Norwegian ferry operator Fjord Line plans to add marine gasoil (MGO) to fuelling options for its two LNG-fuelled ferries because of high LNG bunkering costs.

The two ferries — MS Stavangerfjord and MS Bergensfjord — will be converted in January-May and February-June respectively. The conversion project will affect the Bergen-Stavanger-Hirtshals and Hirtshals-Langesund ferry lines, which have been operating at reduced rates since September because of persistently high LNG prices. The two vessels were launched in 2015 as the first in the region to run entirely on LNG.

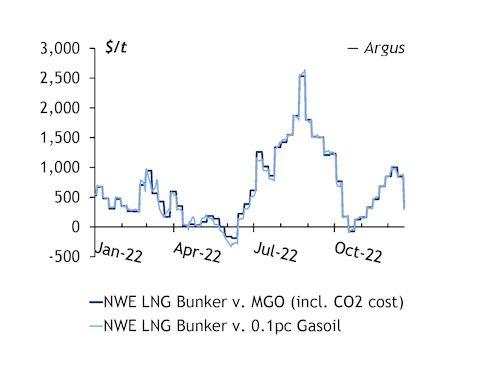

LNG has been mostly more expensive than MGO since Russia's invasion of Ukraine in February. Substantial price movements in both MGO and LNG have created volatile swings in delivered LNG bunker premiums to MGO. LNG bunker prices rose sharply in July to an average of $2,145.75/t across the month from $1,444.25/t in June, but LNG's premium over MGO then returned to a little more than $400/t. So far in December, the average premium has firmed to $912.75/t.

Traditional bunker fuel prices also rose sharply following Russia's invasion of Ukraine. Prices of MGO with 0.1pc sulphur leapt above $1,000/t in March and stayed at that level before easing slightly in November-December. Supply concerns pushed prices to record highs as Russia continued to provide more than half of Europe's seaborne gasoil and diesel imports in 2022.

While shipowners such as Fjord Line are looking to offset the rising cost of LNG as a bunker fuel with MGO, a large amount of uncertainty exists for MGO prices in 2023. The looming Russian oil products ban — set to take effect in February — could create a shortfall in diesel supplies, which could have the knock-on effect of tightening MGO supplies. If prices rise higher than their current levels, the benefit of fitting dual-fuel engines for MGO could be limited.

But shipowners operating along Scandinavian routes have little choice for cost-effective alternatives. An emissions control area limits the sulphur content of fuels burnt in the Baltic Sea, North Sea and English channel to 0.1pc. This rules out the use of cheaper very-low sulphur fuel oil and high-sulphur fuel oil.