The Turkish scrap market is expected to soften further in the coming days on weak demand caused by major restocking since the beginning of January. But strong domestic markets in exporting regions combined with potential Turkish rebar sales to southeast Asia could provide the basis for scrap prices to rebound after a short fall.

Turkish steel mills have completely retreated from the ferrous scrap deep-sea import market since 13 February. Demand has dropped off following significant scrap restocking activity since 8 January, during which time Argus has tracked bookings totalling 2.3mn t of deep-sea tonnage, which does not include confidential deals, short-sea imports or January-February bookings concluded at the end of 2018.

This high deal volume combined with an increase in scrap purchasing lead times from on average four to six weeks means that Turkish mills have mostly fulfilled their March shipment requirements.

Deep-sea scrap exporters are preparing for a small downward correction in the Turkish scrap import price and were able to implement a slight fall in dockside prices this week, with Argus HMS 1/2 delivered to ARAG and UK dock assessments falling by €10/t and £5-7.50/t, respectively, on 19 February.

Seaborne downside could be limited if scrap stays domestic

The strength and stability of both German and US scrap markets at periods over the past year have often made it more attractive for sub-suppliers in those countries to divert tonnage away from Turkey towards domestic sales, contributing to repeated unexpected tightening of availability in the Turkish deep-sea market that has subsequently helped fuel a seaborne price rebound.

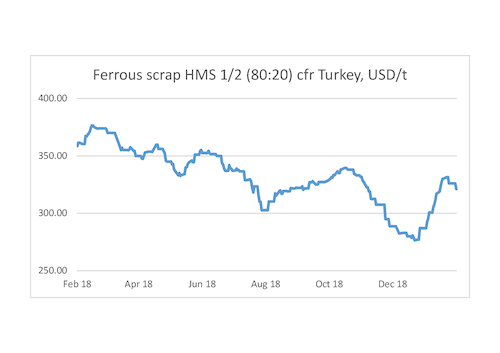

In the past six months alone there have been two occasions when rebar demand has weakened and caused a small downward scrap price correction that has swiftly been followed by a significant upward price movement.

Between 17 and 22 August 2018, there was expectation that the scrap price would fall below $300/t cfr Turkey. But the strength of resistance among sub-suppliers against offloading material to scrap exporters in this environment caused availability of material to become sufficiently limited that the price rebounded and increased by almost $40/t over three months, driving Turkish mills' scrap-rebar margins below $170/t.

This dynamic emerged again at the turn of the year following a steady fall in the Turkish scrap price throughout December. This price weakness was anticipated to continue throughout January based on Turkish mills' advertised winter cuts to steel production. But renewed resistance from sub-suppliers to sell volumes in the first half of January, combined with a swift exit by exporters from short positions, caused the Turkish imported scrap price to begin rising from 16 January onwards.

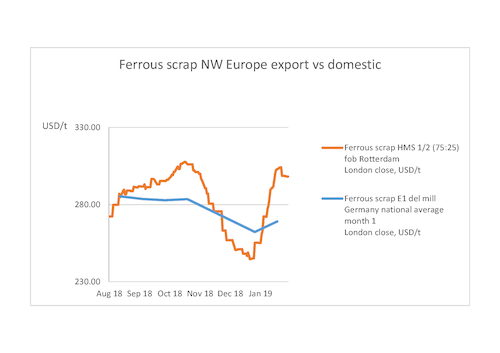

The strength of the German domestic market throughout December-early January is an example of how a strong domestic market in a major exporting region can absorb sub-suppliers' material when the import market weakens.

The Argus fob Rotterdam HMS 1/2 75:25 assessment stood at $280.60/t fob on 30 November 2018 while the Argus E1 German domestic monthly national average assessment was the equivalent of $290.60/t delivered to mill.

When German domestic prices were settled for January deliveries on 15 January, the fob Rotterdam assessment stood at $245.10/t fob Rotterdam and the German domestic national average remained higher at €228.56/t ($262.20/t) delivered to mill. But the next day the fob Rotterdam price shot up by $10.10/t and has stayed above the German domestic price after another $43/t increase in the fob Rotterdam price and only a €10/t increase in the German price in February.

A similar dynamic was observed in the US, where domestic scrap markets have been strong over the past six months as mills have boosted capacity utilisation to fill the gap left by imports that have fallen in response to President Donald Trump's steel tariff.

The Argus monthly assessment for #1 HMS delivered to Detroit stayed flat in December from November and then dropped by $30/t for January delivery. The total decrease from 5 November to 9 January totalled $30/t, lagging a $58.70/t fall in the cfr Turkey HMS 1/2 80:20 price over the same period. #1 HMS delivered to Detroit stood at $295/t on 9 January, $14.80/t higher than the cfr Turkey HMS 1/2 80:20 price and $36.70/t higher than the fob New York HMS 1/2 80:20 assessment on the same day.

Other US domestic markets retained this relative strength against Turkey despite similar decreases of $30-40/t in obsolete grade prices for January shipment. As with continental Europe, sub-suppliers preferred to sell into the domestic market wherever possible, limiting availability to east coast export yards.

The tightness of availability to Turkey raised the Turkish import price, which also lifted prices in other seaborne export markets including south Asia. Exporters were subsequently encouraged to shift material back into the seaborne market until they reached the point in mid-February where the strong availability of imported material significantly outweighed Turkish demand, which is now driving the market downwards.

Despite a mounting economic headwind in the US and the eurozone, there is not yet any indication that the domestic markets in these exporting regions will weaken dramatically enough to prevent a repeat of the August and December-January scenarios that will eventually cut availability of scrap to the seaborne market if the Turkish price falls too far too fast.

Additionally, it has become clear that since the second quarter of 2018, ferrous scrap sub-suppliers have sought to cut inventory levels.

"We are without doubt going through a protectionist era where most of the supply chain is keeping stocks at low levels, and we will see how this approach works in the run-up to spring," one Netherlands-based sub-supplier said.

The fall in sub-suppliers' inventories has caused competition between scrap exporters for available material to intensify, providing additional support for seaborne pricing. And if sub-suppliers continue to run at low inventories, the traditional spring upturn in scrap availability may be diminished, limiting the potential downside for seaborne scrap prices.

Southeast Asia rebar market could fuel rebound

Turkish mills are largely expected to remain absent from deep-sea scrap negotiations for another week. But one or two are likely to make large tonnage rebar deals with southeast Asian importers during this period. One Turkish mill is said to have sold a rebar cargo to southeast Asia today. And two Turkish mills said today that they can sell into southeast Asia today but choose not to. They expect improved Chinese domestic prices in the spring season.

Export prices from China and other competitors in southeast Asia have increased to levels that give Turkish steelmakers room to compete in the region. Chinese offers at $510/t fob China on theoretical weight basis and Qatari offers at $520/t cfr Singapore on theoretical weight basis are higher than the $500/t cfr Singapore theoretical weight basis level that Turkish mills are expected to offer over the next week.

Any Turkish rebar sales made to southeast Asia in the next week may not be sufficient to provide immediate support to ferrous scrap prices because they are likely to be covered by March shipment scrap bookings that mills have already made.

But if Turkish mills are sufficiently encouraged to believe they can remain competitive in southeast Asia for a sustained period they will be likely to return to the scrap market in force more swiftly than expected, which would limit the size and duration of the anticipated near-term scrap price decrease.

The onset of the spring construction season in China over the next three months could provide the support to cfr Asean rebar pricing necessary for Turkey to compete in this market. A combination of strong Turkish export rebar business alongside continued resistance from sub-suppliers in scrap exporting regions to sell into a falling seaborne market could potentially limit the extent of the price fall that is expected to occur and fuel another rebound of the kind that has occurred twice in the past six months.