Slowing the pace of India's oil and coal demand growth will depend on uptake of natural gas and renewables, write Prethika Nair and Rituparna Ghosh

India's energy demand is set to grow significantly over the next few decades, and while oil and coal demand are likely to remain firm, it is adjusting policies so that its energy mix will include a larger share of natural gas and renewables.

India's economy has grown swiftly under the incumbent Bharatiya Janata Party (BJP) led by prime minister Narendra Modi, and the country has become the world's fifth-largest economy by gross domestic product (GDP). It is on track to record the fastest economic expansion among major economies for a third consecutive year, according to energy watchdog the IEA, mainly because of growth in its industrial sector and increased spending by a burgeoning middle class. Its GDP is due to continue expanding at a rate of 6.5pc/yr until 2030, the IEA says, citing a forecast from consultancy Oxford Economics, because of its huge consumer market, low-cost labour pool and demographic advantages.

In line with its growing economy, the country's energy demand is expected to double between now and 2045. Its energy sector imports have been steadily rising, with the country spending around $150bn in 2023, according to consulting firm Rystad. India is likely to account for 25pc of global energy demand growth over the next two decades, oil minister Hardeep Singh Puri predicts. It is already the world's third-largest consumer of oil, third-largest consumer of LPG, fourth-largest refiner and sixth-largest LNG importer.

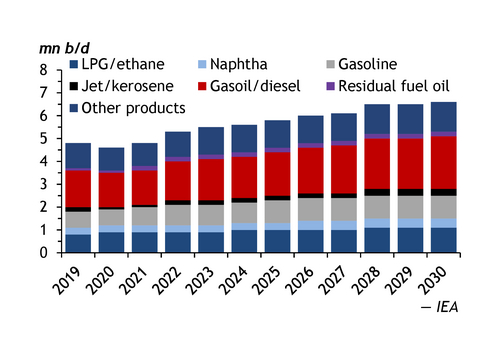

India will become the largest source of global oil demand growth from now until 2030, according to the IEA, because of continued urbanisation, industrialisation, and the expansion of its middle class and a subsequent rise in mobility and tourism. Oil demand is consequently poised to increase by almost 1.2mn b/d from 2023 to 6.6mn b/d by 2030. The country imported 4.48mn b/d of crude in 2023, and increased refinery processing is expected to lift those imports to 5.8mn b/d by 2030, the IEA predicts. Gasoil is likely to be the biggest source of oil demand growth because of India's rapid industrial expansion, and could account for more than half of the rise in the country's demand.

EV and biofuels penetration faces hurdles

India now imports 88pc of its crude requirements, and rising import dependence is adding to New Delhi's energy security concerns. So India has made ambitious plans to increase the share of clean energy in its automotive fuel mix. It aims for ethanol blending in gasoline to reach 20pc of sales volumes by 2025, and electric vehicles (EVs) to account for 30pc of all new vehicle sales by 2030. But it is currently trailing in its ability to deliver on those targets, which may prolong the growing role of oil-fuelled transport in the country's development.

The adoption of EVs and ethanol-blended fuels is still insufficient to keep pace with rising demand for gasoline and diesel. EV sales accounted for only 6pc of India's overall vehicle sales in 2023, while sales of internal combustion engine vehicles configured to run more efficiently on ethanol-blended gasoline accounted for just 2pc. Sales of gasoline-powered vehicles comprised the highest share last year, with 76pc, data from government website Vahan show.

New Delhi reduced its EV subsidies under the Faster Adoption and Manufacturing of Electric Vehicles-2 (Fame-2) scheme to 10,000 rupees/kWh ($120/kWh) in June 2023, from Rs15,000/kWh before this. And a maximum subsidy cap of 40pc of the ex-factory price was reduced to 15pc. But EV sales rose by 12pc in the second half of last year compared with the first half, to 808,571 units. In total, India's EV sales increased by 50pc on the year to 1.5mn units in 2023, although its ability to sustain that growth may come under pressure this year as the government's Fame subsidy expired on 31 March.

The sudden discontinuation of subsidies will raise EV prices by 25pc and affect investment in the sector, industry body the Federation of Indian Chambers of Commerce and Industry says. The group warns that it will be necessary to continue subsidies to reach EV sales targets.

But New Delhi is trying a slightly different tack. It last month rolled out the Electric Mobility Promotion Scheme (EMPS) 2024 to replace Fame-2 and provide $60mn in subsidies over April-July. The EMPS targets two-wheeler electric vehicles, which comprise the majority of Indian EV sales because of their affordability, and three-wheelers, which are mostly used to carry goods. It is also aimed at establishing a domestic EV industry to increase employment.

India's rate of ethanol blending in gasoline is among the world's highest, at around 12pc currently, according to the IEA. But its flagship E20 initiative, which aims to increase ethanol blending using sugar cane to 15pc in the November 2023-October 2024 ethanol supply year and by 20pc by 2025, may also stumble after a poor harvest. India has not set any targets beyond 2025 as it still assessing the feasibility of ethanol blending to determine how much this will reduce oil demand.

Natural gas — a question of price?

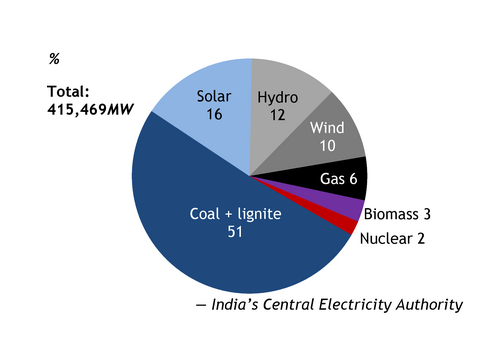

India is aiming to more than double the share of natural gas in its primary energy mix to 15pc by 2030 from 6pc in 2022, to cut carbon emissions by 1bn t by 2030 from a 2005 baseline. But this increase is centred on plans to boost city gas use, which includes the use of compressed natural gas (CNG) in passenger cars and to cater to growing industrial gas demand, and piped natural gas for household cooking. The fertiliser industry will also be a driver of India's gas demand, as it aims to phase out urea imports by 2025. The share of gas in power generation is due to fall from 6pc at present to just 3pc of India's generation capacity by 2030, and the government has no plans to build any new gas-fired plants.

The rising adoption of EVs in India could threaten demand for CNG, with EVs being the preferred alternative to city gas distribution companies having to rely on domestic gas production and expensive LNG imports. The New Delhi government last year asked taxicab aggregators and delivery service providers to make their entire fleet electric by 2030. It intends to make 25pc of all new vehicles registered in Delhi electric by 2025, and will provide subsidies on battery capacity.

India is trying to tap into its deepwater gas reserves to reduce its reliance on imports. The government plans to invest close to $67bn on India's natural gas supply chain in the next 5-6 years. But whether or not gas hits its target share may depend on affordability, especially with imports that are underpinned by international gas prices.

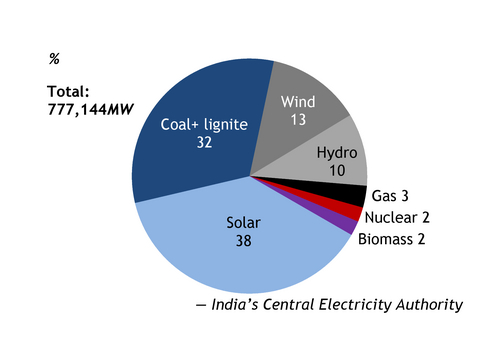

Coal remains India's dominant power generation fuel, accounting for 49pc of the power mix and, with most demand met by domestic production, it is a key pillar of its energy security. India has ambitious renewable power plans, aiming to boost capacity to 500GW by 2030 from 180GW now. But it also plans to add 80GW of new coal-fired generation capacity over the same period to underpin its energy needs, as coal is an abundant and affordable means of meeting rising power demand, while at the same time scaling up renewable energy capacity to reduce greenhouse gas emissions.

The longer-term outlook will depend on how far renewables growth can displace coal in the sector. Scenarios in the latest BP Energy Outlook project the share of renewable energy in a range of 33-68pc by 2050, with the share of coal ranging from 33pc to just 6pc depending on renewables uptake. But with New Delhi only committing to net zero by 2070, economic priorities may continue to take precedence over sustainability when it comes to phasing out coal use.