Overview

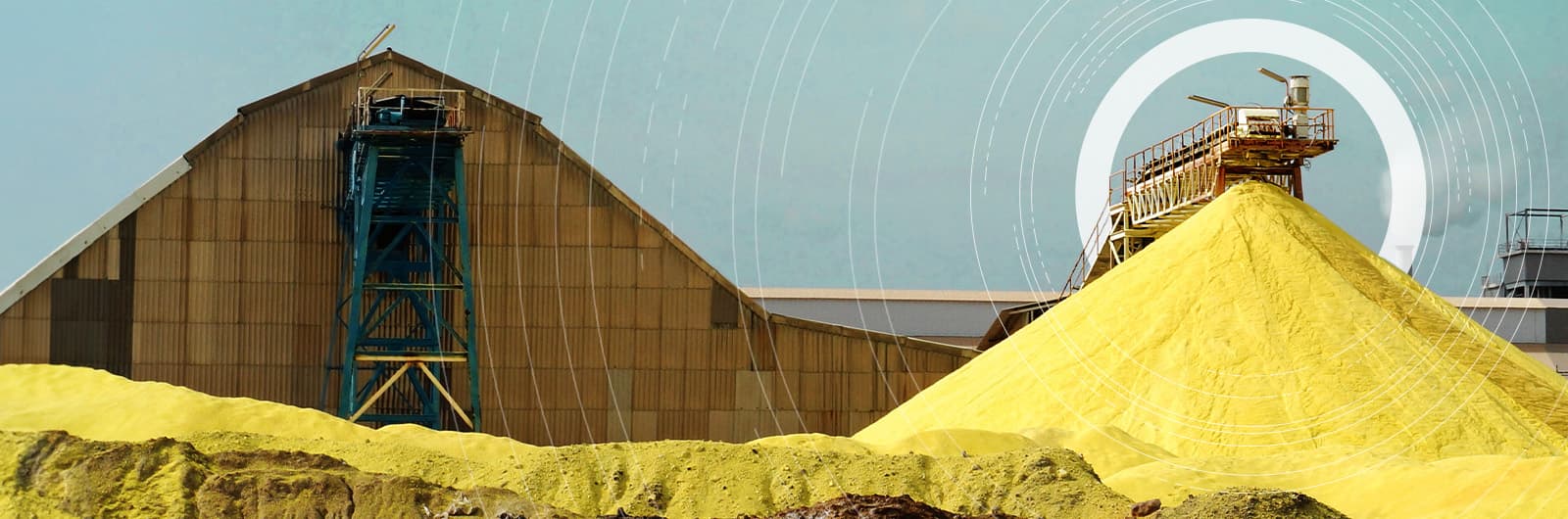

The global sulphur market has gone through fundamental changes in buying patterns, trade routes and pricing over the past few years. Fixed price contracts and formula-based indexation have become the dominant ways in which supplies are bought and sold around the world, which makes accurate price assessments and detailed analysis key to any sulphur market participants.

The global sulphuric acid industry has seen structural change in recent years and new capacities will continue to challenge the balance in the years to come. While demand will be driven by fertilizers — predominantly the increased production of phosphate and ammonium sulphates — the market will continue to be exposed to short-term supply shocks, especially from the metals sector.

Rising demand for battery materials such as nickel and cobalt (due to growing electric vehicle production) will in turn bolster demand for sulphur and sulphuric acid, increase competition for supply and impact pricing.

Our extensive market coverage includes formed sulphur (both granular and prilled), crushed lump sulphur, molten/liquid sulphur and sulphuric acid. Argus has decades of experience covering these markets, and incorporate our multi-commodity market expertise in key areas including phosphates and metals to provide the full market narrative.

Argus support market participants with:

- Price assessments (daily and weekly for sulphur, weekly for sulphuric acid), proprietary data and market commentary assessments

- Short and medium to long-term forecasting, modelling and analysis of sulphur and sulphuric acid prices, supply, demand, trade and projects

- Bespoke consulting project support

Latest sulphur and sulphuric acid news

Browse the latest market moving news on the global sulphur and sulphuric acid industry.

Kuwait's KPC raises Feb sulphur price by $4/t

Kuwait's KPC raises Feb sulphur price by $4/t

London, 2 February (Argus) — Kuwait's state-owned sulphur producer KPC has set its February Kuwait Sulphur Price (KSP) at $520/t fob Kuwait, up by $4/t from the January KSP. The February KSP implies a delivered price to China of $542-547/t cfr at current freight rates, which were assessed on 29 January at $22-24/t to south China and at $26-27/t to Chinese river ports for a 30,000-35,000t shipment. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Indonesian sulphur imports outpace sulacid in 2025

Indonesian sulphur imports outpace sulacid in 2025

Singapore, 2 February (Argus) — Sulphur imports into Indonesia surged to 5.35mn t in 2025, up by 48pc from 3.62mn t a year earlier, according to the latest Global Trade Tracker (GTT) data. Indonesia is the world's third-largest sulphur importer after China and Morocco. The sharp rise in demand was driven largely by two newly commissioned sulphur burners by battery materials producer QMB New Energy Materials, which together require around 553,000 t/yr of sulphur at full capacity. Higher sulphur burning activity, combined with difficulties in securing sulphuric acid import permits, pushed buyers with the flexibility to switch between the two raw materials toward more sulphur purchases despite steadily rising prices throughout the year. Argus assessed cfr Indonesia granular sulphur at $547/t on a midpoint basis on 18 December 2025, up by $360/t or 193pc from the start of the year. A perfect storm of geopolitical uncertainty linked to sanctions and tariffs disrupting trade flows, alongside lower sulphur output from key supply regions, lent further support to prices across 2025. Sulphur deliveries increased from most major origins in 2025. Imports from Saudi Arabia and Qatar climbed to 1.76mn t and 930,500t respectively, up from 1mn t and 418,000t in 2024. Canadian shipments also rose by 36pc on the year to 514,500t, because higher prices widened arbitrage opportunities and a Middle East supply deficit boosted the competitiveness of Canadian sulphur. Sulphuric acid imports fall Indonesia's sulphuric acid imports fell by 3pc on the year to 1.09mn t in 2025. Ongoing challenges in obtaining import licences kept many buyers out of the market and encouraged some usual sulphuric acid buyers, like QMB New Energy Materials, to lean more on sulphur instead, given that sulphur imports do not require licences. Sulphuric acid imports from South Korea and Japan fell sharply by 40pc and 65pc respectively to 172,000t and 105,900t, GTT data show, because persistently low treatment and refining charges (TC/RCs) for copper concentrates squeezed margins and curbed smelter operating rates. But imports from China more than doubled to 670,300t because revenue from by-products including sulphuric acid helped cushion falling copper margins and kept Chinese smelters running at high utilisation rates . By Deon Ngee Indonesian sulphur imports 2025 ('000t) Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

QatarEnergy raises February sulphur price by $3/t

QatarEnergy raises February sulphur price by $3/t

London, 1 February (Argus) — State-owned QatarEnergy Marketing has raised its February Qatar Sulphur Price (QSP) to $520/t fob, up by $3/t from $517/t fob Ras Laffan/Mesaieed for January. The February QSP implies a delivered price to China of $542-547/t cfr at current freight rates, which were assessed on 29 January at $22-24/t to south China and at $26-27/t to Chinese river ports for a 30,000-35,000t shipment. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Tupras announces sulphur export tender for Feb loading

Tupras announces sulphur export tender for Feb loading

London, 29 January (Argus) — Turkish refiner Tupras' monthly 8,000t sell tender closes on Friday, with loading in mid-February. Tupras usually runs the tender on a monthly basis for exported sulphur volumes out of its Izmir refinery. Tupras' last export tender closed on 16 December at $455/t fob. By Fenella Rhodes Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Argus Fertilizer Market Highlights

The complimentary Argus Fertilizer Market Highlights package includes:

• Bi-weekly Fertilizer Newsletter

• Monthly Market Update Video

• Bi-monthly Fertilizer Focus Magazine

Spotlight content

Browse the latest thought leadership produced by our global team of experts.