The northwest European biopropane premium over its fossil-fuel equivalent in the third quarter has averaged its lowest since Argus began the assessment in October 2023, pressured by weaker biopropane demand and underlying propane values.

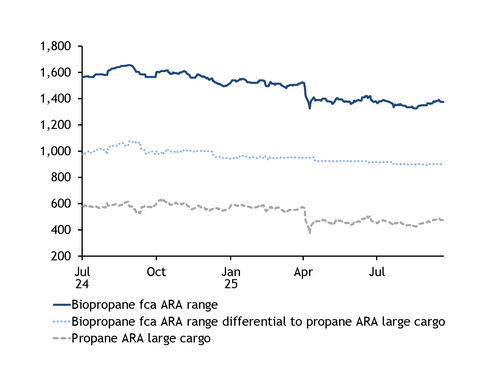

The used cooking oil (UCO)-based biopropane price averaged $1,359.75/t fca Amsterdam-Rotterdam-Antwerp (ARA) in the third quarter to date. This compares with an average of $1,393.25/t and $1,519.50/t in the previous two quarters and $1,599/t in the third quarter of 2024.

The biopropane outright price was partly lower because of softer underlying propane prices. The northwest European propane market drifted into its seasonal lull in the summer months, keeping the value of the benchmark large cargo ARA anchored below $500/t for most of June-August with a steady inflow of US LPG even during the slowest weeks of demand.

Europe has also benefited from weaker Chinese summer demand and uncertainty over tariffs between US and China.

Demand from the heating sector was weak, as is typical during the warmer months, and enquiries from petrochemical users were not much stronger. Propane's discount to naphtha remained above $100/t for the majority of July and August, signalling the lighter grade was a much more profitable feedstock. But narrow margins and cracker shutdowns, including the mothballing of one train at US-based Dow's three-cracker complex in Terneuzen, Netherlands, capped buying interest.

No mandates, no momentum

The average biopropane premium to propane large cargoes at ARA was lower by around $24/t on the quarter and by $117/t on the year, at just over $900/t in the third quarter.

Biopropane can be blended in the road transport sector as an alternative to LPG, used for heating, or as a sustainable feedstock for renewable polymers production. It is a by-product of hydrotreated vegetable oil (HVO) and hydrotreated esters and fatty acids synthesised paraffinic kerosene (HEFA-SPK) sustainable aviation fuel (SAF) production.

Global SAF and HVO capacity from standalone plants has picked up in recent years, and more refineries in Europe are co-processing renewable feedstocks alongside crude. These are adding to biopropane supplies as demand struggles to grow in the absence of legislation mandating use. Some producers have been opting to recycle biopropane in their internal refining process to improve the overall greenhouse gas (GHG) savings of their final HVO and SAF production.

As a result, buying and selling stances have diverged significantly over the last few months, and biopropane premiums have failed to track the recent rise in northwest European HVO and northwest European SAF prices.

Mandates in the making

While biopropane use remains largely voluntary, some countries have introduced legislation to promote the adoption of renewable energy in heating, packaging, and road transport sectors.

The EU introduced its Packaging and Packaging Waste Regulation (PPWR) this year, which mandates packaging reductions of 5pc by 2030, 10pc by 2035 and 15pc by 2040. It also states that all packaging placed on the EU market shall be recyclable.

The EU will publish a position in early 2028 on whether to allow bio-based plastics to count towards recycled content targets under the PPWR. If this is introduced, demand for biopropane could rise significantly.

For heating, the Irish government approved a renewable heat obligation (RHO) bill that obliges fossil fuel suppliers to replace a fraction of the fuel supplied for heat with renewable alternatives. Although this mostly incentivises biomethane, some market participants said biopropane uptake could increase. The scheme will run from 2026 to 2045, with the 2026 obligation set at 1.5pc, rising to 3pc in 2027.

In Germany, the buildings energy act asks owners of new buildings to install heating systems using at least 65pc renewable energy, and Sweden encourages biopropane use by exempting it from energy and CO2 taxation if used in motor fuel and heat generation.

Most countries mandate the use of renewables in transport, but some such as France are moving toward more sector-specific requirements. France's current draft implementation of the recast renewable energy directive (RED) — which is due to be adopted in 2027 — sets GHG reduction targets that are broken down by transport segment, including LPG.