Record energy subsidy bills have made the issue a more urgent one but left policy makers reluctant to tackle it, write Caroline Varin, Motoko Hasegawa and Adebiyi Olusolape

The G20 Leaders' Summit in India this month rolled over a commitment to phase out fossil fuel subsidies the group first made 14 years ago. But after record energy subsidy levels seen last year, this lack of further ambition does not bode well for reform progress on a key issue affecting energy use and climate change.

G20 members reiterated they will increase efforts "to phase out and rationalise, over the medium term, inefficient fossil fuel subsidies that encourage wasteful consumption... while providing targeted support for the poorest and the most vulnerable", but did not offer clearer timelines or definitions. Think-tank the International Institute for Sustainable Development (IISD) senior policy adviser Shruti Sharma sees a missed opportunity. G20 president India "could have been in a position to show leadership" as it cut subsidies for fossil fuels by 76pc between 2014 and 2022, to just over $8bn, according to the IISD.

Progress has been slow since the pledge was made in 2009, even though reforms could shift much-needed finance towards clean energy and welfare. The energy crisis has put discussions firmly on the back burner, quashing momentum after fossil fuels subsidies were mentioned for the first time in a Cop text in 2021, and reducing chances for meaningful discussions at Cop 28.

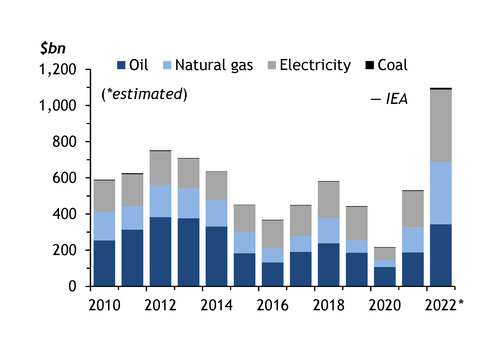

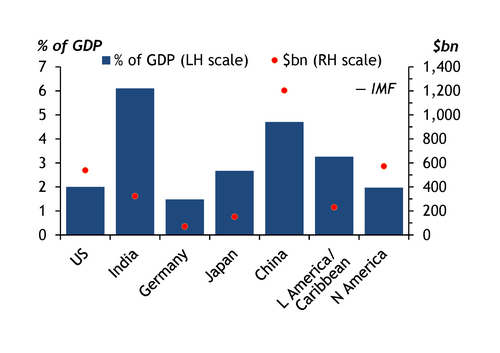

Global fossil fuel subsidies exceeded $1 trillion in 2022, a record high according to differing methodologies used by the IMF and IEA. Governments scrambled to cushion the impact of higher energy prices resulting from the war in Ukraine. But more than half the subsidies were in fossil fuel exporting countries, the IEA found. Including implicit subsidies, levels have ballooned to $7 trillion, the IMF says.

The IMF expects explicit subsidies to decline when prices fall, suggesting governments might get a window to act. "India used the opportunity of lower prices in 2014 and in the early 2020s to remove some subsidies when oil prices were low," Sharma says. But the energy crisis should have been the time to talk about subsidy reforms and have G20 members commit to a timeline, she says. The G7 has a 2025 deadline — the IISD suggests that G20 members should commit to 2030.

Old habits

But the G7 is not exactly leading by example. Japan, which held the G7 presidency this year, has continued domestic support for fossil fuels consumption in the wake of last year's energy crisis. To mitigate the impact of rising oil products prices, trade and industry ministry Meti has set aside ¥6.2 trillion ($42bn) for January 2022-December 2023. It has also allocated ¥3.1 trillion to cap rises in retail electricity and city gas prices throughout 2023 to ease inflation.

"Politically, it is challenging to raise energy prices, particularly when they have been surging, because of the impacts on households and firms when countries are acting unilaterally. It impacts on competitiveness," IMF fiscal policy expert Ian Parry says. "It would be easier if countries, especially the world's largest emitters China, India, the EU and the US, moved in a co-ordinated direction."

And reform acceptability is key. Nigeria's new government in May cancelled gasoline subsidies costing the state billions of dollars a year, tripling retail prices. But growing social unrest in response forced a policy retreat last month, as Abuja kept gasoline prices at July levels and again absorbed the cost of recent rises. "Market prices need to be phased in gradually, and people have to trust that the welfare protection mechanism will start at the right time," Sharma says.

But policies to increase the price of fossil fuels relative to clean fuel technologies must play a pivotal role in cutting greenhouse gas emissions by 25-50pc below 2019 levels by 2030, the IMF says. Not achieving this is likely to put the Paris agreement target of limiting temperature rises to 1.5-2°C beyond reach.

implicitsubsidies15092023095834.jpg)