Visão geral

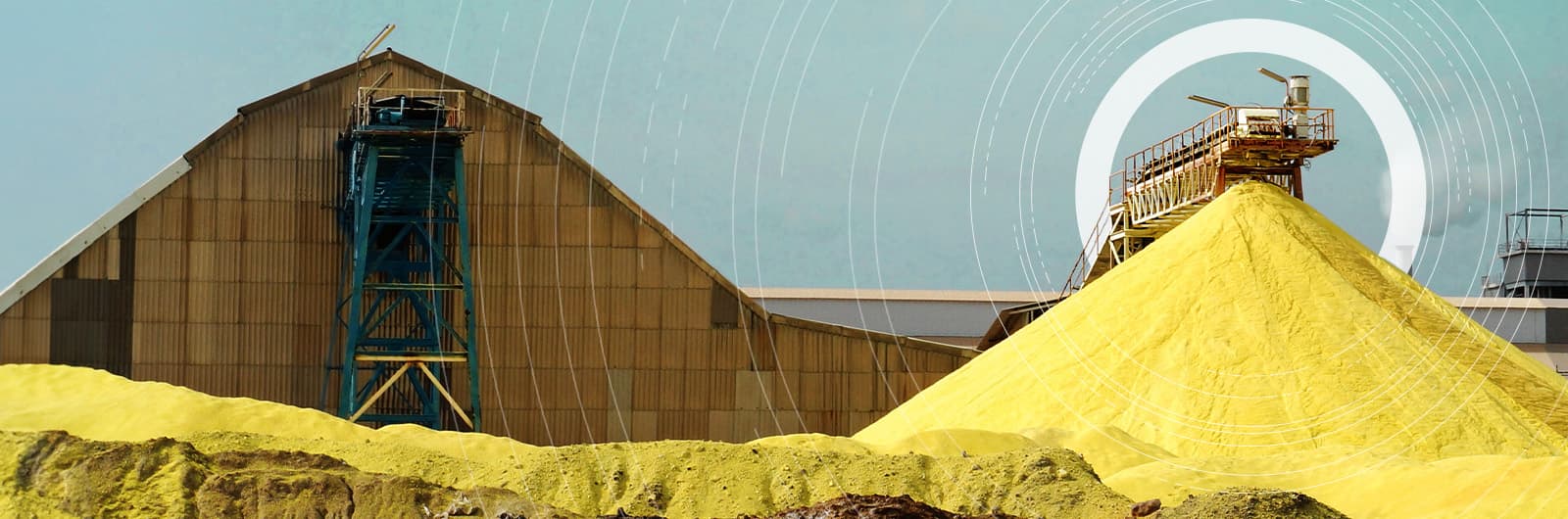

O mercado global de enxofre passou por mudanças fundamentais nos padrões de compra, rotas comerciais e preços nos últimos anos. Contratos de preço fixo e indexação baseada em fórmulas tornaram-se as maneiras dominantes pelas quais os suprimentos são comprados e vendidos em todo o mundo, o que torna avaliações precisas de preços e análises detalhadas essenciais para qualquer participante do mercado de enxofre.

A indústria global de ácido sulfúrico viu mudanças estruturais nos últimos anos e novas capacidades continuarão desafiando o equilíbrio nos próximos anos. Enquanto a demanda será impulsionada por fertilizantes — predominantemente o aumento da produção de fosfato e sulfato de amônio — o mercado continuará exposto a choques de fornecimento de curto prazo, especialmente do setor de metais.

A crescente demanda por materiais de bateria, como níquel e cobalto (devido ao crescimento da produção de veículos elétricos), por sua vez, reforçará a demanda por enxofre e ácido sulfúrico, aumentará a concorrência pela oferta e os preços de impacto.

Nossa ampla cobertura de mercado inclui enxofre formado (tanto granulado quanto granulado), enxofre em pedaços triturados, enxofre fundido/líquido e ácido sulfúrico. A Argus tem décadas de experiência abrangendo esses mercados e incorpora nossa experiência de mercado multicommodity em áreas-chave, incluindo fosfatos e metais, para fornecer a narrativa completa do mercado.

A Argus apoia os participantes do mercado com:

- Avaliações de preços (diárias e semanais para enxofre, semanais para ácido sulfúrico), dados proprietários e avaliações de comentários de mercado

- Previsão de curto e médio a longo prazo, modelagem e análise de preços de enxofre e ácido sulfúrico, oferta, demanda, comércio e projetos

- Suporte de projeto de consultoria sob medida

Últimas notícias sobre enxofre e ácido sulfúrico

Navegue pelas últimas notícias do mercado sobre a indústria global de enxofre e ácido sulfúrico.

Kuwait's KPC raises Feb sulphur price by $4/t

Kuwait's KPC raises Feb sulphur price by $4/t

London, 2 February (Argus) — Kuwait's state-owned sulphur producer KPC has set its February Kuwait Sulphur Price (KSP) at $520/t fob Kuwait, up by $4/t from the January KSP. The February KSP implies a delivered price to China of $542-547/t cfr at current freight rates, which were assessed on 29 January at $22-24/t to south China and at $26-27/t to Chinese river ports for a 30,000-35,000t shipment. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Indonesian sulphur imports outpace sulacid in 2025

Indonesian sulphur imports outpace sulacid in 2025

Singapore, 2 February (Argus) — Sulphur imports into Indonesia surged to 5.35mn t in 2025, up by 48pc from 3.62mn t a year earlier, according to the latest Global Trade Tracker (GTT) data. Indonesia is the world's third-largest sulphur importer after China and Morocco. The sharp rise in demand was driven largely by two newly commissioned sulphur burners by battery materials producer QMB New Energy Materials, which together require around 553,000 t/yr of sulphur at full capacity. Higher sulphur burning activity, combined with difficulties in securing sulphuric acid import permits, pushed buyers with the flexibility to switch between the two raw materials toward more sulphur purchases despite steadily rising prices throughout the year. Argus assessed cfr Indonesia granular sulphur at $547/t on a midpoint basis on 18 December 2025, up by $360/t or 193pc from the start of the year. A perfect storm of geopolitical uncertainty linked to sanctions and tariffs disrupting trade flows, alongside lower sulphur output from key supply regions, lent further support to prices across 2025. Sulphur deliveries increased from most major origins in 2025. Imports from Saudi Arabia and Qatar climbed to 1.76mn t and 930,500t respectively, up from 1mn t and 418,000t in 2024. Canadian shipments also rose by 36pc on the year to 514,500t, because higher prices widened arbitrage opportunities and a Middle East supply deficit boosted the competitiveness of Canadian sulphur. Sulphuric acid imports fall Indonesia's sulphuric acid imports fell by 3pc on the year to 1.09mn t in 2025. Ongoing challenges in obtaining import licences kept many buyers out of the market and encouraged some usual sulphuric acid buyers, like QMB New Energy Materials, to lean more on sulphur instead, given that sulphur imports do not require licences. Sulphuric acid imports from South Korea and Japan fell sharply by 40pc and 65pc respectively to 172,000t and 105,900t, GTT data show, because persistently low treatment and refining charges (TC/RCs) for copper concentrates squeezed margins and curbed smelter operating rates. But imports from China more than doubled to 670,300t because revenue from by-products including sulphuric acid helped cushion falling copper margins and kept Chinese smelters running at high utilisation rates . By Deon Ngee Indonesian sulphur imports 2025 ('000t) Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

QatarEnergy raises February sulphur price by $3/t

QatarEnergy raises February sulphur price by $3/t

London, 1 February (Argus) — State-owned QatarEnergy Marketing has raised its February Qatar Sulphur Price (QSP) to $520/t fob, up by $3/t from $517/t fob Ras Laffan/Mesaieed for January. The February QSP implies a delivered price to China of $542-547/t cfr at current freight rates, which were assessed on 29 January at $22-24/t to south China and at $26-27/t to Chinese river ports for a 30,000-35,000t shipment. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Tupras announces sulphur export tender for Feb loading

Tupras announces sulphur export tender for Feb loading

London, 29 January (Argus) — Turkish refiner Tupras' monthly 8,000t sell tender closes on Friday, with loading in mid-February. Tupras usually runs the tender on a monthly basis for exported sulphur volumes out of its Izmir refinery. Tupras' last export tender closed on 16 December at $455/t fob. By Fenella Rhodes Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Destaques do mercado de fertilizantes da Argus

O pacote gratuito de Destaques do Mercado de Fertilizantes da Argus inclui:

• Boletim informativo bisemanal sobre fertilizantes • Vídeo de atualização mensal do mercado • Revista bimestral de foco em fertilizantes

Conteúdo em destaque

Explore as mais recentes análises produzidas por nossa equipe global de especialistas.