European coal burn rose in September despite strong output from renewables, as natural gas supply tightness supported short-term prices and lifted coal plants in the merit order for thermal generation.

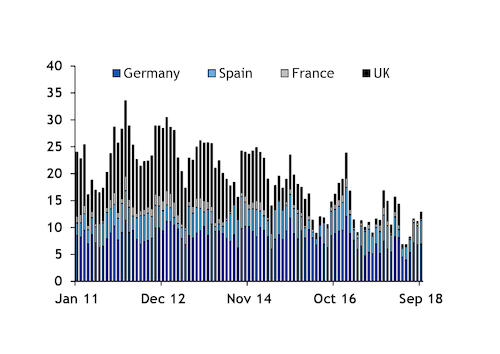

Aggregate coal-fired generation in Germany, Spain, the UK and France rose by 11pc on the year to a total of 12.9TWh in September, according to provisional data from grid operators and research group Fraunhofer Ise.

Coal burn rose despite record September output from renewable sources — which gained by nearly 17pc on the year to 34.2TWh — as surging gas prices lifted the relative profitability of coal-fired output in the thermal generation mix.

Total gas burn in the same four countries fell by 28pc on the year to a total of 12.6TWh last month, driven in large part by a sharp contraction in gas-fired generation in the UK. This meant that coal-fired generation across the four countries surpassed gas burn for the first time since December 2015.

UK coal burn recovers

UK coal burn rose by more than a fifth on the year to 1.3TWh in September and now looks likely to make further gains in the final quarter of the year.

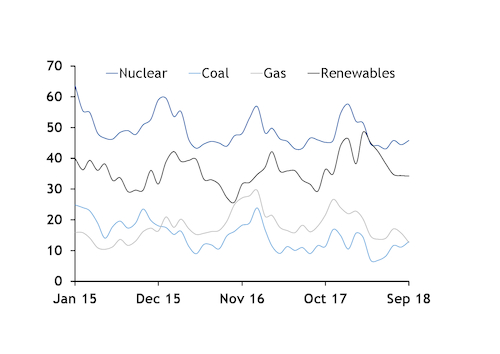

Gas has dominated the thermal generation mix in the UK in recent years, but a supply crunch driven by weak LNG imports, heavily curtailed storage infrastructure and declining domestic production across northwest Europe has boosted prices and cut into the profitability of gas-fired power generation.

The premium held by day-ahead clean spark spreads for 55pc efficient gas plants over clean dark spreads for 38pc coal units was slashed to an average of €3.20/MWh in September, from €9.09/MWh in August and €11.26/MWh in September 2017. This drove a swing towards coal-fired output in the thermal generation mix in September, with gas burn falling by 24pc on the year to a 40-month low of 6.74TWh.

Gas-to-coal fuel switching was significant enough to lift coal burn on the year despite record September output from renewables of around 5.5TWh. Available wind capacity in the UK has risen above 20GW following the commissioning of the 659MW Walney Extension offshore wind farm in early September, up from a total of around 19.1GW at the end of 2017.

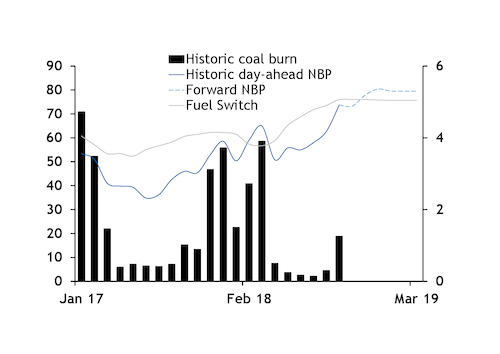

Outright clean dark spreads for winter generation were more than twice as high on the year in September and forward NBP gas prices suggest that coal will also become increasingly competitive with gas for thermal generation as winter progresses.

Day-ahead NBP gas prices were narrowly short of the threshold above which a 39pc efficient coal plant starts to compete with a 55pc efficient gas unit throughout September, but average prices for November, December and the first quarter of 2019 were all higher than the fuel switch level.

This suggests that coal could begin to displace a larger proportion of natural gas from the UK mix from next month, although gas-to-coal fuel switching will be limited by the UK's diminished capacity for coal-fired generation. The UK has around 10.4GW of coal-fired capacity going into this winter, down from 13GW a year earlier, which is enough to burn up to 3 mn t/month of NAR 5,700kcal/kg coal.

UK winter coal imports averaged around 2.6 mn t/month in 2014-15 but have since fallen to around 500,000 t/month in the past two winters, according to Eurostat data.

German coal burn resists rising wind output

German coal burn was only flat on the year in September at 6.9TWh, but increasingly favourable margins for coal generators ensured that gas plants bore the brunt of a surge in renewable output across the month.

Renewable output rose by a fifth on the year to 17.3TWh according to provisional Fraunhofer Ise data, with greater wind output accounting for 60pc of the overall growth. This more than offset a 12pc decline in nuclear output, but the impact on thermal generation was focused on gas burn, which fell by 48pc on the year to its lowest since September 2015 at less than 1.8TWh.

Day-ahead clean dark spreads for 38pc efficient coal plants averaged a €6.86/MWh premium to clean sparks for 55pc gas plants in September, compared with only a €1.40/MWh premium in August and a €1.19/MWh discount in September 2017.

German clean dark spreads for fourth-quarter generation from a 38pc efficient coal plant fell sharply at the end of September, but still expired at a significant premium to the previous two years amid concerns about nuclear availability in France, Belgium and Germany. The fourth-quarter margin averaged €8.69/MWh in September, up from €4.43/MWh and €4.60/MWh in September 2016 and 2017, respectively.

Fourth-quarter coal burn totalled 18.6TWh last year and peaked at 7.5TWh in November.

Spanish coal burn rises

Spanish coal burn recorded even bigger growth than in the UK in September, rising by 42pc on the year to 4.4TWh.

As in the UK and Germany, coal displaced some gas from the mix with gas-fired output falling by 27pc to 2.5TWh last month. Spanish renewable output was up less than 2pc on the year in September at around 6TWh, while nuclear generation increased by 6pc to 5TWh.

Fourth-quarter clean dark spreads for 38pc efficient Spanish coal units averaged nearly €22/MWh in September, up from €18.61/MWh last year, suggesting further growth in coal demand in the final months of the year. Spanish coal burn totalled 13TWh in the fourth quarter of 2017 and peaked at 5TWh in December.