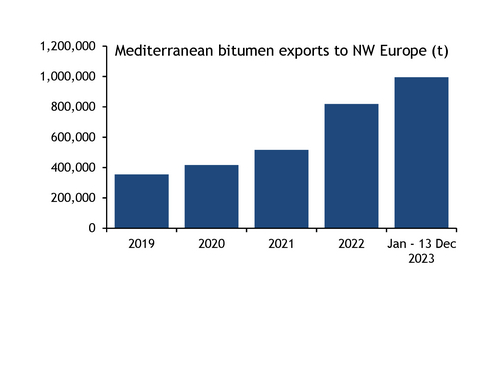

Bitumen exports from the Mediterranean region to northwest Europe are on track to surpass 1mn t this year, double the levels of just two years ago.

The sharp increase is partly down to tighter supply in northern Europe, underpinned by a lack of Russian bitumen imports since sanctions kicked in. But it has also been supported by lower prices and sluggish demand in the Mediterranean. Vortexa data show bitumen exports from the Mediterranean to northwest Europe have reached 995,000t in the year to date, up from 819,000t last year, 516,000t in 2021, 417,000t in 2020 and 355,000t in 2019.

Russian bitumen exports from the St Petersburg area to Europe reached around 400,000t in 2021 before tumbling to 170,000t last year following the invasion of Ukraine. Russia has increased rail exports to central Asia and China since EU sanctions were imposed on its bitumen trade, while the supply gap left by the absence of Russian product in northern Europe has been filled by exporters from Turkey, Greece, Italy, Spain and Lithuania.

Before sanctions, the majority of Russian bitumen was shipped to terminals across the UK and Nordic countries. Trading firms Trafigura and Vitol continued fulfilling term deals that were signed before the invasion for the remainder of 2022, but there have only been a handful of cargoes from Russia to Europe this year. The EU banned Russian bitumen on 27 May, bringing the bloc in line with the UK, which prohibited imports of Russian bitumen from 5 December last year.

Northwest Europe supply and demand down

Bitumen output in northern Europe has been dented this year by refiners switching away from medium sour Russian Urals crude, notably in Germany. But demand in the region has fallen too, as higher inflation and rising interest rates weighed on road construction in key consumption markets like Germany and France.

Polish oil firm Orlen's Lithuanian subsidiary Orlen Lietuva has played an important role in helping road construction companies in the Nordic region weather the effects of Russian sanctions. Bitumen production at the firm's 190,000 b/d Mazeikiai refinery jumped to 235,000t in the first half of this year, from 77,300t in the same period last year, boosting bitumen export availability from outlets at Klaipeda in Lithuania and Liepaja in Latvia.

Med supply up, demand down

Cargo exports of Iraqi bitumen from a new terminal at Dortyol on Turkey's southern coast started in January, supplying around 170,000t to northwest Europe before suddenly halting in August, while Greek bitumen exports from Agio Theodori and Aspropyrgos had already exceeded 1mn t before the end of October, surpassing full-year exports for 2021 and 2022.

While supply in the Mediterranean has increased, demand is down. Egypt's state-owned EGPC stopped issuing bitumen import tenders as a result of a continued currency crisis, crimping regional consumption. Egypt imported around 350,000t of bitumen in 2022.

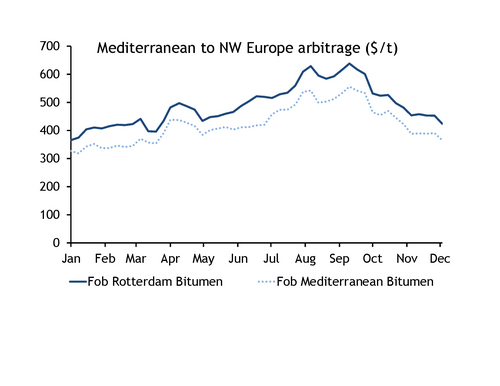

Arbitrage shipments from the Mediterranean to the US east coast and east of Suez have been hard to work for most of the year, limiting export options for the region's surplus bitumen supply. The spread between Argus' fob Mediterranean bitumen index and fob Rotterdam cargoes has been volatile this year. It was at its lowest in early January at around $38/t and peaked in mid-June at over $103/t. As of 8 December, it stood at just under $59/t in favour of Rotterdam.