Switzerland-based trading and mining firm Glencore is reviewing its options after the New South Wales (NSW) Independent Planning Commission (IPC) rejected the firm's plan to expand its Glendell thermal coal mine in Australia.

Glencore planned to expand the Glendell mine from 3.7mn t/yr to 10mn t/yr, and to extend its lifespan by 20 years to 2044. Glendell is one of Glencore's four thermal and coking coal mines in Australia that are facing closure as they reach the end of their approved mine lives. The four mines have a combined nominal capacity of 15.7mn t/yr.

Australian thermal coal exports have declined in the past two years because of Covid-19 disruptions to demand and labor force absenteeism, as well as above-average wet weather disrupting production. This has contributed to high volatile coal pricing at a time when trade has been disrupted by Russia's invasion of Ukraine.

The NSW IPC rejected the Glendell extension on heritage grounds and Glencore has options to appeal the ruling. But the firm may be forced to close the mine while it appeals, with Australian mining firm New Hope closing its 4.8mn t/yr New Acland coal mine in Queensland because of delayed approvals.

Glencore's 5.5mn t/yr Newlands thermal and coking coal mine in Queensland's northern Bowen basin, as well as the 4.5mn t/yr Liddell semi-soft and thermal open-pit coal mine and the 2mn t/yr Integra underground thermal coal mine in NSW's Hunter Valley region are approaching the end of their approved mine lives. They were slated for closure next year, but increased demand and prices may see additional reserves becoming economic, extending their mine lives.

Glencore on 28 October lowered its 2022 combined thermal, coking and semi-soft coal production guidance to 106mn-114mn t, down by 11mn t or 9pc from the initial guidance, because of extremely wet weather in Australia. Its guidance remains higher than last year's production of 103mn t, partly because of its increased ownership of the 28mn t/yr Cerrejon mine in Colombia.

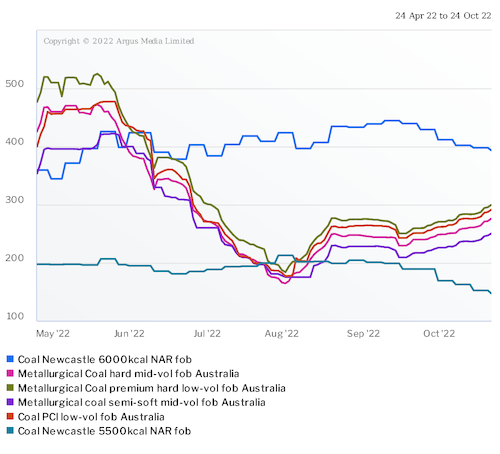

Argus assessed high-grade 6,000 kcal/kg NAR thermal coal at $376.22/t fob Newcastle on 28 October, down from a peak of $444.59/t on 9 September. It last assessed the hard mid-vol coking coal price at $287/t fob Australia on 28 October, up from $166/t on 1 August but down from a peak of $623.65/t on 15 March. It last assessed semi-soft coking coal prices at $260.40/t fob Australia on 28 October, up from $178/t on 1 August.