Primary aluminium output in southeast Asia is expected to rise to 2.7mn t in 2026, but supply tightness will likely persist in the first quarter because the ramp up of new capacities will be gradual, while export demand will remain strong.

Southeast Asia will add 780,000 t of primary aluminium output in 2026, driven by smelter expansion in Indonesia and new smelters in Vietnam. Of which, 705,000t will come from Indonesia, sending the country's expected total output to 1.55mn t.

Key projects in Indonesia include Chinese-backed Juwan in Weda Bay, Taijing in Morowali and Kaltara in North Kalimantan.

Taijing and Juwan, jointly developed by Chinese companies Tsingshan and Xinfa, are expected to bring new capacity on line in 2026. Taijing plans to start production in the third quarter of 2026 with expected output of around 180,000t, while Juwan expects to reach its full capacity of 250,000 t/yr in the first quarter of 2026.

Kaltara, developed by Indonesian firm Adaro and Chinese firm Lygend, began phase one operations in October-December. It plans to ramp up to its full phase one capacity of 500,000 t/yr by October 2026.

These projects form part of Indonesia's strategy to leverage its abundant bauxite reserves. Indonesia's ample bauxite reserves and its success in developing a local nickel supply chain over the past decade have attracted a growing number of Chinese value-added producers seeking to integrate production chains in the country.

In addition, more Chinese value-added-product (VAP) producers have expanded operations in Indonesia over the past eighteen months. They are looking to diversify supply chains to pre-empt any disruptions if China reaches its government-imposed annual capacity cap of 45mn t/yr for aluminium production. China produced about 3.8mn t of primary aluminium during January-October, up by 2pc from a year earlier, according to China's National Bureau of Statistics.

This trend of building integrated supply chains locally in Indonesia is expected to absorb part of Indonesia's additional primary aluminium output in the coming years, given that some Chinese producers are likely to purchase aluminium to process into VAPs. Meanwhile, exports will continue to grow.

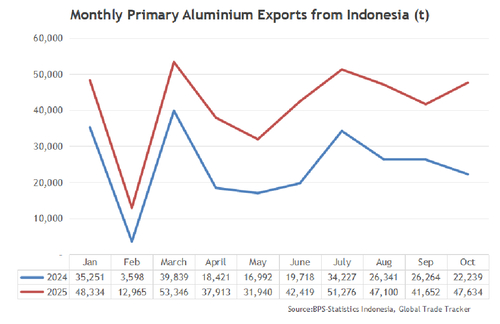

Indonesia's primary aluminium exports rose by 71pc on the year to 414,600t in January–October, from 243,000t in the same period a year earlier. China remained the top destination, taking 191,500t, or 46pc of total volumes. Exports of aluminium value-added products — under HS code 7604, 7605, 7606, 7607, 7608, 7609, 7610 and 7616 — increased by 40pc on the year to around 111,000t in the same period, according to Global Trade Tracker data.

Power stability and reliance on coal remain key bottlenecks for Indonesian smelters. Coal-fired captive plants dominate power supply, while renewable energy adoption is slow because of long lead times for infrastructure development and high costs, despite government efforts to push integration under its Net Zero 2060 roadmap, market participants said.

In other parts of southeast Asia, Vietnam's Dak Nong smelter will commence the first phase of its operations, which has a nameplate capacity of 150,000 t/yr, in the second quarter of 2026. The project is expected to produce 75,000t of aluminium in 2026.

Malaysia's Press Metal remains southeast Asia's largest integrated aluminium producer with a capacity of 1.08mn t/yr. Press is expected to operate at a utilisation rate close to 100pc for 2025 and 2026. Demand for Press' products from its smelter in Sarawak, which are considered low-carbon products in Turkey and Europe because of its hydro-powered smelter, will likely rise in response to EU's tighter carbon boarder adjustment mechanism (CBAM) requirements, effective on 1 January 2026.

Indonesian state-owned producer Inalum is expected to keep output at around 280,000t or raise it slightly to about 285,000t in 2026.

| Southeast Asia aluminium output outlook | t | |||||

| Smelter | Company | Country | 2025E ('000) | 2026E ('000) | ± in 2026 | Designed Capacity ('000 t/yr) |

| Press Metal Bintulu | Press Metal | Malaysia | 960 | 960 | 0 | 960 |

| Press Metal Mukah | Press Metal | Malaysia | 120 | 120 | 0 | 120 |

| Inalum Kuala Tanjung | MIND ID | Indonesia | 280 | 285 | 5 | 600 |

| Hua Chin Aluminum Indonesia | Tsinghan/Huafon | Indonesia | 490 | 500 | 10 | 500 |

| Taijing (IMIP Phase I) | Tsinghan/ Xinfa | Indonesia | 0 | 180 | 180 | 600 |

| Juwan (IWIP Phase I) | Tsingshan /Xinfa | Indonesia | 50 | 250 | 200 | 250 |

| Xianfeng (IWIP Phase II) | Tsingshan /Xinfa | Indonesia | 0 | 50 | 50 | 250 |

| Bintan Nanshan (BAI) | Nanshan Group | Indonesia | 0 | 0 | 0 | 1,000 |

| Kaltara | Adaro, Lygend | Indonesia | 20 | 280 | 260 | 500 |

| Dharma Inti Bersama (DIB) | Harita | Indonesia | 0 | 0 | 0 | 1,000 |

| East Hope Indonesia | East Hope | Indonesia | 0 | 0 | 0 | 2,400 |

| Dak Nong | Dak Nong | Vietnam | 0 | 75 | 75 | 450 |

| Duc Giang | Duc Giang | Vietnam | 0 | 0 | 0 | 500 |

| Bosal Malaysia project | Bosal | Malaysia | 0 | 0 | 0 | 1,000 |

| Total | 1,920 | 2,700 | 780 | 10,130 | ||

| Source: Argus Media, Company reports, Market sources | ||||||

| Indonesia primary aluminium shipments by market in 2025 | ||||

| 1Q | 2Q | 3Q | Jan-Oct '25 | |

| China | 15,504 | 64,547 | 87,356 | 191,475 |

| South Korea | 46,188 | 13,599 | 4,500 | 65,787 |

| Vietnam | 7,893 | 9,114 | 16,938 | 42,284 |

| Turkey | 29,997 | 5,899 | - | 35,896 |

| Malaysia | 4,000 | 1,000 | 16,094 | 22,394 |

| Thailand | 2,520 | 7,891 | 10,191 | 20,702 |

| Japan | 2,250 | 5,775 | 3,050 | 11,700 |

| Spain | - | - | - | 10,000 |

| Taiwan | 1,646 | 4,346 | 1,698 | 9,390 |

| Italy | 4,647 | - | - | 4,647 |

| Others | - | - | 200 | 302 |

| World | 114,645 | 112,272 | 140,027 | 414,577 |

| Source: BPS-Statistics Indonesia,Global Trade Tracker | ||||