B24 dob Algeciras-Gibraltar prices rose to $816.75/t on 29 January, its highest since the price launched, as firming fossil fuel prices combined with biofuel supply uncertainty to support values.

The Mediterranean marine biodiesel blend comprising 76pc very-low sulphur fuel oil (VLSFO) and 24pc used cooking oil methyl ester (Ucome) continued to firm, hitting an all-time high, despite market participants reporting thin spot demand in recent sessions. Some suppliers had reported an increase in enquiries this week as the premium held by B24 dob Algeciras-Gibraltar against VLSFO dob Gibraltar-Algeciras-Ceuta (GAC) narrowed to a month-low of $141.39/t on 26 January when accounting for EU emission trading system (ETS) costs.

The slight increase in buying interest was overshadowed by firming levels in the conventional bunker fuel market. VLSFO dob GAC has averaged just under $598/t so far this month, higher by $9.50/t from December. Conventional bunker fuel prices have been volatile since the onset of Red Sea traffic disruption in November, lending to uncertainty around shipping demand. The disruption has also led to stronger refining margins as participants reported expectations of firmer bunkering demand caused by diverted vessels avoiding the Red Sea.

But the uncertainty has not been limited to the fossil fuel market. Participants reported a potential impact on used cooking oil (UCO) — the feedstock used for the production of Ucome — trade flows to Spain, much of which originates from the Asia-Pacific region and usually passes through the Suez Canal on route to Europe. The disruption could also delay the arrival of vessels to European ports by up to 15 days, further constraining supplies. This has been further compounded by the EU's anti-dumping probe into Chinese-origin biofuels. Relief that may have ensued from last week's news that the European Biodiesel Board (EBB) retracted its proposal to the European Commission for investigating the possible circumvention of trade measures against Indonesian biodiesel was quickly counteracted by the European Commission's decision to continue its investigation nonetheless.

Chinese exports of UCO and fatty acid methyl ester (fame) biodiesel tumbled by more than two thirds on the month to January, to 20,000t from 69,000t according to global trade analytics platform Kpler. UCO imports into Spain from Asia-Pacific fell to 22,750t in November, compared with 36,300t a month prior, according to GTT data. About 60pc of Spanish UCO imports in 2023 originated from Asia-Pacific.

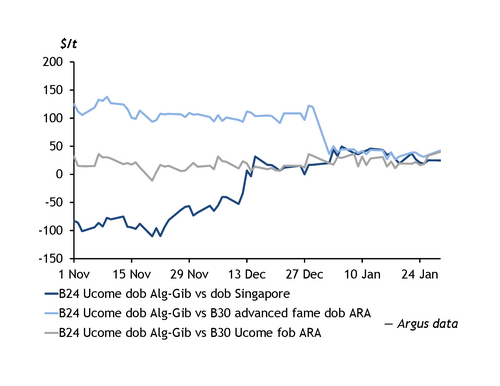

Strong B24 levels in the Mediterranean have also led to changes in regional spreads. The premium held by B24 dob Algeciras-Gibraltar against B30 Ucome fob ARA widened to $40.10/t — a 5.47pc premium — on 29 January, its widest since the Mediterranean marine biodiesel blend price launched. B24's premium against the B30 advanced fame 0 dob ARA blend also hit a two-week high of $42.33/t (see graph).