Closures and rationalisations in the European polyvinyl chloride (PVC) and chlor-vinyls chain are likely without more protection from imports and support from government to reduce energy costs, according to European producers.

High feedstock costs put European chemical producers at a structural disadvantage compared with other producing regions, and this is coupled with weak domestic demand from outlets such as the construction and automotive sectors. PVC is particularly exposed to the high cost of energy because of the electrolysis process used to produce chlorine.

Natural gas costs averaged $12.46/mnBtu on the European TTF day-ahead index over the past year, while US natural gas costs at the Henry Hub averaged $3.76/mnBtu over the same period. Asian gas costs are closer in scope to Europe but lighter environmental regulation and emissions costs compared to Europe mean chemicals firm there operate with a cost advantage.

European demand for PVC was largely flat in 2025, with domestic producers operating at low rates, participants said.

Chemical company Ineos' chlor-vinyl subsidiary Inovyn has called on the EU to use anti-dumping duties to combat "low-cost, high-carbon imports" flowing into Europe from China, South Korea and Taiwan.

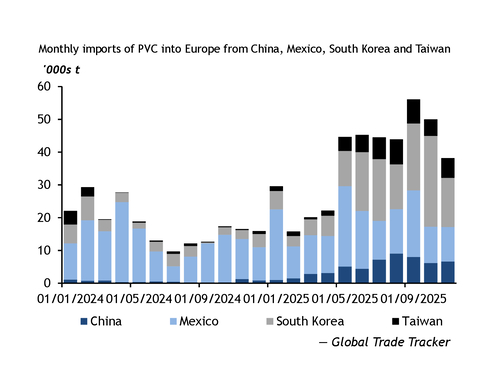

The bloc placed anti-dumping duties on US and Egyptian origin product in 2024, at between 63.7-100.1pc for PVC resins, effectively cutting of supply from these countries. But these have now largely been replaced by imports from Asia-Pacific.

Total imports of PVC resin into Europe from China, Taiwan, Mexico and South Korea were roughly 410,300t in the first 11 months of 2025, according to Global Trade Tracker, more than double the same period a year earlier. Total imports into Europe rose to 540,000t from 469,000t in that time.

Extension of duties would further cut European imports, as could the scheduled cancellation of a 13pc Chinese export tax rebate for PVC on 1 April. This is likely to raise Chinese export prices, making the east-to-west flow for PVC less favourable. Some European producers welcomed this news, noting that Chinese material was often the cheapest on the import market and the change may help raise the price floor for the whole market, supporting European producer margins.

Imported spot material from South Korea is closer in price to European domestic contracted material, and Chinese and Taiwanese resin has consistently been cheaper. The Argus cif Europe import price for PVC resin hit a recent low of $715/t because of these cheaper imports, although it has ticked back up marginally as of last week.

Inovyn's call for wider duties has been echoed by Vynova, whose Belgium subsidiary Tessenderlo is operating under a supervisory order until April after financial constraints emerged in December. A wider financial restructuring of the group is being worked on.

Vynova companies in England and Germany have entered insolvency proceedings and may or may not emerge as part of the restructured entity. The company closed its 225,000 t/yr PVC-producing asset in Beek, the Netherlands, in 2025 citing pressure from "global overcapacity, persistently weak demand and increased competition from regions with lower production costs and less stringent regulations".

Vynova's struggles are not unique. Spolana shut a 135,000 t/yr capacity site in the Czech Republic, and Fortischem closed a smaller site in Slovakia. Inovyn shut half of its PVC capacity at its Martorell, Spain, site before December 2025. The site was allocating fewer volumes to the export market, particularly Turkey, people with knowledge of the matter said.