Latest customs data show marked changes to traditional patterns in Spanish ethanol traffic, with imports and exports at parity in the first four months of this year.

Spain has long been a net exporter of ethanol, largely shipping fuel ethanol to other EU countries and importing medicinal and beverage ethanol from Pakistan and France. But customs data for January-April show Spain imported the same amount as it exported, in both cases around 100,000t.

Exports rose from 70,000t in the same period last year, while imports increased from 45,000t. The 100,000t of imports in January-April is already close to total imports of 145,000t in 2022 and 105,000t in 2021.

This year's increase is largely the result of a particularly high 25,000t of deliveries coming from the US in the first four months. This compares with negligible imports from the US in 2019-22. The last Spanish imports of any size from the US were 3,100t in 2018. Shipments this year have come in 5,000t cargoes and appear to be arriving from Lake Charles in Louisiana. Four cargoes went to Spain's east coast port of Tarragona and one to the southern port of Cadiz. US corn prices have been low, boosting competitiveness, while ethanol demand is increasing in Europe as gasoline consumption rises.

Spain has also increased imports from the Netherlands, with over 10,000t arriving in January-April, up from 3,000t a year earlier. These shipments went to Tarragona and further north to Barcelona. It is unclear how the imported ethanol is being used domestically or what plans the importers have. Some is being re-exported in smaller cargoes into the Mediterranean. But some remains in storage in Spain.

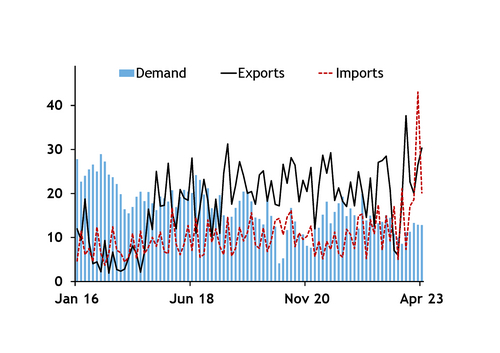

Consumption in Spain remains weak as the country merges all biofuels into a single state mandate, limiting demand for ethanol. Imports are now significantly outstripping demand. The country's strategic reserve Cores estimates consumption was 13,000t in April, flat on the month and 3pc lower on the year. Demand was 50,000t in the first four months of the year, compared with 60,000t in January-April 2022, according to Cores.

If the rising imports are not re-exported and start to compete with domestic output, it could put pressure on Spain's dominant producer, Vertex Bioenergy, which runs three largely corn-fed plants at Coruna, Salamanca and Cartagena with an overall nameplate capacity of 430,000 t/yr. Spain's apparent ethanol output — assessed using import, export and demand data — was under 25,000t in April. Estimated output in January-April was 50,000t, down from 75,000t in the same period last year.