From 1967 until the oil crisis of 1973 there were orders for about 80 very large crude carriers (VLCC) and 40 ultra large crude carriers (ULCC), according to engine manufacturer Wartsila. This boom was followed by the total collapse of the newbuild market for these tankers until the middle of the 1980s. Since then, over 400 VLCC have been ordered, but it took more than 20 years before the next ULCC contract was signed.

The new TI class of ULCCs were delivered in the early 2000s, but within a decade most had been converted to floating production, storage and offloading (FPSO) vessels (FSOs) for use in the Mideast Gulf and southeast Asia. Prizing quantity over flexibility, these ships were wider than the new Panama Canal locks (begun in 2007 and completed in 2016), and could not travel through the Suez Canal unless on a ballast voyage.

Their massive capacity of more than 3mn barrels of crude oil reflected climbing global oil demand – almost double what it was in 1973 – and China’s arrival as the world's largest importer of crude oil. Some forecasters now predict oil demand will peak in 2030, reducing the need for supertankers, but other forces have seen shipowners and others return to newbuilding markets for VLCCs in recent months.

Pandemics, infrastructure projects, price wars and actual wars have moved and lengthened trade flows in the last four years, making larger vessels more attractive because of their economies of scale. These have impacted the make-up of the global tanker fleet in other ways as well, such as prompting a small recovery in interest in small Panamax tankers, which have long been sliding out of existence.

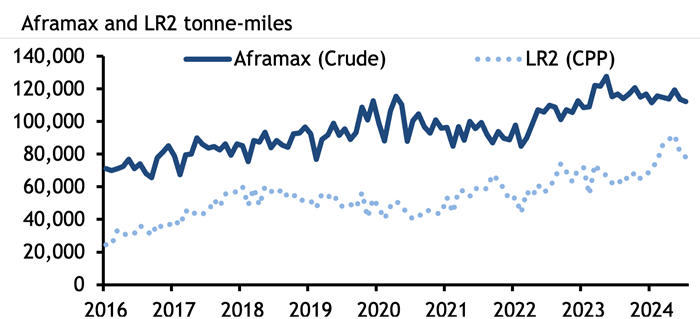

The role of vessel size in tanker freight markets is sometimes underappreciated. In the wake of the G7+ ban on imports of Russian crude and oil and products, and attacks on merchant shipping in the Red Sea and Gulf of Aden by Yemen’s Houthi militants, flows of crude oil have had to make massive diversions. Russian crude oil is flowing now to India and China rather than to Europe, while Europe’s imports of oil, diesel and jet fuel from the Mideast Gulf are taking two weeks longer, going around the Cape of Good Hope to avoid Houthi attacks. This has pushed up tonne-miles – a measure of shipping demand – to record levels. Global clean Long Range 2 (LR2) tanker tonne-miles rose to a record high in May this year, data from analytics firm Kpler show, while tonne-miles for dirty Aframax tankers rose to a record high in May last year. It has also supported freight rates.

High freight rates have brought smaller vessels into competition with larger tankers, at the same time as long routes have increased the appeal of larger ships. The Atlantic basin appears to be key site for increases in production (from the US, Brazil, Guyana and even Namibia), and an eastward shift in refining capacity globally will further entrench these long routes and demand for economies of scale.

Aframax and LR2 tankers are the same sized ships carrying around 80,000-120,000t of crude oil or products. LR2 tankers have coated tanks, which allows them to carry both dirty and clean cargoes, and shipowners may switch their

LR2/Aframax vessels between the clean and dirty markets, with expensive cleaning, depending on which offers them the best returns. But an unusually high number of VLCCs – at least six – have also switched from dirty to clean recently. Shipowner Okeanis, which now has three of its VLCCs transporting clean products, said it had cleaned up another one in the third quarter.

A VLCC switching from crude to products is very rare. Switching to clean products from crude is estimated to cost around $1mn for a VLCC. It takes several days to clean the vessel's tanks, during which time the tanker is not generating revenue. But a seasonal slide in VLCC rates in the northern hemisphere this summer has made cleaning an attractive option for shipowners, while their economies of scale make the larger tankers more attractive to clean charterers as product voyages lengthen.

Argus assessed the cost of shipping a 280,000t VLCC of crude from the Mideast Gulf to northwest Europe or the Mediterranean averaged $10.52/t in June, much lower than the average cost of $67.94/t for shipping a 90,000t LR2 clean oil cargo on the same route in the same period. It is likely these vessels will stay in the products market, as cleaning a ship is a costly undertaking for a single voyage.

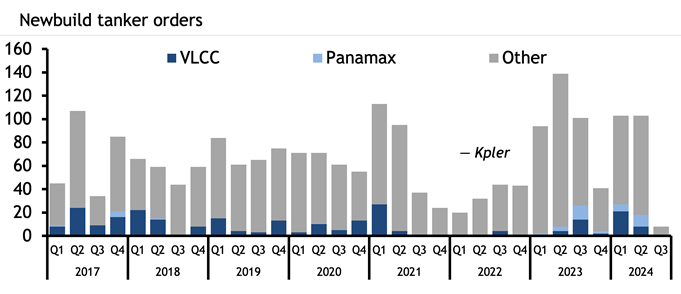

Typically, a VLCC will only carry a clean cargo when it is new and on its inaugural voyage, but just one new VLCC has joined the fleet this year, further incentivising traders to clean up vessels as demand for larger ones increases. This year has seen a jump in demand for new VLCCs, with 29 ordered so far. There were 20 ordered in 2023, just six in 2023 and 32 in the whole of 2021, Kpler data show. But the vast majority of these new VLCCs will not hit the water until 2026, 2027 or later because of a shortage of shipyard capacity.

Last year and 2024 also saw the first substantial newbuilding orders for Panamax tankers, also called LR1s, since 2017. Product tanker owner Hafnia and trader Mercuria recently partnered to launch a Panamax pool. The rationale may be that Panamax vessels can pass through the older locks at the Panama Canal, and so are not subject to the same draft restrictions imposed because of drought that has throttled transits and led to shipowners paying exorbitant auction fees to transit.

Aframaxes and MRs will remain the workhorses of crude and product tanker markets respectively, but the stretching and discombobulation of trade routes (which appear likely to stay) has already driven changes in which vessels are used and which are ordered. When these ships hit the water, they will join a tanker market very different to the one owners and charterers were operating in just four years ago.

Spotlight content

Related news

Iran strikes trigger regional airspace closure

Iran strikes trigger regional airspace closure

Dubai, 28 February (Argus) — Several Mideast Gulf countries have closed their airspace and major international airlines have suspended operations after Iran launched retaliatory missile strikes in response to US–Israeli attacks earlier on Saturday , triggering widespread disruption to one of the world's busiest aviation corridors. Dubai Airports confirmed cancellations and delays at Dubai International (DXB) and Al Maktoum International (DWC) because of a "partial and temporary" closure of UAE airspace as a precautionary measure. Emirates, the world's largest international airline by passenger traffic, has suspended all flights to and from Dubai, citing multiple regional airspace closures. Qatar has also temporarily closed its airspace, halting operations of Qatar Airways, while Kuwait Airways has postponed all arrivals and departures at Kuwait International Airport, citing passenger and aircraft safety. Israel and Iran have both shut their airspace following the exchange of strikes, while Iraq, Oman and Bahrain have also imposed airspace restrictions. Jordan's Royal Jordanian said it continues operating normally as long as national airspace remains open and safe, but warned that some flights to affected destinations could face schedule changes. European aviation regulator EASA issued a Conflict Zone Information Bulletin advising airlines not to operate in the affected airspace "at all flight levels and altitudes", warning of a "high risk to civil aviation" given the ongoing military action. Among international carriers suspending or cancelling services to the Mideast Gulf and Israel are Turkish Airlines, Lufthansa and British Airways. British Airways said it has cancelled flights to Tel Aviv and Bahrain until 3 March and has scrapped its service to Amman in Jordan. The Middle East forms a critical east–west air transit hub linking Europe, Asia and Africa, with Dubai, Doha and Abu Dhabi among the world's largest long-haul transfer points. The closure of multiple airspace zones forces airlines to cancel services or reroute around restricted areas, increasing flight times and fuel burn and disrupting passenger flows. By Bachar Halabi and Rithika Krishna Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

US, Israel launch major attack on Iran: Update

US, Israel launch major attack on Iran: Update

adds details throughout Dubai, 28 February (Argus) — The US military today began "major combat operations" in Iran following co-ordinated Israeli strikes, marking the most significant escalation in years in the oil-rich Mideast Gulf and sharply raising the risk of oil and gas supply disruptions. Iran has responded by firing missiles towards Israel and US military bases across the region. "A short time ago, the United States military began major combat operations in Iran. Our objective is to defend the American people by eliminating imminent threats from the Iranian regime," President Donald Trump said. The US Department of Defense has codenamed the attack "Operation Epic Fury". Trump said the US would destroy Iran's missile inventory and industry and "annihilate their navy", reiterating that Tehran "will never have a nuclear weapon". He told members of Iran's Islamic Revolutionary Guard Corps (IRGC) and security forces to "lay down your weapons and have complete immunity or face certain death". Israeli prime minister Benjamin Netanyahu said the joint US-Israeli attack on Iran "will create the conditions for the brave Iranian people to take their destiny into their own hands". "The time has come for all sections of the people in Iran … to remove the yoke of tyranny … and bring a free and peace-loving Iran," Netanyahu said in a televised statement. Videos circulated on social media indicated explosions in Tehran shortly before Trump's remarks. Israel earlier confirmed it had launched what it described as a "pre-emptive attack" against Iran, and defence minister Israel Katz declared a national state of emergency and warned of expected retaliatory missile and drone strikes. Israel closed its airspace to civilian traffic, suspended non-essential activities and instructed citizens to remain near shelters. Iran also closed its airspace, and several commercial airlines have diverted or cancelled flights to the region. Bahrain said the service centre of the US Fifth Fleet had been subjected to a missile attack. Video footage showed a thick grey plume of smoke rising in Manama. The UAE, Kuwait and Qatar said their air-defence systems intercepted Iranian missiles that violated their airspace. Saudi Arabia strongly condemned what it called "blatant Iranian aggression" and a dangerous violation of the sovereignty of other Mideast Gulf countries. All Mideast Gulf oil producers host US forces, including Saudi Arabia, Qatar, the UAE, Bahrain, Oman and Kuwait. Meanwhile, EU high representative for foreign affairs Kaja Kallas said the bloc's "Aspides" naval mission "remains on high alert in the Red Sea and stands ready to help keep the maritime corridor open." The strikes today signal the collapse of renewed US-Iran nuclear negotiations held in Switzerland this week. Trump said the military operation began after Iran refused to renounce nuclear weapons ambitions. Tehran has repeatedly denied seeking atomic weapons and warned it would retaliate against US bases in the Mideast Gulf region if attacked. It launched missiles towards the US Al Udeid air base in Qatar during a 12-day conflict in June 2025, after US and Israeli strikes on Iranian nuclear facilities. Oil markets were already pricing in some geopolitical risk ahead of the escalation, with front-month Ice Brent crude trading near $73/bl on Friday, its highest since July. An outright war between the US-Israel and Iran risks disruption to shipping lanes and flows through the strait of Hormuz, through which around 20pc of global oil supply and a significant share of LNG exports transit. Opec+ ministers of the core group of eight are scheduled to meet on Sunday to review production policy for the month of April. Delegates had been weighing a modest supply increase from April, but the escalation introduces new uncertainty over supply balances and the group's strategy. The US has significantly expanded its military presence in the Middle East in recent weeks, including air and naval assets, ahead of the breakdown in talks. Trump in his statement today acknowledged the risk of US casualties but said the operation was necessary to prevent Iran from acquiring nuclear weapons. By Bachar Halabi Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

US, Israel launch major attack on Iran

US, Israel launch major attack on Iran

Dubai, 28 February (Argus) — The US military today has begun "major combat operations" in Iran following co-ordinated Israeli strikes, marking the most significant escalation in years in the oil-rich Mideast Gulf region and sharply raising the risk of oil and gas supply disruptions. "A short time ago, the United States military began major combat operations in Iran. Our objective is to defend the American people by eliminating imminent threats from the Iranian regime," President Donald Trump said. Trump said the US would destroy Iran's missile inventory and industry and "annihilate their navy", reiterating that Tehran "will never have a nuclear weapon". He told members of Iran's Islamic Revolutionary Guard Corps (IRGC) and security forces to "lay down your weapons and have complete immunity or face certain death". Videos circulated on social media indicating explosions in Tehran shortly before Trump's remarks. Israel earlier confirmed it had launched what it described as a "pre-emptive attack" against Iran, with defence minister Israel Katz declaring a national state of emergency and warning of expected retaliatory missile and drone strikes. Israel closed its airspace to civilian traffic, suspended non-essential activities and instructed citizens to remain near shelters. Iran also closed its airspace. The strikes today signal the collapse of renewed US-Iran nuclear negotiations held in Switzerland this week. Trump said the military operation began after Iran refused to renounce nuclear weapons ambitions. Tehran has repeatedly denied seeking atomic weapons and warned it would retaliate against US bases in the Mideast Gulf region if attacked. It launched missiles toward the US Al Udeid air base in Qatar during a 12-day conflict in June 2025, after US and Israeli strikes on Iranian nuclear facilities. All Mideast Gulf oil producers host US forces, including Saudi Arabia, Qatar, the UAE, Bahrain and Kuwait. Oil markets were already pricing in some geopolitical risk ahead of the escalation, with front-month Ice Brent crude trading near $73/bl on Friday, its highest since July. An outright war between the US-Israel and Iran risks disruption to shipping lanes and flows through the strait of Hormuz, through which around 20pc of global oil supply and a significant share of LNG exports transit. Opec+ ministers of the core group of eight are scheduled to meet on Sunday to review production policy for the month of April. Delegates had been weighing a modest supply increase from April, but the escalation introduces new uncertainty over supply balances and the group's strategy. The US has significantly expanded its military presence in the Middle East in recent weeks, including air and naval assets, ahead of the breakdown in talks. Trump in his statement today acknowledged the risk of US casualties but said the operation was necessary to prevent Iran from acquiring nuclear weapons. By Bachar Halabi Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

HF Sinclair CEO and CFO to leave company

HF Sinclair CEO and CFO to leave company

Houston, 27 February (Argus) — US independent refiner HF Sinclair will part with its chief executive Timothy Go and chief financial officer Atanas Atanasov after concerns raised regarding disclosure processes. The company expects to negotiate a mutually agreeable separation arrangement with Go and Atanasov, HF Sinclair said Friday in a filing with the US Securities and Exchange Commission (SEC). HF Sinclair's board of directors on 24 February received and accepted a request from Atanasov to take a voluntary leave of absence from his duties, the company said in the filing. The board appointed the company's chief accounting officer and controller Vivek Garg as acting chief financial officer. HF Sinclair previously disclosed that Go on 17 February also requested and received a leave of absence from the board. Current board chair Franklin Myers was elected as chief executive on a temporary basis. According to Friday's SEC filing, on 26 January the company's audit committee began to assess "certain matters relating to the company's disclosure processes" after Atanasov raised concerns that certain actions taken by Go created an unfavorable "tone at the top" in relation to the 2025 disclosure processes. The audit committee concluded that Go's actions did not create an unfavorable "tone at the top" and that the company's disclosure controls and procedures are effective, the SEC filing said. But the board said it developed separate concerns about the approach taken by Go in some communications to management during the 2025 disclosure processes, as well as concerns relating to actions taken by Atanasov "bearing upon the review process" and "the viability of his future working relationships with other members of the company's management team." Delek did not disclose how long Myers and Garg were expected to serve in the temporary roles. By Eunice Bridges Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.