The European Commission will allow international carbon credits to contribute to the bloc's 2040 climate target, but will exclude their use in the EU emissions trading system (ETS), temporarily allaying fears of a potential carbon market impact, although questions around solutions to the ETS' diminishing allowance supply persist.

The commission's proposal to cut EU greenhouse gas emissions by 90pc by 2040 compared with 1990 levels would, from 2036 onwards, allow up to 3pc of the goal to be met using international carbon credits issued under Article 6 of the Paris climate agreement.

But contrary to speculation since the commission's director-general Kurt Vandenberghe indicated last month that the goal would include "flexibilities", it does not envisage integrating the offsets into the EU ETS. "These international credits should not play a role for compliance in the EU carbon market," the proposal states.

The text must still be negotiated by the European Parliament and EU member states before its adoption, but the commission's approach is likely to have provided some initial reassurance to EU ETS participants, which may have feared the inclusion of credits could undermine the market.

A study by research body the Oeko-Institut published last month warned that introducing Article 6 credits to the ETS "poses significant risks to the functioning and environmental integrity of the system".

CDM impacts linger

The concerns are not without precedent. Until 2020, participants were permitted to meet part of their ETS compliance obligations using international carbon offsets issued under Article 6's predecessor, the clean development mechanism (CDM).

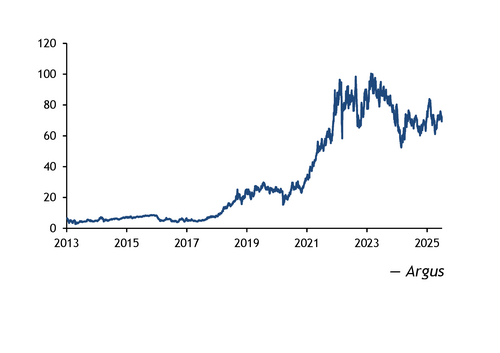

The high availability of often cheap credits of varying environmental integrity increased the ETS' supply glut last decade, which in turn dampened the signal for companies covered by the scheme to decarbonise. The EU ETS benchmark front-year contract closed at an average of €11.90/t of CO2 equivalent in Argus assessments over the system's third trading phase, from 2013-20.

EU carbon market tightens

But the market context by the end of next decade will be very different. The system's supply cap is expected to fall to zero by 2039, from 2.04bn allowances in 2013, leading to calls for the integration of instruments — in some cases including international credits — to bring flexibility to the market and avoid forcing sectors with residual emissions to shut down.

And Article 6 credits will be more closely regulated than their antecedents, which could support their value and make any interaction between the markets less bearish for EU ETS allowances.

At the World Bank's Innovate4Climate conference in Seville, Spain, last month, head of carbon markets at Spain-based bank BBVA, Ingo Ramming, told delegates that the EU needs to overcome reservations about international carbon credits stemming from past CDM experiences if it is to find a solution to the declining ETS supply cap.

Political challenges remain

Article 6's inclusion in the 2040 target in any form is likely to prove divisive in negotiations on the proposal.

A number of EU countries were pushing for the inclusion of Article 6 credits in the goal ahead of the commission's proposal, but some parliamentary groups were quick to signal their disapproval of the approach set out in the text.

Leader of the Greens in the parliament Bas Eickhout said he hopes to persuade other parties not to allow international credits into the target, while the S&D group — the second-largest in parliament — warned against their use, terming them "a last resort".