Russian state-controlled Gazprom's sales to Europe, excluding the Baltic states, and Turkey dropped in February from a year earlier, along with its realised sales price.

Sales fell under 12.8bn m³ — excluding the resale of central Asian gas — from 15.2bn m³ a year earlier and 13.1bn m³ in January. This was the lowest for any month since it sold 9.9bn m³ in February 2015.

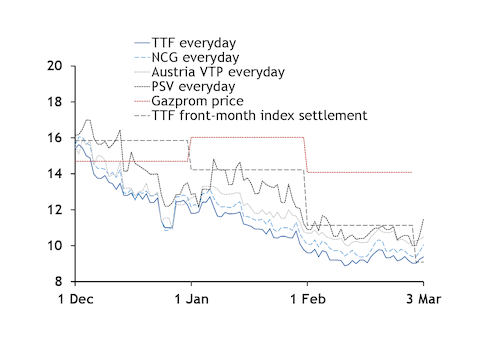

Gazprom's sales fell on the year as most European prompt prices mostly held well below the TTF front-month index's settlement for February of €11.13/MWh over most of the month, which may have discouraged imports by firms with contracts linked to the index (see prompt prices graph).

Unseasonably mild weather and quick LNG deliveries have pressured European hub prices from the front of the curve in recent months, paring demand for pipeline gas imports.

But sales were buoyed by strong sales through the Russian firm's online platform. Sales on the platform climbed sharply from a year ago and accounted for a larger share of Gazprom's aggregate February sales compared with a year earlier.

Gazprom uses the platform to optimise its sales activities and to make deliveries along routes where it can consider capacity costs sunk, it said. And slow deliveries under long-term contracts might have left the firm with ample spare, already-booked capacity, allowing strong sales through the platform without incurring additional capacity booking costs.

But the firm only transited 135mn m³/d through Ukraine in February, well below booked capacity of 178mn m³/d. Gazprom is paying Ukrainian state-owned Naftogaz a marginal fee of $31.72/'000m³ (€2.83/MWh) for booking entry and exit capacity at Ukraine's borders in 2020-24.

And the start of the new year might have provided importers with supply contracts running on the calendar year with flexibility to defer contractual receipts under take-or-pay clauses. This could require take to rise later in the year under these contracts, even if prompt prices incentivise minimising take. And stronger contractual take later in the year could crowd out deliveries from other sources of supply, especially if stocks remain high, providing little additional demand for injections.

Stock surplus grows

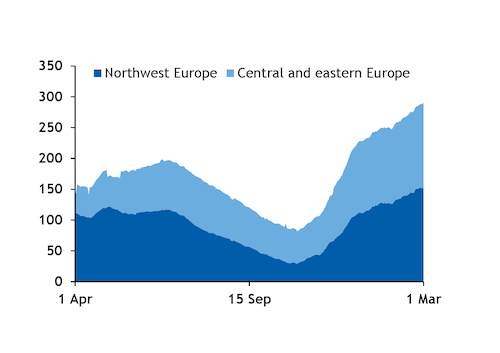

The mild weather and quick LNG deliveries have helped curb withdrawals in recent months despite slow Russian sales, allowing most European markets to continue building a large stock surplus ahead of the summer.

Stocks across most of the continent widened their stock surplus to the three-year average last month (see stock surplus graph). Combined stocks in Germany, France and the Netherlands — excluding the Norg facility, which is used to shape production from the Groningen low-calorie gas field — were almost 294TWh on 1 March, more than double the three-year average for the date of 141TWh and a record high for the day (see northwest European stocks graph). The 153TWh stock surplus on 1 March was out from 128TWh on 1 February and 44.6TWh on 1 October.

Stocks in central and eastern Europe also retained a large surplus to previous years. Combined Austrian, Czech, Slovak, Hungarian, Polish and Romanian stocks were 254TWh yesterday, up from the three-year average of 116TWh and a record high (see central and eastern European stocks graph). The 137TWh stock surplus was out from 123TWh on 1 February and 55.8TWh at the start of the winter.

Even if withdrawals accelerate this month, these markets will enter the summer with a substantial storage overhang, paring import demand substantially this summer.

Pipeline flows for flex

Gazprom may have met demand for Russian gas predominantly with pipeline deliveries, rather than withdrawals from storage, preserving stocks for use the following winter.

Aggregate pipeline deliveries to European markets — excluding flows to Turkey — were 11.9bn m³ in February, not far off aggregate sales to most of the same markets (see pipeline deliveries graph). Deliveries have held above sales at times in recent summers, when Gazprom injects gas into its European storage capacity for withdrawal over the winter.

But the firm may not need to inject much this summer, even if it seeks to take high stocks into winter 2020-21.

Gazprom plans to preserve the high stocks it holds in European storage facilities this winter and maximise use of its booked transport capacity. The firm built stocks of around 11.4bn m³ in Europe by October, up from 5.8bn m³ a year earlier and significantly more than in previous years, to ensure it could maintain deliveries to customers from the start of this year in case of a disruption to transit flows through Ukraine. And it may continue to hold some of this gas in storage.

The firm sold 2.55bn m³ of its stocks to affiliate Gazprombank in December and 5.05bn m³ in August-November, as part of repurchase agreements — effectively a loan with gas as collateral — which it could regain control of by next winter, assuming it has booked the requisite capacity. And withdrawals have been slow or minimal from sites where the firm is known to hold capacity — including the Netherlands' Bergermeer, Austria's Haidach, the Czech Republic's Damborice and Germany's Katharina and Rehden.

Gazprom expects to maintain quick sales to Europe this year, which could leave it with little scope to turn down deliveries if it maintains its stocks, especially with sales having fallen so sharply in January-February.

Gazprom's price follows European hub drop

Gazprom's average realised sales price for exports fell sharply in February from a month earlier, along with a decline in hub prices (see monthly prices graph).

The firm's average price fell to $158/'000m³ (€14.09/MWh) from $183/'000m³ in January and $254/'000m³ in February 2019.

The firm revised down its expected average export price for the year earlier this month, to $175-185/'000m³ from the $200/'000m³ it previously expected.

But slower sales at a lower price could make it difficult for Gazprom to maintain its investment plans for the year. The firm's budget is based on an average export price for Europe, excluding the Baltic states, and Turkey of $200/'000m³, with sales at around 199bn m³. And it expects to cover around two thirds of its "priority projects" with the budget, with the remainder covered by project financing.

03032020044548.jpg)