Imports will be able to meet the subsidy scheme's extra demand, but the country also faces the problem of sourcing more LPG cylinders, writes Gabriel Lara

Brazilian distributors will import additional LPG mainly from the US to meet the expected growth in demand brought about by the government's incoming Gas do Povo subsidy scheme, companies said on the sidelines of Liquid Gas Week in Rio de Janeiro over 22-26 September.

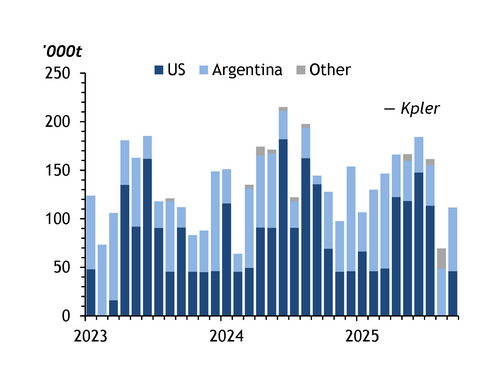

The country's four main distributors — Copa Energia, Nacional Gas, Supergasbras and Ultragaz — account for nearly 90pc of the domestic market and have already confirmed that demand under the programme will be met by LPG imports. This will come from countries other than the US, most notably from nearby Argentina. But US LPG is expected to make up the majority given abundant and growing export availability from the country's Gulf coast and its geographic proximity to Brazilian LPG terminals, most of which are located in the northeast.

Ultragaz will import LPG for the scheme from the US, chief executive Tabajara Bertelli Costa said on the sidelines of the event. Nacional Gas also plans to import supply from the US as well as Argentina and Bolivia, while Supergasbras confirmed that state-controlled Petrobras could not raise domestic production by enough to meet new demand. Copa Energia, Brazil's largest company, said itsdemand will probably be met by imports from Argentina.

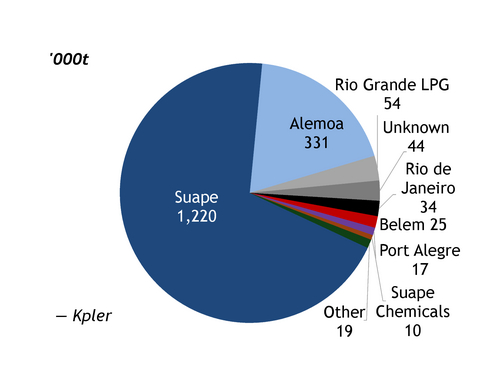

Brazil consumed around 7.6mn t of LPG in 2024, of which around 1.7mn t was imported, with 55pc coming from the US, regulator ANP data show, arriving at Suape and Santos. Domestic demand is expected to grow by 5-8pc owing to the Gas do Povo programme, leading to greater import dependency, according to LPG association Sindigias president Sergio Bandeira de Mello. Gas do Povo was launched in September and is due to start from November, reaching full implementation by March 2026. Under the scheme, more than 15mn qualifying low-income homes in off-grid areas will receive vouchers to purchase free LPG cylinders, in a bid to reduce the use of harmful wood and charcoal for cooking.

Lack of bottle

Brazil should be able to bring in sufficient LPG to meet Gas do Povo's demand but may lack the necessary cylinders to do so, market participants said at the event. The country may need as many as 5mn-10mn new cylinders by March, de Mello said.

But regulatory uncertainty surrounding the programme is preventing distributors from placing new cylinder orders domestically, and the limited timeframe may force them to buy them overseas, delegates heard. Ultragaz and fellow distributor Copagaz are considering importing cylinders from Chinese companies. Brazilian cylinder manufacturers would have to more than double production to meet the new demand, Copa Energia chief executive Pedro Turqueto said. Ultragaz plans to buy most of its new cylinders domestically but is also considering purchasing them from abroad, including from China, Bertellisaid.

ANP is still waiting for the government to provide the subsidy budget and guidelines so it can definecylinderinspection criteria. The government expects to distribute the LPG cylinders under the scheme in November and reach all of the homes and a total of 50mn people covered by March next year, but regulatory delays could postpone these goals.

LPG distributors are reluctant to place orders for additional cylinders given the uncertainty. A substantial increase in demand is needed to justify investment and prevent surplus cylinder capacity — a concern if the government does not extend the subsidy beyond 2026. The two main independent cylinder manufacturers in Brazil, Mangels and Aratell, said they have the capacity and enough available steel to deliver the additional cylinders but would require delivery times of at least six months. Meeting demand for 10mn new cylinders would probably take closer to a year.