European hot-rolled coil (HRC) prices have shed most of their premium to fob China prices this year. The level of Chinese stimulus and any new US tariffs — alongside European demand conditions — will help determine whether the premium rebounds or flips to a discount.

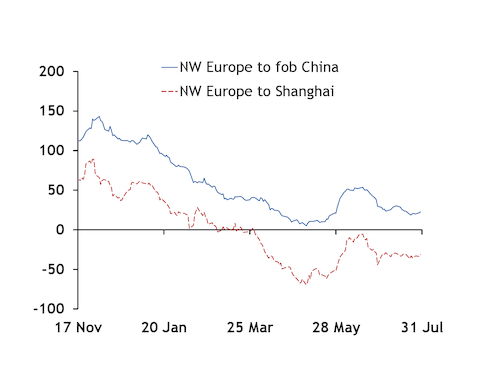

The Argus northwest Europe HRC index has fallen by 9.5pc to €470.50/t ($524.41/t) ex-works since 1 January, while the Argus fob China HRC index has risen by 3.9pc to $501/t over the same period, narrowing the differential to below $20/t briefly in late July. European HRC held a premium of more than $100/t to China at the start of the year.

The Chinese steel market was expecting second-half prices to get support from stimulus-driven construction demand and tighter supply during China's 70th anniversary celebrations in October. China ramped up infrastructure spending and monetary easing at the start of the year, keeping construction demand high enough to absorb record steel output. The demand has kept domestic prices above seaborne levels, including Shanghai HRC ex-warehouse prices that have maintained a premium to European HRC prices since late March.

But price outlooks have been shaken by softer macroeconomic data and the communist party's politburo vowing "not to use real estate as a means of stimulating the economy in the short term" in a 30 July statement. The politburo warned that "downward pressure on the domestic economy is increasing". China's GDP growth slowed in the second quarter, and in July its steel sector contracted further.

The politburo statement left room for more fiscal easing and specified infrastructure investment in older urban areas, parking lots and city clusters. It also dropped wording on "structural deleveraging", meaning credit could be more freely available.

But any new US tariffs would add downward pressure on prices. US president Donald Trump has threatened a further $300bn/yr in tariffs on the remaining Chinese exports not yet subject to blanket duties, but delayed them in June. He resumed criticism of China and threatened to proceed with tariffs but trade talks have resumed, with the next round scheduled for September.

China's steel industry could also be its own undoing. Supply-side reform efforts have to a large extent saved the industry from oversupply in the past three years, but few obsolete operations remain and more mills are equipped with emissions controls and can avoid pollution restrictions. China's steel inventories swell in the winter and are drawn down into summer. They remain well above year-ago levels, with nationwide major steel categories higher by 29pc, third-party data show. Rebar stocks are higher by 40pc and HRC is up by 18pc.

The European market is widely expected to rebound in the fourth quarter on the back of supply cuts, a normalisation of apparent demand after significant destocking, and as mills look to rebuild their margins. But some steelmakers are already dropping their offers after buyers shunned higher levels. That said, summer demand is clouding the picture at present, and a concerted effort by mills to raise prices from September could reverse sentiment. In Italy, concern about supply is growing given ArcelorMittal's recent issues. Sources suggest a pier at ArcelorMittal's Taranto plant is still seized after the recent death of a worker, and the company cannot discharge raw materials in larger vessels as a result.

One potential hurdle on the horizon is the likelihood of US Section 232 tariffs on automotive imports. This would be a huge issue for European mills, which ship over 60pc of their hot-dip galvanised to the automotive industry.