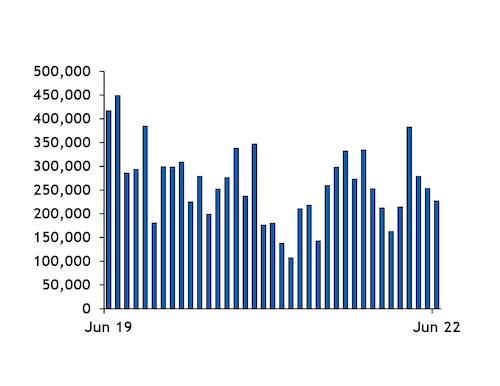

EU biodiesel imports fell by 10pc from a month earlier in June and were the lowest since February (see chart), but arrivals from Argentina reached the highest since March as some blenders sought more soybean-based biodiesel amid tighter availability of Asian supplies.

Provisional Eurostat data show EU imports of fatty acid methyl ester (Fame) from non-EU countries fell by around 26,500t on the month to 227,000t and were down by 32,500t from a year ago. Eurostat revised the figure for May up to 253,500t from 220,500t.

Volumes from Argentina reached close to 116,500t, up from 101,000t in May but down from 184,500t in July last year.

Market participants in the fob ARA barge market have reported that many of the Fame 0 barges sold on Argus Open Markets (AOM) since June have been carrying soybean oil proof of sustainability (PoS) paperwork, with the premium for soybean methyl ester (SME) falling by $20/t earlier in August with a rise in Fame 0 premiums and better availability of product relative to other varieties of Fame.

But for Indonesia and Malaysia — key suppliers of palm methyl ester (PME) — volumes fell to the lowest since March and April, respectively, at 9,500t from Indonesia and 21,000t from Malaysia. This compared with 11,500t and 50,000t in May, and 5,000t and 25,500t in June last year.

PME has been in short supply in Europe this summer, a period when demand for palm-based biodiesel typically rises owing to its higher cold filler plugging point (cfpp) relative to other crop-based grades.

But volumes from China — a key supplier of used cooking oil methyl ester (Ucome) — rose to 59,500t from 47,000t in May and 13,000t a year earlier.

Prices in Europe for Ucome and UCO fell in Europe toward the end of the month as buyers sought out lower cost crop-based Fame amid a steep fall into July for Fame 0 premiums, with a slow resumption of Indonesian exporters willing to offer product from the end of May.

The Netherlands, Spain and Belgium remained the largest arrival points for EU-bound biodiesel, with volumes for June from outside the bloc to these countries registered at 112,000t, 78,500t and 33,000t, respectively.

The EU exported less than 22,500t of biodiesel in June, down from a revised 34,500t for May and 57,000t in June 2021. The US took around 10,000t, with 6,500t going to Switzerland.

UK exports reached 32,000t, all delivered to the EU. UK imports reached 92,000t, with most of the volume coming from the Netherlands.

By Thomas Hughes