Tougher European targets for renewable fuel use look set to support demand and premiums for hydrotreated vegetable oil (HVO) this year — and continue attracting supply from the US, Canada and China — despite the recent dip in prices from the highs recorded toward the end of last year.

The Argus HVO Class II fob Amsterdam-Rotterdam-Antwerp (ARA) premium to gasoil fell to $1,284/m³ on 28 January, its lowest in more than four months, after reaching a more than three year high of $1,650/m³ in October on the back of stronger demand from blenders needing to meet year end renewable energy directive (RED) compliance targets.

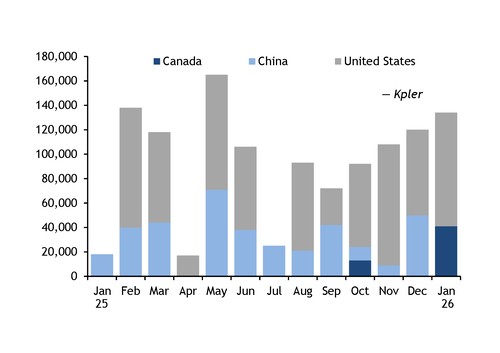

The decline in prices largely reflects the reaction to that higher year-end demand, which triggered steep backwardation, creating arbitrage opportunities for sellers in the US, Canada and China and drawing in a wave of imports that is now eroding premiums (see graph). Some carried inventory from December into January, while weak diesel demand — along with the typically slower blending activity at the start of a new compliance year — continued to pressure physical blending

But the broader outlook for 2026 is one of regulatory changes supporting demand as key EU member states increase renewable fuel use targets. In Germany, planned legislative changes are set to boost HVO demand from 1.2bn l (or around 936,000t) in 2025 to 2.6bn l this year, according to estimates from Argus' consulting division. Berlin is set to end the double counting of biofuels produced from waste and residue feedstocks listed under the EU's RED Annex IX Part A — also known as 'advanced' feedstocks — which means that higher physical biofuel volumes will be required to meet quotas.

The Netherlands is also planning to end double counting as it switches to a greenhouse gas (GHG) savings mandate from an energy basis one. Argus' consulting services project overall European HVO demand rising to 9.4bn l this year, up from 6.9bn l in 2025.

Suppliers are also increasingly turning to HVO to meet the EU Fuel Quality Directive 7pc cap on blending conventional methyl ester biodiesel into diesel as biofuels mandates rise. HVO is a drop-in fuel virtually chemically identical to fossil diesel and can be blended in greater volumes.

This shift drove a sharp rise in spot trade in 2025, with Argus Open Markets (AOM) volumes traded for HVO Class II reaching 154,000t for the year, compared with 44,000t in 2024. And 2026 is already off to a strong start, with 37,000t of trade initiated so far in January, up from 18,000t in January last year.

Trade of cash-settled futures that link to the HVO Class II spot price has also picked up. A total of 5mn futures traded on the Intercontinental Exchange (Ice) in 2025, up from around 680,000t in 2024. Open interest now extends to March 2027.

Arbitrage volumes into Europe could also be supported in 2026 by weaker domestic demand in the US, where California's winter pause in diesel intensive agricultural activity is cutting into consumption. Combined with limited US regulatory incentives, buying interest in the US has been muted in recent months and helped open the arbitrage to Europe.

For sales into the EU market, US and Canadian HVO is subject to anti-dumping and anti-subsidy measures, with combined countervailing and anti-dumping duties for most major producers — including Diamond Green Diesel, Phillips 66 and Calumet Montana Renewables — set at around €400/t.

Definitive anti-dumping duties on HVO from China were imposed in February last year, and range from 10pc–36.6pc, limiting potential for exports to Europe. Nonetheless, price strength in Europe and supply availability from producers liable only for lower EU duties did open the door for moderate export flows in recent months.