The platinum group metals (PGM) price rally has slowed in the second quarter after hitting record highs earlier this year as semiconductor shortages curtailed automotive production and reduced demand for PGM loadings.

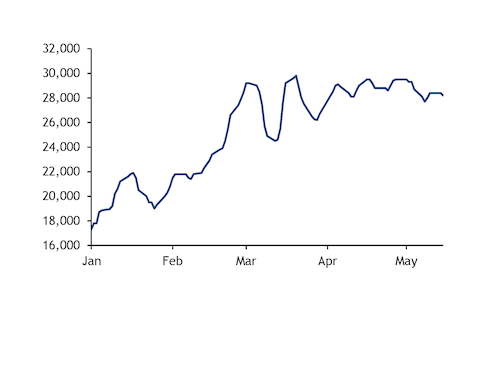

Rhodium prices, which peaked on 23 March at $29,800/toz, dropped to $26,2000/toz on 29 March. Palladium, too, has risen sharply to hit a record high of $3,016/toz on 5 May, rising by over 25pc since the start of the year, but fell to $2,880/toz mid-May, data from Johnson Matthey show.

Despite the early price recovery, the PGM market is facing the knock-on effect of the semiconductor shortage that has hit auto production. Recently, various original equipment manufacturers (OEMs) from BMW to Stellantis have warned that production could fall in the second and third quarters, which in turn could reduce PGM loadings in auto-catalysts.

"On the demand side, the downward pressure on auto production given the global chip shortage also raises corresponding downside risks to PGM demand and prices," Swiss Investment bank UBS said in a report today.

It expects palladium demand to total 11.6mn oz in 2021, out of which 9.8mn oz is auto demand accounting for 84pc of the total. In a similar but less stark fashion, total expected demand for platinum amounted to 8.1mn oz in 2021, with auto demand making up 3.2mn oz or roughly 40pc of overall platinum demand.

Looking ahead, UK chemical producer Johnson Matthey added that the uptake of electric vehicles could further dent loadings of PGMs as the world shifts away from fossil fuel-run vehicles. Johnson Matthey also noted that automakers are "thrifting" to maximise PGM usage.

"Future growth in overall PGM demand will rely primarily on regional legislative programmes (and their impact on loadings) rather than on increases in ICE vehicle output," it said. "In Europe, there are signs that gasoline loadings may begin to trend downwards next year."

Although prices have slowed from earlier this year, PGM prices remain well above 2020 levels, while demand for autos is near 2019 levels. Platinum prices have averaged $1,187/toz so far in 2021, around 33pc up from the 2020 average of $893/toz.

"For 2021, global light-duty production is expected to be 86.5m units, 16pc higher than 2020, while heavy-duty output is forecast to improve by 3pc," the World Platinum Investment Council said in a report this week. "This will result in an increase in platinum demand of 24pc (+557,000 oz) to 2.9mn oz and exceeding the pre-pandemic 2019 level." Auto demand for rhodium and palladium is likely to be similar.

19052021032707.jpg)