China will raise tariffs on imports of US LNG and other energy commodities — except crude — to 25pc from 10pc on 1 June, in retaliation for US president Donald Trump's escalation of the trade war between the two countries.

The US has increased tariff rates on $200bn/yr of imports from China to 25pc effective 10 May, but set an exception for products shipped before that date and arriving before 1 June. The Chinese countermeasures match 1 June as the effective date.

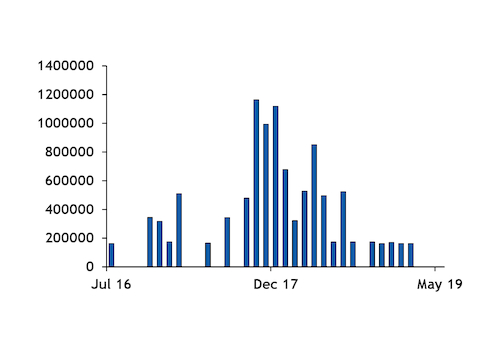

China's 10pc tariff on US LNG, implemented in September, already led to a sharp drop in US LNG flows to China in recent months. The tariff increase to 25pc is unlikely to have a substantial and immediate effect on LNG flows, given already low US LNG exports to China and in a well-supplied global LNG market where Chinese importers can source LNG from other producers.

The escalation of the trade tensions between the US and China may hamper new US LNG projects reaching a final investment decision, several market participants said. But US producer Cheniere said last week that it planned to fund the expansion of its Corpus Christi LNG plant "with or without China".

Trump's decision to raise tariffs will lead to "escalation of Sino-US economic and trade frictions, contrary to the consensus between China and the US on resolving trade differences through consultations, jeopardising the interests of both sides and not meeting the general expectations of the international community", China's commerce ministry said today.

The Chinese government has invited US trade representative Robert Lighthizer and treasury secretary Steven Mnuchin to visit Beijing to continue negotiations, White House chief economic adviser Larry Kudlow said in a televised interview yesterday. But the two governments have not set a date for the next round of talks, Kudlow said.

Existing US tariffs affect $250bn of the $539bn/yr the US imports from China, including many chemical and industrial products. But the latest round of US tariffs and Chinese countermeasures is not going to be the last. The US today will commence the administrative process for imposing tariffs on the entirety of imports of goods from China, the US Trade Representative (USTR) said on 10 May. The process could be completed in two to three months, Kudlow said.

The tariff hike process involves public consultations, inviting comments from the potentially affected companies. The overwhelming majority of comments from US companies in the previous three rounds of tariffs last year pushed back against the proposal, which did not prevent USTR from moving ahead with tariffs.