Australian Carbon Credit Unit (ACCU) supply surged on the month in April, because of strong issuances from waste methods, bringing total supply to just above 5mn units in January-April.

A total of 1.99mn ACCUs were issued in April, up from 965,836 in March, according to data released by the Clean Energy Regulator (CER) on 21 May. Waste methods — mainly from landfill gas projects — accounted for 1.39mn, or 70pc of the total, up from shares of just 7.5pc in March and 5pc in February.

Bioenergy company LMS Energy led issuances last month with 1mn ACCUs, followed by environmental market investor GreenCollar's subsidiary Terra Carbon at 185,870, as well as waste management firms LGI and Cleanaway at 107,414 and 84,175, respectively.

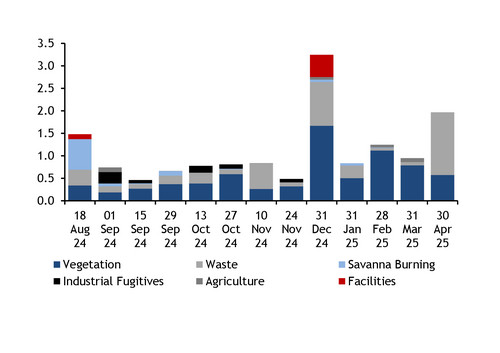

ACCUs from vegetation methods accounted for 29pc of the total at 575,258 units in April. The share is the lowest since August last year, although the CER previously released fortnight data before switching to monthly figures in 2025 (see chart).

CER's latest data show 5.03mn of issuances in the first four months of 2025. The regulator said earlier this year that it expects to issue between 19mn-24mn ACCUs in 2025, up from the record high of 18.78mn in 2024.

The strong issuances in April may have limited price gains last month. The Argus ACCU generic (no avoided deforestation) spot price assessments averaged A$34.35/t CO2 equivalent ($22/t CO2e) in April, up by A$1/t CO2e from March, although below A$34.50/t CO2e in February and A$35.45/t CO2e in January.

Prices have continued to increase this month, closing at A$35.75/t CO2e on 20 May.

The CER noted it started to publish new information in its project register on 21 May, beginning with the crediting period start and end dates of all projects and the permanence period start date of all sequestration projects.