PVDF demand to increase chlor-alkali consumption

The demand growth of polyvinylidene fluoride (PVDF) is dependent on lithium-ion batteries for battery-operated electric vehicle (EV) demand and stationery electrical storage. Argus forecasts global lithium-ion battery demand in EVs to reach 3.8GWh by 2034 from 0.7GWh in 2023. EV sales are expected to rise at an average growth rate of 10pc in the next 10 years reaching more than 46mn units.

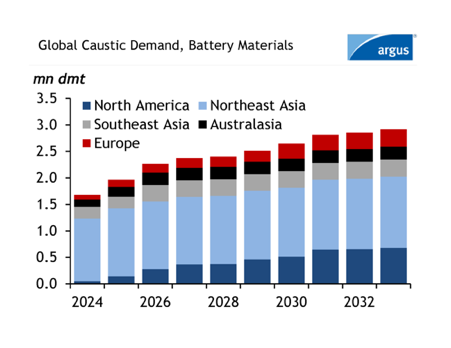

Global caustic soda demand into battery materials for leading regions is shown in the figure. Argus’s latest caustic soda analytics forecast explains an exponential rise in caustic soda consumption for battery material processing. Global caustic soda consumption in the processing of lithium hydroxide, lithium carbonate, cathode materials and recycled black mass was at 1.5mn dmt in 2023 and is expected to reach 3mn dmt in 2033 at a CAGR of 10pc in the first five years.

The relationship between chlor-alkali products and battery materials is gaining focus in the market. With increasing Lithium-based battery capacity globally, demand for associated battery materials is expected to rise. Among the other components of the Li-ion battery stack, PVDF plays an important role as a binder and separator coating, optimizing energy storage efficiency and reducing battery weight in EVs.

PVDF utilizes caustic soda and chlorine in its production at different stages. Primary feedstock includes vinylidene chloride or vinylidene fluoride, which are derivatives of caustic soda and chlorine.

Some significant developments in PVDF capacity are taking place in North America and Northeast Asia. Belgian chemical company Solvay entered into a joint venture with Mexico-based PVC producer Orbia to build the largest production facility of battery-grade suspension PVDF in North America with a capacity of 20,000 t/yr. Commercial production is expected to start in 2026 and the expected caustic soda and chlorine demand can be 8,000 t/yr and 12,000 t/yr respectively.

Solvay has doubled its capacity in Changshu, China in the past five years and raised its capacity in France by 35pc reaching 35,000 t/yr making it the largest production site in Europe. Another major producer French chemical company Arkema increased production capacity by 50pc last year at its Changshu site in China.

Japan-based producer Kureha is undergoing expansion at its Iwaki site in Japan, having a production capacity of 6,500 t/yr. The expansion is in two phases, first is a new capacity of 8,000 t/yr and another 2,000 t/yr in the second phase by debottlenecking resulting in a total capacity of 20,000 t/yr by 2026.

This article was created using data and insight from Argus Caustic Soda Analytics and Argus Battery Materials.

Spotlight content

Related news

South Korea approves Hyundai Chemical, Lotte merger

South Korea approves Hyundai Chemical, Lotte merger

Singapore, 25 February (Argus) — South Korea's trade, industry and resource ministry (Motir) has approved chemical producers Hyundai Chemical and Lotte Chemical Daesan's restructuring plans along with a support package on 25 February. Hyundai Chemical and Lotte Chemical jointly applied to merge their plants in November 2025 . Hyundai Chemical is a joint venture between Hyundai Oilbank and Lotte Chemical. This is the first project approved under South Korea's government-led rationalisation efforts across the Daesan, Ulsan and Yeosu petrochemical complexes. These efforts were in response to the industry's prolonged losses since 2021, driven by rapid capacity expansions, particularly in China. Under the approved plans, Lotte Chemical will merge its Daesan petrochemical plant with Hyundai Chemical, integrating the naphtha cracking centre (NCC) and downstream units. Parent companies Lotte Chemical and Hyundai Oilbank will invest 600bn Korean won ($420mn) each and will share equal ownership of the newly integrated corporation. The restructuring is expected to take three years, during which Lotte Chemical will suspend its 1.1mn t/yr ethylene cracker in Daesan, and reduce operations of low-profit downstream facilities to curb oversupply in the Daesan petrochemical complex. The newly integrated corporation aims to focus on producing higher value-added and eco-friendly products instead of general-purpose products, Motir said. The South Korean government will also provide a customised support package worth W2.1 trillion, which will include financial, taxation, regulatory, cost structure improvement, employment, and technology development assistance for the firms' restructuring implementation. But the specific financial measures are to be finalised by the Korean Development Bank after consultations with institutional creditors. Other key producers including YNCC, GS Caltex, LG Chem, S-Oil, SKGC, and KPIC also submitted their business restructuring proposals in December 2025, and are under government review. The submitted plans would meet the collective target to reduce the nation's naphtha cracking capacity by 2.7mn-3.7mn t, according to the ministry. But revisions to the plans have been requested, and finalised drafts for restructuring plans for the Yeosu and Ulsan petrochemical complexes are expected by the end of the first quarter of 2026, said market sources close to South Korean cracker operators. By Angie Liew Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

European biochemicals projects stall

European biochemicals projects stall

London, 24 February (Argus) — Growth in European bio-attributed chemical projects has stalled, with projects being pushed back or moved because of cost pressures and weak demand. Various companies planned projects to produce bio-attributed chemicals in Europe, with many originally scheduled to come online before 2028. Current Argus tracking indicate many of these are now likely to come online in 2029-30. Weak demand, cost pressures and, at times, a lack of feedstock are all behind decisions to delay or move projects. The Moller Holding-owned chemical start-up Vioneo is "pulling out" of Europe, and shifting its planned 300,000 t/yr methanol-to-polymers plant to China to enable "a faster route to market", it said in January. The company initially planned to bring a plant online in 2028 in Antwerp, Belgium. Production is now likely to take place in China in 2029-30, with capacity unchanged, the company said. The firm's priority is to bring "fossil-free plastics to market as quickly as possible", and moving to China will allow it to be more competitive on pricing, it said. Bioethylene company Syclus had intended to start production in 2026, with 100,000 t/yr planned for a site in Geleen, the Netherlands. This is now more likely to be completed in 2030. Futerro, which is planning a polylactic acid (PLA) plant in Port Jerome, France, will aim for production at its site to start "no later than 2029", it said, after initial attempts to commercialise by 2027 . The plant will have the capacity to produce up to 75,000 t/yr of PLA derived from plant starches. Blue Circle Olefins aims to bring a 200,000 t/yt methanol-to-olefins (MTO) site in Rotterdam, the Netherlands, online in 2030 . The site will aim to use "sustainable" methanol as a feedstock, and the company signed a long-term offtake agreement with Dutch polypropylene producer Ducor Petrochemicals in November 2025. Finnish forestry group UPM aims to produce bio-monoethylene glycol (bio-MEG), bio-monopropylene glycol (bio-MPG) and industrial sugars at its site in Leuna, Germany, this year . It expects to enter the commercial market with products from Leuna in the first half, with total capacity at the site being 220,000 t/yr of biochemicals. Sustainability has fallen down the list of priorities for some large packaging companies, with cost pressure persisting, particularly in Europe. This week, chemical producer LyondellBasell cut its 2030 target for producing and marketing recycled and renewable-based polymers to 800,000 t/yr from 2mn t/yr. Demand for sustainable plastics anticipated to follow pledges made by some packaged goods companies in 2019-20 has not come to pass , putting pressure on sustainable plastic production. Europe is at a structural disadvantage for fossil-based chemicals, compared with other producing regions with cheaper energy prices and feedstocks, and the story is similar for biochemical demand. A European Bioeconomy Strategy, launched at the end of 2025 , aims to support the use of bio-based plastics and novel materials by 2027 alongside recycling. Currently operational projects for bio-attributed chemicals and bio-attributed plastics total over 1.5mn t/yr of capacity, compared with planned projects in Europe totalling 741,000 t/yr by 2030, Argus projections show as tracked in the Biochemicals and bioplastics project tracker. Regulatory support will be key for projects to succeed, along with factors including proximity to feedstock. Sustainable methanol and ethanol feedstock projects require access to a steady supply of feedstock to compete with fossil-fuel-based projects. "The European bio-plastics industry faces similar hurdles to other European industries — trade hurdles, investment hurdles, competition with other regions in the world," the EU Policy Affairs manager from the European Bioplastics industry working group said in November 2025. "We developed a lot of the bioplastics technology in Europe but the industrialisation can often take place outside of Europe because of lower energy costs and investment opportunities." By George Barsted Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

ET Fuels secures bunkering buyer for Texas e-methanol

ET Fuels secures bunkering buyer for Texas e-methanol

Paris, 24 February (Argus) — Irish project developer ET Fuels signed a binding long-term offtake agreement to supply e-methanol "at a fixed price" to UK-based shipping company RFOcean from 2030. The supply will come from ET Fuels' most advanced project in the US, the Rattlesnake Gap plant in Texas that will produce 120,000 t/yr of e-methanol. Neither company disclosed the amount involved, but ET Fuels said it will "still have volumes to sell for any other early movers." The agreement with RFOcean has given ET Fuels "a clear path" to raise the financing it needs to move forward with Rattlesnake Gap, chief executive Lara Naqushbandi told Argus . The EU's FuelEU Maritime regulation requiring shipping companies to gradually reduce the carbon intensity of bunker fuels was the main driver behind the deal, said RFOcean chief executive Fredrik Rye-Florentz. "Compliant fuel will be scarce," he said. "By locking in supply now at fixed prices, we can offer our customers certainty" of fuel supply that meets requirements under FuelEU Maritime. This is RFOcean's first e-fuel procurement agreement. The multiplier applied for use of non-carbon fuels from 2030-34 gives "a big incentive" to shipping companies to secure e-fuels, Rye-Florentz said. Naqushbandi said the offtake agreement "sends a clear message to policymakers: stable regulations unlock investment. "Any weakening of the EU's green fuel standards would undermine momentum at exactly the wrong time," she said. Rattlesnake Gap is in an advanced initial engineering design phase. ET Fuels aims to start construction by 2027 and production by 2030, to meet the timeline requirements to benefit from four different types of tax credits in US. It is planning other similar projects in the US and Europe. The company recently secured €118.6mn ($140mn) in tax credits from Business Finland for a 100,000 t/yr e-methanol project being developed in partnership with state-owned energy company Neova. Finland is one of Europe's "most attractive jurisdictions" for production of renewable hydrogen and derivatives because of "abundant renewable and biogenic CO2 resources, streamlined permitting, and stable policy frameworks," ET Fuels said. By Pamela Machado Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Netherlands opens €33.6mn clean shipping subsidy round

Netherlands opens €33.6mn clean shipping subsidy round

London, 23 February (Argus) — The Netherlands will open the second funding round under its €210mn ($247.8mn) Maritime Masterplan (MMP) on 19 May 2026, allocating €33.6mn to projects deploying alternative marine fuels on newbuild or retrofitted vessels, the infrastructure and water management ministry said. The 2026 call expands on the first 2024 round, which backed hydrogen and methanol propulsion as well as carbon capture systems on LNG fuelled ships. The new round adds "limited eligibility" for ammonia and bioethanol projects. The ministry said the change follows industry feedback seeking wider fuel options. Companies have until 3 November 2026 to apply. Projects can receive up to €8mn each, covering research and development and demonstration activities. Of the total budget, €21.6mn is reserved for projects requesting more than €4mn, with €12mn available for applications below that threshold. Each bid must come from a consortium of at least "two unrelated firms". The funding is intended to support the government's plan to demonstrate around 30 climate neutral vessels in the coming years as part of its zero emission shipping strategy. The first MMP round, open from June to October 2024, awarded €85mn across three technology lines: €40mn for hydrogen powered vessels, €25mn for methanol projects and €20mn for carbon capture systems on LNG ships. A third and final call under the scheme is scheduled for 2029. By Chingis Idrissov Projects selected under the 2024 MMP round Project name Consortium Vessel type Fuel line technology Blue Horizon Carbotreat, IHC, Anthony Veder, TNO Retrofit for LNG tanker (Coral Energy) Carbon capture unit on LNG vessel ME2CC Carbotreat, IHC, others Retrofit for roll-on-roll-off cargo ship (Samskip Kvitbjorn) Carbon capture unit on LNG vessel Columbus Zero One Mineralis, NPRC, Faasse Maritiem Newbuild inland beunschip (sand-carrier barge) Gaseous H2 (350 bar) with fuel cells Gaasterland H2 Mineralis, TNO, Vink Diesel, Kuster H2 Energy, Nexus Marine, Zwijnenburg Shipyard, Verhoef EMC Retrofit deep-suction dredger Hybrid with H2 combustion engine and fuel cells H2Estia Nederlandse Innovatie Maatschappij (NIM), suppliers & research partners Newbuild coastal general cargo ship Liquid H2 with fuel cells Hydro Navis SIF Group, NPRC, Hydro Nova, Marin, NIM, Concordia Damen Newbuild inland push-tug and barge Liquid H2 with fuel cells Nera-H2 NPRC, Marin, Teamco, NIM, others Newbuild river cruise vessel Hydrogen fuel cells and battery system Methanorms Fugro + 9 industrial partners + 5 research institutes Retrofit survey vessel (Fugro Galaxy) Methanol-powered vessel Moby-NL Victrol, Shipping Technology, NIM, Rensen & Driessen, MARIN, TNO Newbuild methanol bunkering vessel Methanol-powered vessel Dutch Maritime Network Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.