Global LPG markets strengthened in December as Asia-Pacific propane prices rose on winter heating demand and tighter US exports. Stronger LPG narrowed propane’s discount to naphtha, while Saudi Aramco raised January CPs on firm Indian and SE Asian demand. Chinese PDH rates slipped with maintenance. Europe saw prices surge on cold weather and reduced US arrivals. In the US, high inventories kept Mont Belvieu values soft. Winter demand will support prices short term, but easing demand from March may trigger declines.

Scroll down or navigate to each regional commentary using the buttons above.

Asia-Pacific

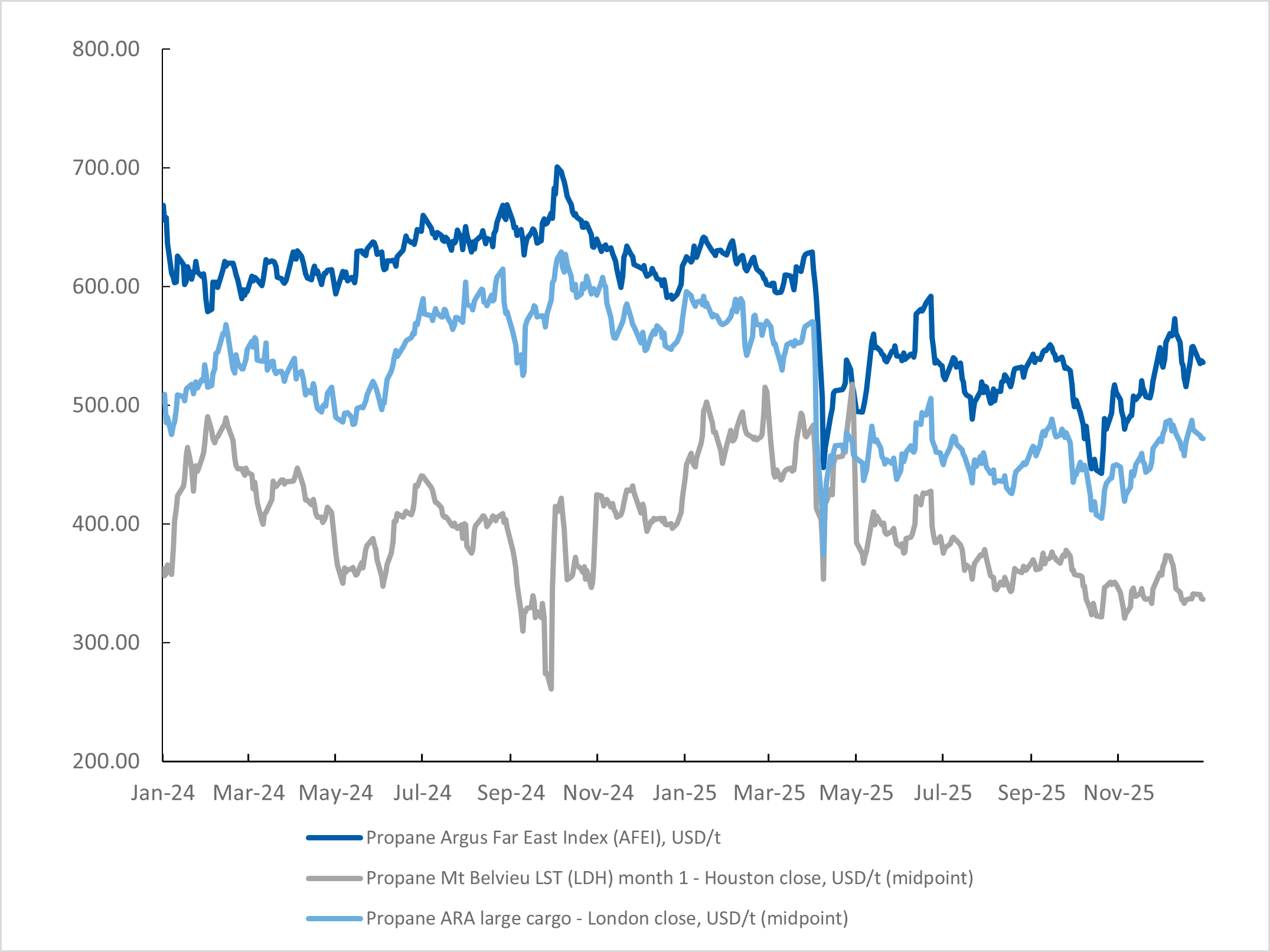

Global Propane Prices

- Average of propane delivered prices into Japan in December increased by 7.3pc from a month ago owing to strong winter heating demand in northeast Asia.

- Spot premiums rose to $42/t against the January Argus Far East Index (AFEI) for January shipments to reflect prompt supply tightness brought on by delayed exports from the US.

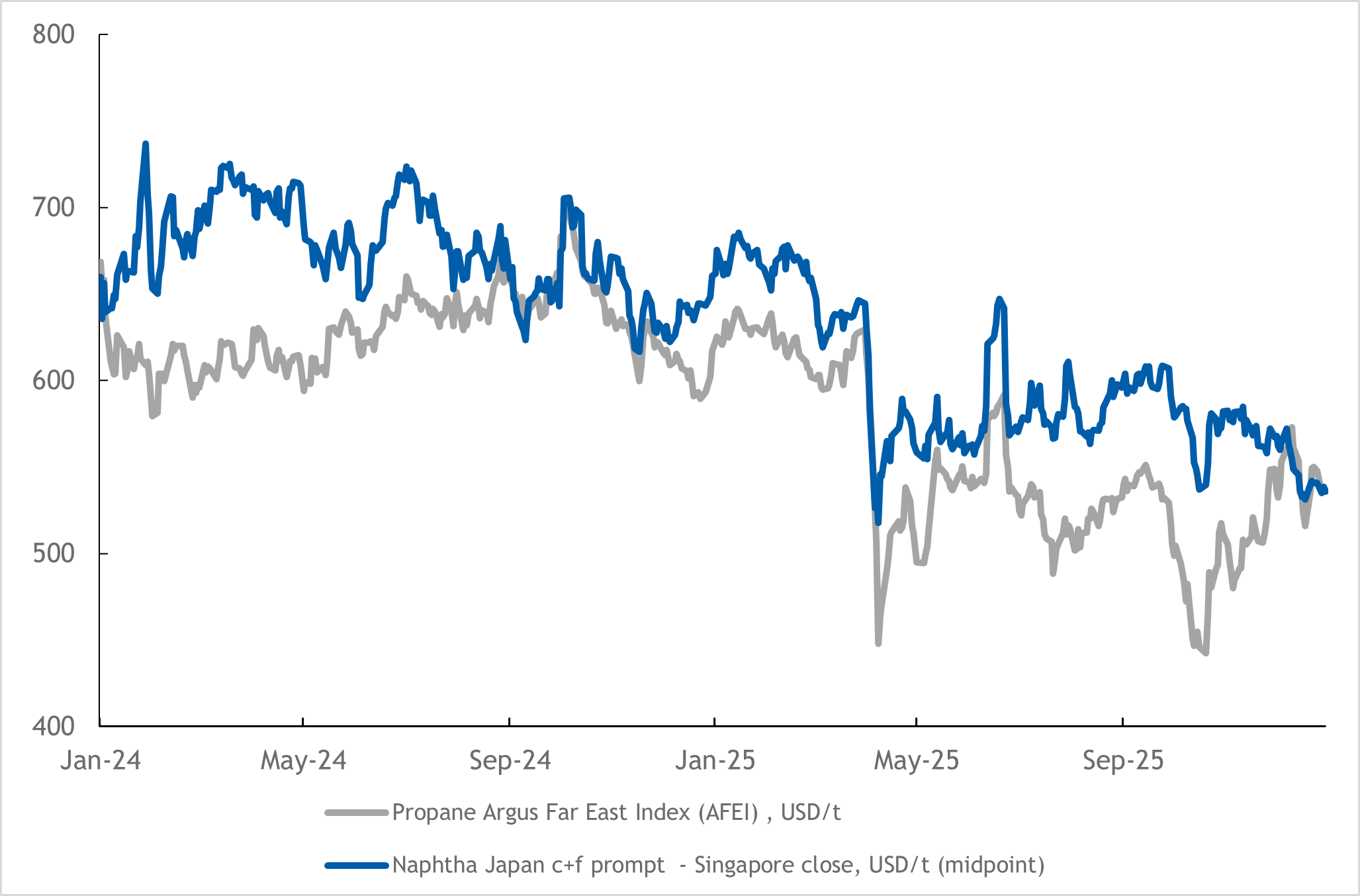

LPG versus Naphtha

- Firmer prices in the LPG complex narrowed propane’s discount to naphtha which dented feedstock cracking switching demand from regional crackers.

- The front-month propane swaps averaged $15/t discount to its naphtha counterpart in December, from discounts of $64/t the previous month after LPG supply tightened in the run-up to the peak winter heating season.

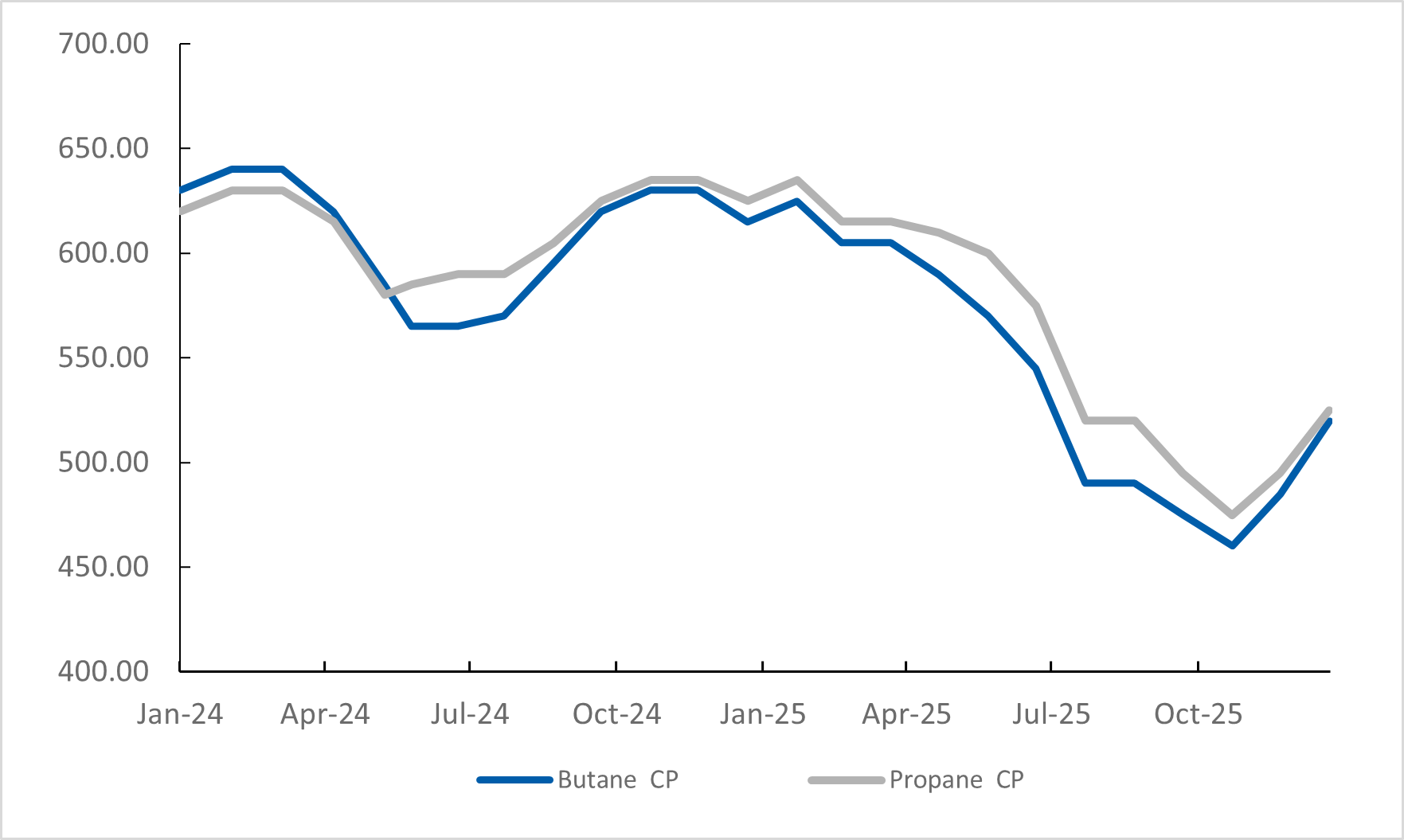

Saudi Aramco Posted Propane & Butane CP

- Saudi Arabia’s state-controlled Saudi Aramco raised the January Contract Prices (CP) for propane and butane to $525/t and $520/t respectively, up by $30/t and $35/t from last month owing to strong demand from India and southeast Asia.

- Despite tepid demand from China for January shipments, regional importers increased spot purchases due to inadequate term coverage for the first quarter.

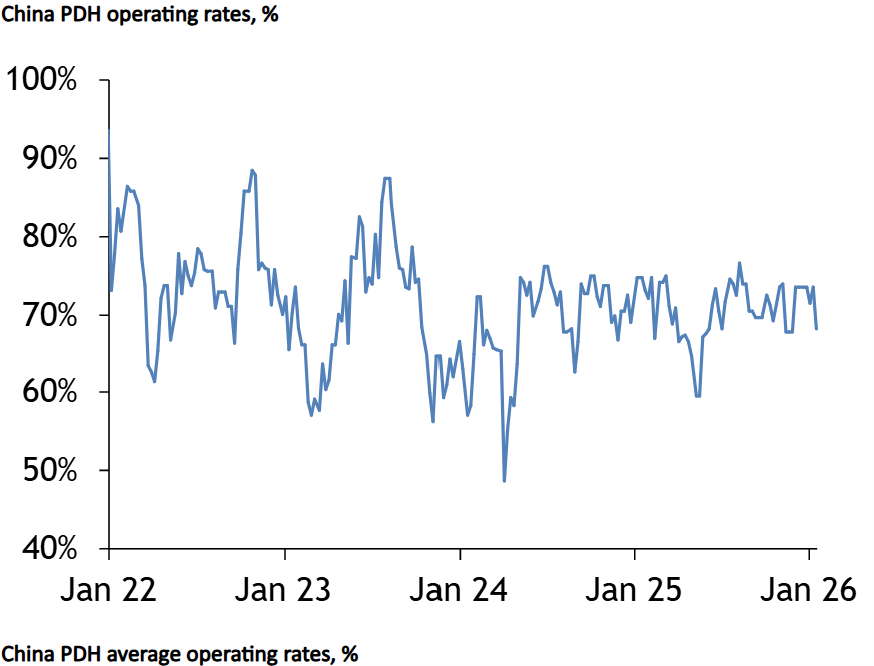

Chinese PDH Performance

- Run rates at Chinese PDH plants averaged 73.5pc in December but slipped to 68pc by mid-January owing to plant maintenance.

- Tightening propylene supply and rising downstream demand could buffer production losses amid high propane feedstock costs.

Europe

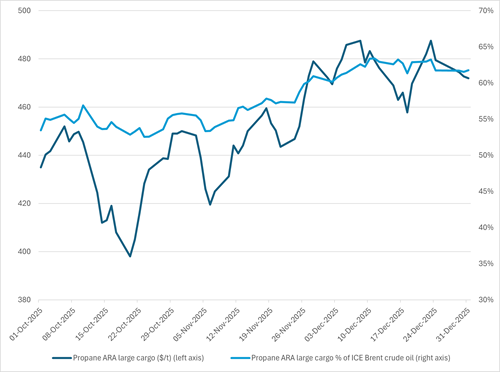

Northwest European large‑cargo prices surged in early December as a result of rising prompt demand driven by colder weather and reduced US imports, with fog causing disruptions at US Gulf coast (USGC) terminals. Large‑cargo propane prices peaked at $487.50/t cif Amsterdam–Rotterdam–Antwerp (ARA) on 8 December, having been as low as $398/t as recently as late October.

Local propane supply was also constrained, as were expectations for US imports, because North Sea LPG fractions continued to be left in natural gas streams to the maximum extent possible, given the region’s high natural gas prices. This trend persisted throughout 2025, and LPG exports from six major North Sea terminals — Mongstad, Melkoya, Karsto and Sture in Norway, and Braefoot Bay and Teesside in the UK — fell by 10pc to 4.4mn t year on year.

After the early‑month peak near $490/t, outright pricing was subsequently pulled lower by weaker crude benchmarks but largely maintained its relative strength versus broader energy markets. This resilience was driven primarily by renewed demand from the Asia‑Pacific region, with which northwest Europe must competitively bid for US supply to balance its market.

Propane pricing relative to local crude benchmark ICE Brent opened December at around 60pc, firmed quickly above 62pc, and remained tightly rangebound near that level through year‑end.

Americas

US propane prices saw little support from delivered prices on the Argus Far East Index (AFEI) in December, as US inventories ended the month at 100.3mn bl — up 27pc over the five-year average, according to the US Energy Information Administration (EIA).

Prompt-month LST propane at Mont Belvieu, Texas, fell from 69¢/USG ($359.49/t) at the start of December to 64.625¢/USG ($336.70/t) by the end of the year, as ample supplies and loading delays at US export terminals contributed to bearish sentiment. Mont Belvieu EPC propane, which has traded at a discount to LST (also known as Tet) propane for much of the last quarter, fell from 67.19¢/USG to 61¢/USG over the same period.

Gulf coast export facilities at Houston and Nederland, Texas, experienced 14 days and 7 days of traffic delays, respectively, in December, largely owing to seasonal fog. The potential for additional loading delays tightened availability for incremental spot cargoes and supported spot terminal fees, which averaged Mont Belvieu EPC +8¢/USG during the month, down from the 16.5¢/USG average seen the prior year. Kpler tracking showed US propane exports averaged 1.7mn b/d in December, down from 1.85mn b/d a year earlier.

LST propane’s value relative to Nymex WTI averaged 48.7pc in December, up from 45.7pc in November and stronger than the 46.8pc value recorded in December 2024.

US propane stocks continued to draw only modestly into January and remained 33pc above the five-year average for the second week of January.

US butane exports rose year over year in December to an estimated 428,000 b/d, according to Kpler, supported by lower US gasoline prices that reduced gasoline blending demand and enabled greater international shipments. US butane prices at Mont Belvieu averaged 60.3pc of Nymex WTI in December, down from 67pc in December 2024, as outright EPC prices at Mont Belvieu fell from 87.19¢/USG ($394.97/t) to 77.69¢/USG last month.

US ethane prices fell from 30.5¢/USG ($225/t) to 22.19¢/USG during December, tracking weakness in natural gas prices, as gas inventories also remained above average.

Outlook

The quarter ahead

- LPG prices will remain strong relative to naphtha due to seasonally strong demand from winter heating

- But strong inventories will prevent rapid price rises and we can expect declines to begin towards March as demand begins to ease

- Outright prices could decline alongside crude if tensions between the US and Iran begin to ease

The next 6 months and longer term

- Stronger crude and naphtha prices towards the end of 2026 will boost LPG

- Growing Mideast production and muted Asia demand increases will keep LPG weak relative to naphtha

- VLGC freight rates are expected to weaken over 2026, narrowing regional spreads

Argus Market Highlights LPG

If you’d like to receive an email notification when we publish our monthly newsletter — featuring news analysis from Argus LPG World, podcasts, and market insights — sign up here to get the next issue delivered to your inbox.

Sign-up