Chinese ferrous futures reversed declines today after industry data showed the country's steel inventories falling this week, raising hopes that construction demand was finally returning to normal.

Fears that the coronavirus pandemic will eventually drag down Chinese domestic markets sent futures sharply lower in morning trade. The most-liquid May futures contracts for iron ore and hot-rolled coil (HRC) both fell by the 6pc daily limit. Shanghai traders cut prices for HRC by 70 yuan/t ($10/t) to Yn3,420/t ($481/t) and for rebar by Yn20/t to Yn3,510/t, while PB iron ore fines offers fell by Yn5-10/wet metric tonne (wmt) to Yn665-675/wmt in north China in the morning.

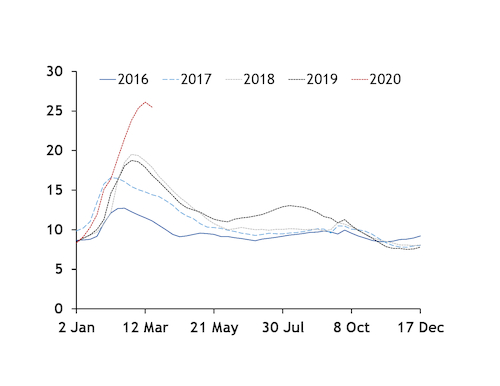

Mill- and trader-held steel inventories fell by 1.9mn t in the week to 19 March, according to industry data released during midday. It was the first weekly decline since December and showed trader-held warehouse stocks peaking at over 26mn t in the week of 12 March, above and after the usual 20mn t seasonal peak in late February or early March. Most of the declines this week were for long products, while flat steel products fell by around 300,000t.

Markets narrowed declines after the data release. Iron ore closed flat at Yn678/t, rebar closed down by 0.9pc at 3,528/t and HRC fell by 1.7pc to Yn3,429/t. Physical prices also moved lower in domestic and seaborne trade.

China's ferrous markets have been able to escape the meltdown in other markets hit by the effects of the coronavirus and its containment measures, even with today's declines. Most Asian ferrous markets have held steady or moved higher this year and with China reporting no new virus cases today, market participants said their main concerns are from risks outside of China.

European auto factory shutdowns weighed on sentiment yesterday and there are signs of overseas weakness filtering back into China. Its outlook remains stronger than regional counterparts, so imports are reappearing. Indonesian billet was sold to China at $405/t cfr last week and there was an unconfirmed sale of Russian billet at $395/t cfr China today.

Aggressive fiscal and monetary policies have stabilised China's steel markets by allowing most of its blast furnaces to keep running, despite a collapse in construction and industrial steel demand. The result has been record steel inventories, financed by a flood of credit into China's economy.

Larger mills have taken out tens of billions of yuan for medium- and long-term financing since the outbreak to keep operations running, market participants said. Smaller mills that are unable to get more credit have had to reduce production or cut costs, or shift inventories to traders.

"We heard some mills are selling their iron ore cargoes to get cash back - maybe they are facing difficulty with cash flow," a Shandong trader said.

China has reduced taxes on steel exports, freed up bank liquidity, and waived port fees and accelerated bond issuances.

China's central bank said this week that banks have issued Yn111bn in low-cost loans as of 15 March to support the restart of the economy, with more support expected to go to industries hit hard by the virus such as tourism, food and transportation.